Love is or it ain’t. Thin love ain’t love at all. – Toni Morrison, Beloved

When Pittsburgh Steelers wide receiver DK Metcalf proposed to Grammy-nominated singer Normani in March 2025, everyone saw the romance. But few understood the deeper significance. Three years earlier, Russell Wilson and Ciara had orchestrated the introduction at a party where Ciara made sure Normani attended. “They was playing cupid, but it worked,” Normani later said. “If you could trust a couple [to set you up], that would be the couple.”

Four months later in July 2025, when NBA star Donovan Mitchell proposed to singer Coco Jones, the Wilsons were once again celebrating behind the scenes. Russell had helped plan the proposal, working with luxury event planners to create the perfect moment.

Two high-profile engagements. One couple quietly orchestrating connections. But this isn’t just celebrity matchmaking—it’s something more profound. Russell and Ciara Wilson are modeling what intentional Black love looks like, and the ripple effects could fundamentally reshape African American institutional capacity at a moment when our community desperately needs it.

What makes the Wilsons’ matchmaking significant isn’t the celebrity of the couples they bring together—it’s the deliberateness of it. They’re not hoping love happens. They’re creating the conditions for it. They’re investing three years of relationship before an engagement. They’re using their social capital to bridge different professional spheres, connecting successful Black professionals across industries who might never meet organically despite moving in similar circles.

This kind of intentionality around Black love has historical resonance. During the segregation era and Jim Crow, when every institution worked to keep Black families separated and destabilized, our communities survived by being deliberate about connection. Churches served as matchmakers. Family networks facilitated introductions. HBCUs became spaces where Black professionals met their future spouses. The community understood that strong marriages weren’t just about individual happiness—they were about survival and institutional building.

The data reveals something striking: marriage rates for Black adults were higher than for white adults in every U.S. Census from 1890 to 1940—the height of overt racism and segregation. Even in 1960, the marriage rate for Black adults was 61%, and two-thirds of Black children lived in two-parent households. Today, only 31% of Black Americans are married, and half have never been married at all.

What changed wasn’t racism—that existed then and persists now. What changed was the infrastructure of intentionality around Black love. The systems that deliberately brought people together, that supported young marriages, that made partnership formation a community priority—those eroded while the obstacles remained.

Understanding what the Wilsons are doing requires understanding what Black families have survived—and what continues to threaten our ability to build generational wealth and institutional power through stable partnerships.

The historical attacks on Black family formation were systematic and devastating. During segregation, redlining prevented Black families from buying homes in appreciating neighborhoods, which meant that even when Black couples married and saved, their wealth accumulated at a fraction of the rate of white families. Housing policies created by the federal government in the 1930s explicitly designated Black neighborhoods as too risky for mortgage lending, forcing Black families into predatory contracts that often ended in eviction.

But perhaps no threat has been more insidious than the systematic devaluation of Black women as romantic partners. Research consistently shows that Black women face unique marginalization in the dating market. Studies reveal that Black women receive the lowest desirability ratings on dating platforms from men of all races, with one 2014 OKCupid analysis finding Black women rated as “least attractive” compared to women of other races. These aren’t just numbers—they reflect deep-seated stereotypes that paint Black women as too masculine, too strong, too independent, too angry to be desirable partners.

The roots of these stereotypes trace directly to slavery, when Black femininity was deliberately contrasted against white femininity to justify Black women’s oppression and exploitation. When Black women assertively advocate for themselves, society—including some Black men—uses labels like “loud,” “angry,” and “emasculating” to question their worthiness for romantic relationships. The myth persists despite Black women’s clear desire for marriage and partnership.

This devaluation creates a devastating cycle. Black men face their own pressures and internalized racism, sometimes leading them to view relationships outside the Black community as aspirational—an “upgrade” that signals status and success. The data bears this out: among Black newlyweds with bachelor’s degrees, men are more than twice as likely as women to marry outside their race (30% versus 13%). Some Black men internalize colorism and Eurocentric beauty standards, further narrowing the pool of Black women they consider desirable partners.

When successful Black men choose partners outside the community without understanding the implications, they dilute the very networks and institutional capacity the Black community needs to build generational power. They reduce the already constrained supply of partners for Black women who, despite facing the most challenging dating environment of any demographic, remain the group most committed to intra-racial partnership. This isn’t about policing individual choice—it’s about recognizing that individual choices, aggregated across thousands of successful Black professionals, have community-level consequences for institutional sustainability.

