“Every great dream begins with a dreamer. Always remember, you have within you the strength, the patience, and the passion to reach for the stars to change the world.” — Harriet Tubman

For African Americans, safety has never been an assumed part of citizenship. It has always been an earned condition won through vigilance, strategy, and often migration. Whether fleeing the violent collapse of Reconstruction or the economic despair of the Jim Crow South, Black Americans have long measured geography as a question of survival. Today, in an America increasingly polarized by race, ideology, and inequality, that calculation has returned. Many are quietly asking: where can African Americans live, work, and raise families with peace of mind? The answer, surprisingly, may not be in traditional Black strongholds like Atlanta, Washington, D.C., or Houston, but in four unlikely places—New Mexico, Maine, Puerto Rico, and the U.S. Virgin Islands—where moderation, multicultural coexistence, and relative political calm offer something rare: a sense of safety that is not performative, but lived.

New Mexico’s reputation as a cultural crossroads has made it one of the few states where African Americans can exist without being framed entirely through America’s racial binary. Its tri-cultural balance among Native American, Hispanic, and White populations disperses dominance. Here, no single identity owns the political landscape. For African Americans who comprise about two percent of the population that means a degree of breathing room. Racial prejudice still exists, but it rarely defines every interaction. The social climate is cooperative, rooted in shared marginalization rather than supremacy. Albuquerque, Las Cruces, and Santa Fe have become quiet havens for African American educators, small-business owners, and retirees seeking both affordability and dignity.

Economically, New Mexico offers something most metropolitan centers have lost: a manageable cost of living and accessible capital. Housing remains attainable. Land ownership long denied to African Americans through discriminatory lending remains within reach for the working and middle class. The rise of renewable energy, sustainable agriculture, and technology hubs has also created new entry points for Black entrepreneurship. In Albuquerque’s South Valley or near Santa Fe’s art cooperatives, one can find a small but visible community of African Americans carving lives that are not merely about surviving but thriving without the constant defensive posture that characterizes so many other states. Safety here is less about walls and more about balance, a social equilibrium where race is a fact, not a fault line.

Maine, on the other hand, is proof that peace can coexist with isolation. Its African American population is minuscule, but its civic culture is built on moderation and integrity. The state’s “town meeting” governance style, where citizens vote directly on local issues, nurtures accountability rarely seen elsewhere. For African Americans who relocate to Portland, Bangor, or Augusta, that transparency matters. Racism in Maine exists, but it lacks institutional depth. More often, African Americans report curiosity over hostility, and when discrimination does occur, it tends to meet public rebuke rather than official silence.

Politically, Maine is refreshingly pragmatic. It elects moderates and independents, resists extremist rhetoric, and maintains a social compact where neighbors generally still speak to each other across ideological lines. For African Americans weary of coded politics, it feels like a return to something America once promised, a functioning democracy. The result is a form of safety rooted not in numbers, but in governance. A place where you can walk, vote, and live without fearing that tomorrow’s election will determine whether your humanity is negotiable.

But safety does not always mean the mainland. Beyond the continental U.S., Puerto Rico and the U.S. Virgin Islands present another dimension of refuge one built on shared African lineage and the lived realities of Caribbean identity. For African Americans seeking both cultural familiarity and distance from America’s racial fatigue, these territories offer a paradoxical safety: not post-racial, but post-obsessive.

Puerto Rico, long a bridge between Latin America and the U.S., exists in an in-between space that defies racial simplification. Its majority Afro-Latino population gives race a different vocabulary one where color is noticed but hierarchy is more fluid. African Americans arriving there encounter both kinship and complexity. In cities like San Juan or Ponce, African American expatriates blend into an Afro-diasporic continuum that feels familiar yet distinct. The island’s economic struggles are real: bankruptcy, hurricanes, and colonial neglect have left deep scars but its community resilience and shared sense of oppression produce solidarity rather than hostility. For African Americans, that means an environment where “Blackness” is neither exoticized nor demonized, but part of the island’s social DNA.

