First our pleasures die – and then our hopes, and then our fears – and when these are dead, the debt is due dust claims dust – and we die too. – Percy Bysshe Shelley

African American household assets reached $7.1 trillion in 2024, a half-trillion-dollar increase that might appear encouraging at first glance. Yet beneath this headline figure lies a structural vulnerability that threatens to undermine decades of hard-won economic progress: consumer credit has surged to $740 billion, now representing nearly half of all African American household debt and approaching parity with home mortgage obligations of $780 billion. In the world of good debt versus bad debt, African America’s bad debt is rapidly choking the economic life away.

This near 1:1 ratio between consumer credit and mortgage debt represents a fundamental inversion of healthy household finance. For white households, the ratio stands at approximately 3:1 in favor of mortgage debt over consumer credit. Hispanic households maintain a similar 3:1 ratio, as do households classified as “Other” in Federal Reserve data. The African American community stands alone in this precarious position, where high-interest, unsecured borrowing rivals the debt secured by appreciating assets.

The implications of this structural imbalance extend far beyond mere statistics. They reveal a community increasingly dependent on expensive credit to maintain living standards, even as asset values nominally rise. Consumer credit grew by 10.4% in 2024, more than double the 4.0% growth in mortgage debt and far exceeding the overall asset appreciation rate. This divergence suggests that rising property values and retirement account balances are not translating into improved financial flexibility. Instead, African American households appear to be running faster merely to stay in place, accumulating debt at an accelerating pace despite wealth gains elsewhere on their balance sheets.

What makes this dynamic particularly insidious is the extractive nature of the debt itself. With African American-owned banks holding just $6.4 billion in combined assets, a figure that has grown modestly from $5.9 billion in 2023, the overwhelming majority of the $1.55 trillion in African American household liabilities flows to institutions outside the community. This represents one of the most significant, yet least discussed, mechanisms of wealth extraction from African America.

Consider the arithmetic: if even a conservative estimate suggests that 95% of African American debt is held by non-Black institutions, and if that debt carries an average interest rate of 8% (likely conservative given the prevalence of credit card debt and auto loans), then African American households are transferring approximately $120 billion annually in interest payments to institutions with no vested interest in Black wealth creation or community reinvestment.

For context, the entire asset base of African American-owned banks—$6.4 billion—represents less than one month’s worth of these interest payments. The disparity is staggering. According to the FDIC’s Minority Depository Institution program, Asian American banks lead with $174 billion in assets, while Hispanic American banks hold $138 billion. African American banking institutions, despite serving a population with $7.1 trillion in household assets (yielding approximately $5.6 trillion in net wealth after liabilities), control less than 0.1% of that wealth through their balance sheets.

This extraction mechanism operates at multiple levels. First, there is the direct transfer of interest payments from Black borrowers to predominantly white-owned financial institutions. Second, there is the opportunity cost: capital that could be intermediated through Black-owned institutions creating deposits, enabling local lending, building institutional capacity but instead enriches institutions that have historically redlined Black communities and continue to deny Black borrowers and business owners at disproportionate rates.

Third, and perhaps most pernicious, is the feedback loop this creates. Without sufficient capital flow through Black-owned institutions, these banks lack the resources to compete effectively for deposits, to invest in technology and branch networks, to attract top talent, or to take on the larger commercial loans that could finance transformative community development projects. They remain, in effect, trapped in a low-equilibrium state unable to scale precisely because they lack access to the very capital that their community generates.

The near-parity between consumer credit and mortgage debt in African American households signals a fundamental divergence from the wealth-building model that has enriched other communities for generations. Mortgage debt, despite its costs, serves as a mechanism for forced savings and wealth accumulation. As homeowners make payments, they build equity in an asset that typically appreciates over time. The debt is secured by a tangible asset, carries relatively low interest rates, and benefits from tax advantages.

Consumer credit operates on precisely the opposite logic. It finances consumption rather than investment, carries interest rates that can exceed 20% on credit cards, builds no equity, and offers no tax benefits. When consumer credit approaches the scale of mortgage debt, it suggests a household finance structure tilted toward consumption smoothing rather than wealth building—using expensive borrowing to maintain living standards in the face of inadequate income growth.

The data from HBCU Money’s 2024 African America Annual Wealth Report confirms this interpretation. While African American real estate assets totaled $2.24 trillion, growing by just 4.3%, consumer credit surged by 10.4%. This divergence suggests that home equity, the traditional engine of African American wealth building, is being offset by the accumulation of high-cost consumer debt.

More troubling still, the concentration of African American wealth in illiquid assets with real estate and retirement accounts comprising nearly 60% of total holdings limits the ability to weather financial shocks without resorting to consumer credit. Unlike households with significant liquid assets or equity portfolios that can be tapped through margin loans at lower rates, African American households facing unexpected expenses must often turn to credit cards, personal loans, or other high-cost borrowing.