When the Great Migration brought millions of Black families north seeking better opportunities, they found wages increasing but housing wealth eroding. Segregated housing markets meant Black families paid higher rents for deteriorating properties while watching their neighborhoods decline in value. The very act of Black families moving into a neighborhood triggered white flight, which collapsed property values. Homes that should have been vehicles for wealth accumulation became wealth traps.

Then came the deliberate destruction. The Tulsa Race Massacre of 1921 obliterated what was known as “Black Wall Street”—a thriving district where Black families owned land, operated businesses, and built wealth estimated at over $200 million in today’s dollars. Hundreds died, thousands were left homeless, and laws were passed to prevent survivors from rebuilding. This wasn’t unique. Chicago saw approximately 1,000 Black homes and businesses burned during the Red Summer of 1919. Across the country, thriving Black communities were systematically destroyed through racial violence that governments failed to prevent and often actively supported.

The wealth that did accumulate often couldn’t be transferred. Without access to estate planning services and facing discriminatory legal systems, many Black families lost property through “heirs property” designations that left land ownership unclear and prevented descendants from accessing the wealth their grandparents had built.

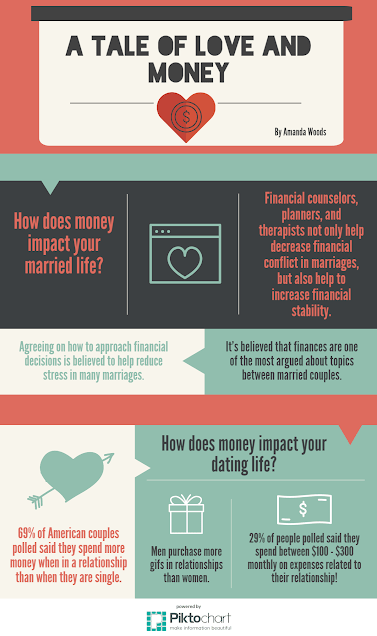

Today’s threats are more subtle but no less destructive. Mass incarceration has removed hundreds of thousands of Black men from their communities, destroying the gender balance needed for relationship formation. The student debt crisis hits Black families hardest—Black graduates owe an average of $25,000 more than their white peers—making the economic foundation for marriage more precarious. The wealth gap means young Black couples can’t fall back on family wealth during rough patches the way white couples can. Geographic dispersion means young Black professionals leave the high-marriage-rate states where HBCU ecosystems once facilitated connections, moving to cities where they’re isolated from institutional support networks.

But perhaps most damaging is the loss of cultural infrastructure around Black love. The deliberate community matchmaking of previous generations has largely disappeared. The social pressure and support for marriage has weakened. Dating apps have replaced friend introductions, optimizing for superficial attraction rather than shared values and compatible life goals. Young Black professionals, especially those who’ve left HBCU networks, often lack access to communities of Black peers navigating similar life stages.

The Wilsons understand something crucial: strong Black marriages aren’t just about personal fulfillment. They’re about building institutional capacity. When they facilitate a marriage between DK Metcalf and Normani, they’re not just creating a happy couple—they’re multiplying resources that could flow to Black institutions.