Economically, Puerto Rico also provides opportunities for African Americans seeking new beginnings in real estate, tourism, or renewable energy sectors. The island’s special tax status and evolving investment laws have attracted mainland professionals and entrepreneurs, some of whom are African American innovators bringing capital and ideas into local partnerships. In this sense, Puerto Rico is not only a sanctuary but also a frontier, a place where the African Diaspora’s ingenuity can meet an economy in reinvention. For those seeking cultural reconnection, the island’s Afro-Boricua traditions like bomba music, Loíza’s festivals, and the rhythms of African pride create an echo of belonging that many African Americans have long been denied in the continental United States.

Then there is the U.S. Virgin Islands, a cluster of Caribbean jewels that quietly symbolize what safe, small-scale Black governance can look like. On St. Thomas, St. Croix, and St. John, African-descended people form the majority. That demographic fact changes everything. Here, African Americans are not minorities but members of a larger Black polity with its own traditions, institutions, and history. The islands’ governance, while tied to Washington, reflects local leadership rooted in Afro-Caribbean sensibilities. For African Americans relocating from the mainland, this translates into a rare psychological experience: existing in a majority-Black jurisdiction where public policy, education, and business life are not filtered through White validation. Safety here is political self-determination.

Economically, the U.S. Virgin Islands are not without challenge like high import costs, hurricane vulnerability, and limited diversification test resilience but they offer something profound in return: cultural sovereignty. African Americans who move there often describe an adjustment period followed by a deep sense of exhale. The smallness of scale fosters community accountability, and the absence of constant racial tension allows ambition to flow without invisible friction. One can walk into a bank, a classroom, or a government office and see reflections rather than reminders of marginalization.

Taken together, New Mexico, Maine, Puerto Rico, and the U.S. Virgin Islands form a loose constellation of calm, a diaspora of safety within the larger storm of American contradiction. What unites them is not homogeneity, but a commitment to civility and shared humanity. Each location offers a different version of safety: political moderation in Maine, cultural equilibrium in New Mexico, diasporic kinship in Puerto Rico, and demographic sovereignty in the Virgin Islands. For African Americans navigating the exhaustion of a national identity under siege, these places suggest that peace might still be found without surrendering pride or progress.