This creates a wealth-to-liquidity trap: substantial assets on paper, but insufficient liquid resources to manage volatility without accumulating expensive debt. The modest representation of corporate equities and mutual funds at just $330 billion, or 4.7% of African American assets means that most Black wealth is locked in homes and retirement accounts that cannot easily be accessed for emergency expenses, business investments, or wealth transfer to the next generation.

The underdevelopment of African American banking institutions represents both a cause and consequence of this debt crisis. With combined assets of just $6.4 billion, Black-owned banks lack the scale to compete effectively for deposits, to offer competitive loan products, or to finance the larger commercial and real estate projects that could drive community wealth creation.

To understand why bank assets matter for addressing household debt, one must grasp a fundamental principle of banking: a bank’s assets are largely composed of the loans it has extended. When a bank reports $1 billion in assets, the majority represents money lent to households and businesses in the form of mortgages, business loans, and lines of credit. These loans are assets to the bank because they generate interest income and (ideally) will be repaid. Conversely, the deposits that customers place in banks appear as liabilities on the bank’s balance sheet, because the bank owes that money back to depositors.

This means that when African American-owned banks hold just $6.4 billion in assets, they have extended roughly $6.4 billion in loans to their communities. By contrast, African American households carry $1.55 trillion in debt. The arithmetic is stark: Black-owned institutions are originating less than 0.5% of the debt carried by Black households. The remaining 99.5% or approximately $1.54 trillion flows to non-Black institutions, carrying interest payments and fees with it. If Black-owned banks held even 10% of African American household debt as assets, they would control over $155 billion in lending capacity more than twenty times their current scale creating a powerful engine for wealth recirculation and community reinvestment.