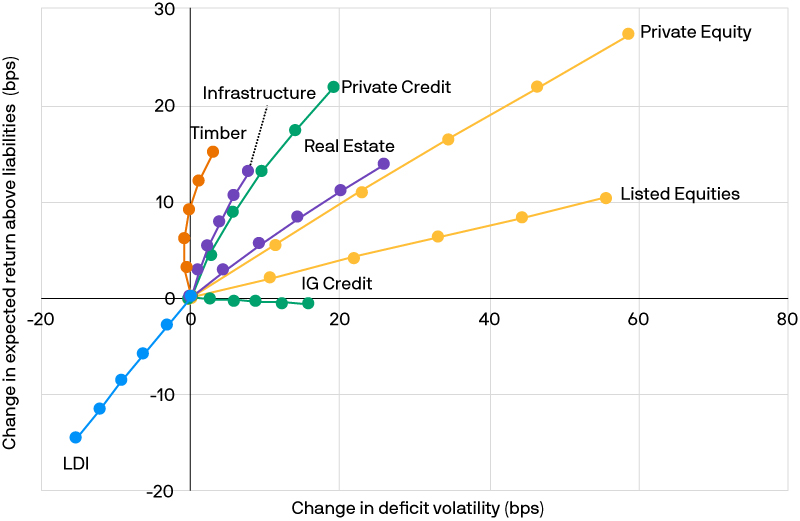

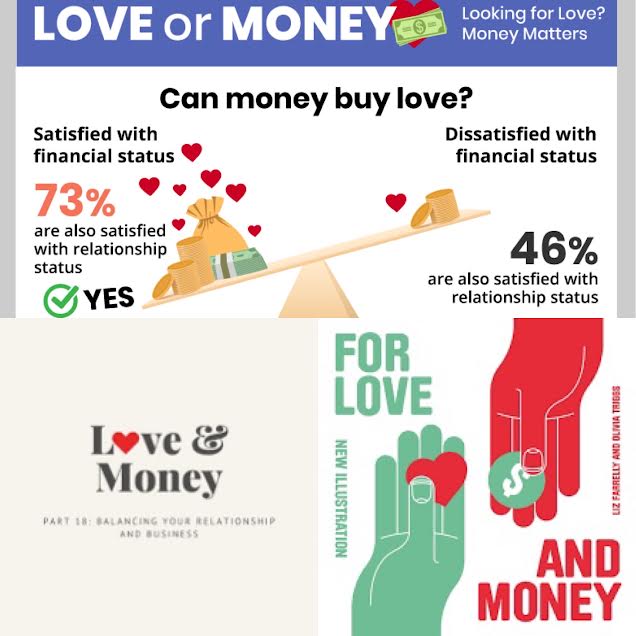

Consider the mathematics of it. Married couples don’t just have double the income of single individuals—they accumulate wealth exponentially faster. Black married couples have a median net worth of $131,000 compared to just $29,000 for single Black individuals. This isn’t because marriage magically creates money. It’s because marriage allows for coordinated financial strategy, shared expenses, combined networks, and the ability to take risks one income couldn’t support.

But the real multiplier effect extends beyond individual household wealth. Strong Black marriages create:

Coordinated Philanthropic Power: A married couple decides together where to direct resources. They create family foundations. They develop multi-year giving strategies to institutions they both value. They leverage their combined networks to recruit other donors. They become major benefactors rather than occasional contributors.

Intergenerational Institutional Commitment: Children from stable two-parent households inherit not just wealth but institutional loyalty. A child whose parents both attended HBCUs, both support Black cultural institutions, both invest in Black businesses—that child grows up with institutional commitment encoded in their identity. They become the next generation of supporters, leaders, and advocates.

Professional Network Effects: When two successful Black professionals marry, their networks merge. Different industries intersect, creating unexpected opportunities. Professional connections multiply. These network overlaps create opportunities for institutional partnerships, corporate sponsorships, business ventures, and talent pipelines that wouldn’t exist otherwise.

Resilience and Risk-Taking: Married couples can take risks single individuals cannot. They can invest in Black startups, fund untested ventures, support experimental programs, and make long-term commitments to institutions precisely because they have a partner sharing the risk. This risk-taking capacity is essential for institutional innovation and growth.

Cultural Modeling and Social Capital: Visible successful Black marriages change cultural narratives. They make marriage aspirational. They demonstrate what’s possible. They create social pressure in the positive sense—the expectation that successful Black professionals will find partners, build families, and invest in community. This cultural shift has compound effects across generations.

The geographic data supports this institutional impact. Seven of the top ten states with highest Black marriage rates—Virginia (34.0%), Maryland (33.2%), Texas and Delaware (32.8%), Florida and North Carolina (31.3%), and Georgia (30.9%)—are HBCU states. These states have thriving Black middle classes, strong African American institutions, and robust professional networks. The marriage rates aren’t coincidental—they’re evidence of how institutional ecosystems and family stability reinforce each other.

What the Wilsons are doing works because they understand marriage formation as network building. They’re not running a dating service. They’re curating a community of successful Black professionals who share values, understand each other’s pressures, and can build partnerships that transcend individual achievement.

Research shows people are still most likely to meet long-term partners through friends, family, or work rather than dating apps. The Wilsons are leveraging this truth at scale. Every couple they help create becomes a new node in an expanding network. Metcalf and Normani will introduce their single friends to each other. Mitchell and Jones will facilitate connections within their circles. The Wilsons’ nine-year marriage serves as the model and proof of concept.

This creates self-reinforcing cycles. Strong marriages produce stable families. Those families invest in institutions. Those institutions create spaces where the next generation forms relationships. Those relationships produce more strong marriages. The cycle builds momentum.