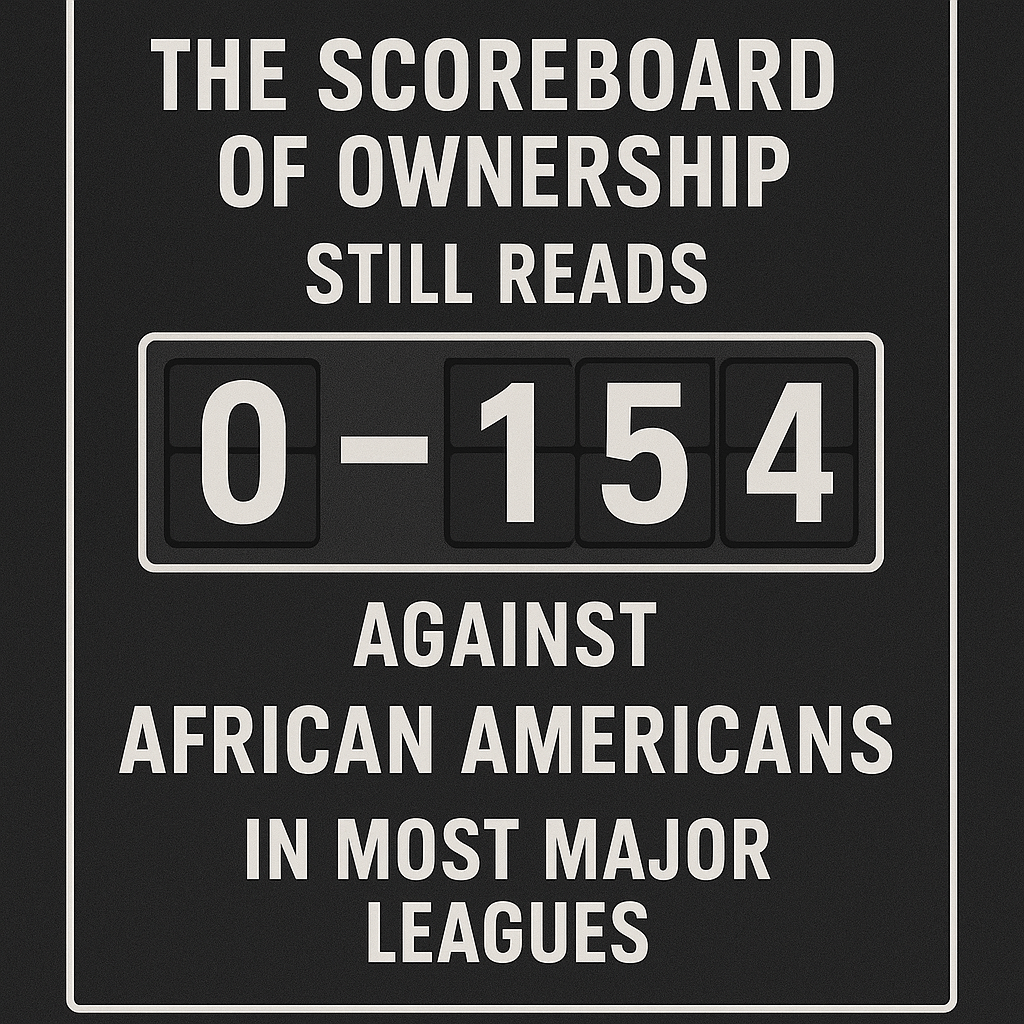

The broader question, however, remains: why must African Americans still seek safety within the very nation they helped build? The resurgence of racial authoritarianism, book bans, and economic inequality reveals a hard truth that safety for African Americans is still conditional, still regional, still a choice rather than a guarantee. Yet, migration has always been the community’s answer to oppression. From the Underground Railroad to the Great Migration, movement has been both resistance and renaissance. Harriet Tubman’s words remain instructive: “Every great dream begins with a dreamer.” Migration, for African Americans, has always been dreaming in motion.

New Mexico and Maine show what governance without racial hysteria looks like. Puerto Rico and the Virgin Islands show what culture looks like when Blackness is normalized rather than marginalized. Together, they present a vision of what the United States could be if its diversity were truly reconciled with its democracy. They remind African America that safety is not about retreating from the nation but reimagining its geography of belonging.

Still, each of these places carries limitations. In New Mexico and Maine, African Americans may find safety but also scarcity with few cultural institutions, churches, or schools designed with them in mind. In Puerto Rico and the Virgin Islands, economic instability and natural disaster risks complicate long-term security. Yet, in all four, there exists something invaluable: the absence of daily racial siege. That reprieve can be transformative. It gives space for creativity, family stability, and the rebuilding of wealth without the constant drag of social mistrust.

As the nation’s politics grow more volatile, African American institutions (HBCUs, banks, and foundations) should view these geographies not simply as refuges but as development frontiers. Instead of imagining new HBCU presences in the Caribbean, they can expand partnerships with the University of the Virgin Islands already a proud HBCU anchoring the region to create joint research programs, faculty exchanges, and diasporic economic initiatives that strengthen both the mainland and the islands or research partnerships with Puerto Rican universities. Imagine Black-owned renewable energy firms anchoring in New Mexico, or a cooperative investment network expanding into Maine’s emerging industries. Safety, after all, is not just the absence of harm it’s the presence of opportunity.

There is a growing possibility that the 21st-century African American migration will not be toward cities of hustle, but toward territories of harmony. Where one can walk into a classroom, café, or coastal market and not feel their presence as provocation. Where the conversation around “diversity” is not theoretical but lived. The call of these four places is subtle but powerful: build where you can breathe.

If history is cyclical, then the current search for safety is not retreat but renewal. Each of these geographies offers a mirror to what African America has always done transform uncertainty into community. From the deserts of the Southwest to the coasts of New England and the Caribbean, a new map of refuge is emerging. Whether the destination is the Sandia Mountains, Casco Bay, San Juan’s Old Town, or Charlotte Amalie’s harbor, the journey is the same: toward dignity.

In the end, the question may not be whether these are the only safe places, but whether they are the first to show what safety could mean in practice. For a people whose freedom has always been self-forged, safety is never static it is strategy. And in that strategy, migration remains both memory and mission.

Disclaimer: This article was assisted by ChatGPT.