This is how communities accumulate power—not through individual success stories but through interconnected networks of families committed to collective advancement. During segregation, Black communities maintained this infrastructure deliberately because they had to. We knew that isolated success meant nothing if it couldn’t be transferred to the next generation or scaled across the community.

The Wilsons are reviving this model for the contemporary moment, when Black professionals are more economically successful than ever but often isolated from the institutional networks that would allow that success to compound.

Imagine if what the Wilsons are doing at the celebrity level was replicated across every tier of Black professional achievement. Imagine if young Black doctors, lawyers, engineers, educators, entrepreneurs were part of deliberate matchmaking networks that facilitated connections based on shared values and institutional commitment.

The compound effects would be staggering:

Economic Impact: Thousands of additional stable Black marriages would translate to billions in accumulated wealth. That wealth, properly channeled, could recapitalize Black institutions that have operated on shoestring budgets for generations. HBCUs could build endowments rivaling elite white institutions. Black hospitals could expand. Community development financial institutions could scale their lending. Black cultural institutions could thrive rather than merely survive.

Political Power: Married couples are more likely to vote, more likely to engage in civic life, more likely to serve on boards and run for office. A generation of politically engaged Black couples could fundamentally shift electoral dynamics and policy priorities in states with large Black populations.

Professional Advancement: The network effects of thousands of strategic Black marriages would create unprecedented opportunities for collaboration. Black entrepreneurs would have access to capital through their spouses’ networks. Black professionals would have insider information about opportunities through their partners’ connections. The “old boys network” that has excluded Black professionals for generations could be matched by networks of Black couples leveraging their combined social capital.

Cultural Renaissance: Stable Black families create the conditions for cultural production. Artists need economic security to take creative risks. Writers need time to develop their craft. Musicians need resources to experiment. When Black creative professionals have partners who can provide economic stability, the entire community benefits from their artistic output.

Institutional Sustainability: Perhaps most critically, networks of strong Black marriages ensure institutional continuity. When couples commit to supporting institutions together, those institutions can plan decades into the future. They can launch ambitious programs knowing they have committed donors. They can weather economic downturns because their supporter base is stable. They can dream bigger because their foundation is stronger.

But recognizing what’s possible raises uncomfortable questions about what’s missing. If the Wilsons can facilitate life-changing connections within celebrity circles, why doesn’t similar infrastructure exist for the thousands of Black professionals outside those circles? If marriage rates for Black adults were higher during Jim Crow than today, what infrastructure did we lose—and how do we rebuild it?

These questions don’t have simple answers, but they demand serious consideration:

How do we recreate the deliberate matchmaking infrastructure that sustained Black communities during segregation, adapted for contemporary circumstances? Church networks and family connections can’t carry the full weight when young Black professionals are geographically dispersed and disconnected from traditional institutions.

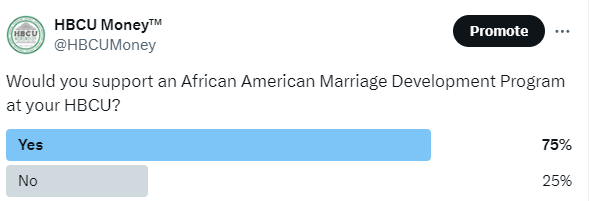

What would institutional investment in Black relationship formation look like? HBCUs, Black Greek organizations, professional associations, cultural institutions—these entities have the trust and access to facilitate connections. But do they recognize this as part of their mission? Do they allocate resources to it? Do they measure success by families formed, not just events hosted?

How do we address the structural barriers that make marriage economically precarious for young Black professionals? Student debt, wage gaps, wealth inequality, housing costs—these aren’t relationship problems, but they make relationship formation dramatically harder for Black Americans than for white Americans with similar educational attainment.

What role does media and culture play in shaping expectations around Black love? When the dominant narratives about Black relationships emphasize dysfunction and failure, when successful Black marriages are invisible, when young Black people grow up without models of healthy partnerships—this creates self-fulfilling prophecies that perpetuate the marriage gap.

How do we balance individual freedom and choice with community needs for strong families and institutions? Nobody should be pressured into marriage. But if the community loses the infrastructure that facilitates healthy relationship formation, individual freedom becomes isolation by default.

The Wilsons have shown what’s possible. Their intentional matchmaking, their sustained investment in couples’ success, their willingness to leverage their social capital for others’ benefit—this is the model. But celebrity circles can only accommodate so many couples. The question is how to scale this intentionality across the Black professional class.

The answer must be institutional, because only institutions can sustain infrastructure across generations. Individual matchmakers burn out. Informal networks fragment. But institutions—if properly designed and resourced—can maintain systems indefinitely.

What might institutional investment in Black love infrastructure look like?

HBCU Alumni Networks as Matchmaking Ecosystems: Alumni associations in major cities could host quarterly events specifically designed to facilitate connections among young Black professionals. Not awkward singles mixers, but sophisticated networking events, community service projects, cultural experiences where relationships form organically among people with shared backgrounds and values. Success could be measured not just by attendance but by marriages facilitated and families formed.

Black Professional Associations as Relationship Hubs: Organizations for Black lawyers, doctors, engineers, educators, entrepreneurs could recognize relationship facilitation as core to their mission. When successful Black professionals marry, their combined professional power benefits the entire community. These associations could create structured mentorship that pairs young professionals not just for career guidance but for life partnership modeling.

Technology Platforms Designed for Black Love: Dating apps optimize for engagement and superficial attraction. What if technology was designed specifically to facilitate meaningful connections among Black professionals committed to community building? Platforms that prioritize shared values, institutional loyalty, life goals, and cultural understanding over swipe-right dynamics.

Financial Incentives for Family Formation: What if institutions offered tangible support for young Black couples? Grants for couples pursuing marriage counseling. Low-interest loans for home purchases for alumni couples. Scholarships for children of HBCU alumni couples. These investments would pay dividends in institutional loyalty that compounds across generations.

Cultural Campaigns Celebrating Black Love: Media campaigns showcasing successful Black marriages, particularly among professionals committed to community advancement. Not aspirational fantasy but realistic portrayals of how successful couples navigate challenges, support each other’s growth, and invest in institutions. Make Black love visible, aspirational, and achievable.

Research Infrastructure: We lack basic data on what makes Black marriages successful. Which combinations of backgrounds, values, and life circumstances predict long-term partnership success? What interventions effectively support young Black couples through early marriage challenges? Hampton University’s National Center on African American Marriage and Parenting represents a start, but we need comprehensive research infrastructure that can inform evidence-based programming.

The answers won’t come from any single intervention but from a ecosystem of institutional support that makes Black love not just possible but probable. That makes stable marriages not just aspirational but expected. That makes family formation not just personal but communal.

Russell and Ciara Wilson didn’t set out to solve the Black marriage crisis or to transform African American institutional capacity. They’re simply two people who understand the value of healthy relationships and want to share that blessing with their friends.

But their efforts reveal what’s missing and what’s possible. They show that when influential people commit to facilitating connections within Black professional circles, life-changing partnerships form. They demonstrate that intentionality around Black love produces results that individual effort alone cannot achieve. They prove that building strong Black marriages is institution-building at its most fundamental level.

The viral social media pleas asking the Wilsons to expand their matchmaking aren’t just jokes. They reflect a genuine hunger for what the Wilsons provide—thoughtful facilitation of connections among Black professionals who share values and aspirations. They reveal the absence of infrastructure that our grandparents’ generation took for granted because it was built into the fabric of Black community life.

The declining marriage rate among African Americans isn’t inevitable. It’s the result of infrastructure collapse that can be reversed through deliberate institutional investment. The opportunity is to recognize that facilitating Black love isn’t tangential to institutional missions—it’s foundational to building the networks of stable families that will sustain Black institutions for generations.

Seven of the ten states with highest Black marriage rates are HBCU states, which means the foundation still exists. The communities are still present. The institutions still stand. What’s needed is leadership willing to acknowledge that the work of building Black institutional power begins with building Black families. That the work of building Black families requires intentional infrastructure. That the work of building that infrastructure is everyone’s responsibility who claims commitment to Black advancement.

The Wilsons are showing us what’s possible when two people commit to intentionally building Black love within their circles of influence. The question for the rest of us—for institutions, for leaders, for anyone with social capital and community commitment—is whether we’ll do the same within our own spheres. Whether we’ll recognize matchmaking as institution-building. Whether we’ll invest in the infrastructure that makes Black love not just possible but inevitable.

The fire is there. The Wilsons are fanning the flames. The question is whether the rest of us will add fuel until it becomes a blaze that lights the way for generations to come.