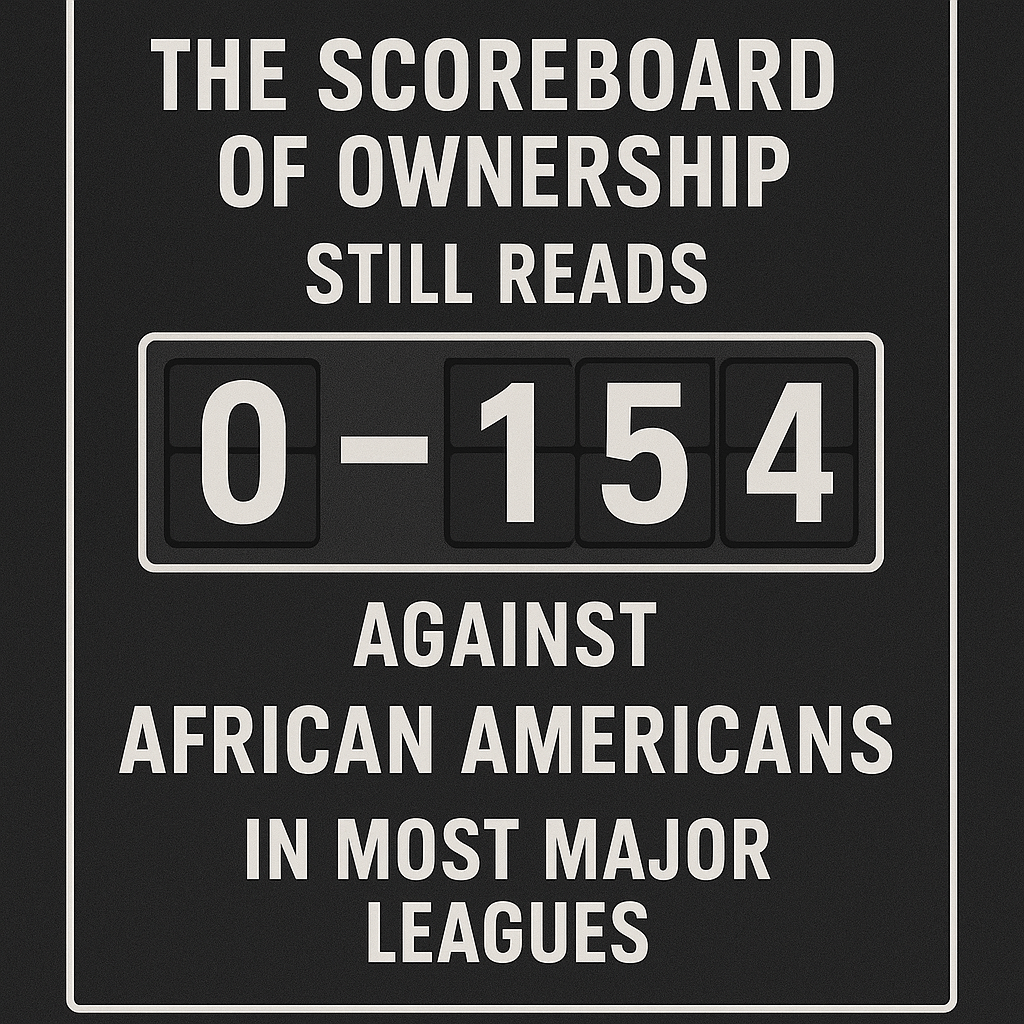

The exclusion from consumer credit is even more complete than these figures suggest. There are no African American-owned credit card companies, and most African American financial institutions lack the scale and infrastructure to issue Visa, MasterCard, or other branded credit cards through their own institutions. When Black consumers carry $740 billion in consumer credit much of it on credit cards charging 18% to 25% interest virtually none of that debt flows through Black-owned institutions. Every swipe, every interest payment, every late fee enriches the handful of large banks and card issuers that dominate the consumer credit market. This represents the most direct and lucrative form of wealth extraction: high-margin, unsecured lending with minimal default risk due to aggressive collection practices, all flowing entirely outside the Black banking ecosystem.

By comparison, a single large regional bank might hold $50 billion or more in assets. The entire African American banking sector commands resources equivalent to roughly one-eighth of one large institution. This scale disadvantage manifests in multiple ways: higher operating costs as a percentage of assets, limited ability to diversify risk, reduced capacity to invest in technology and marketing, and difficulty attracting deposits in an era when consumers increasingly prioritize digital capabilities and nationwide ATM access.

The decrease of Black-owned banks has accelerated these challenges. The number of African American-owned banks has declined from 48 in 2001 to just 18 today, even as the combined assets have grown from $5 billion to $6.4 billion. This suggests that the survivors have achieved modest scale gains, but the overall institutional capacity of the sector has contracted significantly. Each closure represents not just a loss of financial services, but a loss of community knowledge, relationship banking, and the cultural competence that enables Black-owned institutions to serve their communities effectively.

The credit union sector presents a more substantial but still constrained picture. Approximately 205 African American credit unions operate nationwide, holding $8.2 billion in combined assets and serving 727,000 members. While this represents meaningful scale more than the $6.4 billion held by African American banks the distribution reveals deep fragmentation. The average credit union holds $40 million in assets with 3,500 members, but the median tells a more sobering story: just $2.5 million in assets serving 618 members. This means the majority of African American credit unions operate at scales too small to offer competitive products, invest in digital banking infrastructure, or provide the full range of services that members need. Many church-based credit unions, while serving vital community functions for congregations often underserved by traditional banks, hold assets under $500,000. The member-owned structure of credit unions, while fostering community engagement and democratic governance, also constrains their ability to raise capital through equity markets, leaving them dependent on retained earnings and member deposits for growth, a particular challenge when serving communities with limited surplus capital.

This institutional deficit has profound implications for the debt crisis. Without strong Black-owned financial institutions, African American borrowers must rely on financial institutions owned by other communities that often offer less favorable terms. Research consistently shows that Black borrowers face higher denial rates, pay higher interest rates, and receive less favorable terms than similarly situated white borrowers. A 2025 LendingTree analysis of Home Mortgage Disclosure Act data found that Black borrowers faced a mortgage denial rate of 19% compared to 11.27% for all applicants making them 1.7 times more likely to be denied. Black-owned small businesses received full funding in just 38% of cases, compared with 62% for white-owned firms.

These disparities push African American households and businesses toward more expensive credit alternatives. Unable to access conventional mortgages, they turn to FHA loans with higher insurance premiums. Denied bank credit, they turn to credit cards and personal loans with double-digit interest rates. Lacking access to business lines of credit, entrepreneurs tap home equity or personal savings, increasing their financial vulnerability.

The absence of robust Black-owned institutions also deprives the community of an important competitive force. Where Black-owned banks operate, they create pressure on other institutions to serve Black customers more fairly. Their presence signals that discriminatory practices will drive customers to alternatives, creating at least some market discipline. Where they are absent or weak, that discipline evaporates.

Corporate DEI programs that once channeled deposits to Black-owned banks have been largely eliminated. The current federal political environment is openly hostile to African American advancement, with programs like the Treasury Department’s Emergency Capital Investment Program facing uncertain futures. External support structures are collapsing precisely when they are most needed, leaving African American institutions and individuals as the primary actors in their own financial liberation, a task made exponentially more difficult by the very extraction mechanisms this analysis has documented.

The near-parity between consumer credit and mortgage debt in African American households is not a reflection of poor financial decision-making or cultural deficiency. It is the predictable outcome of structural inequalities that have limited income growth, constrained access to affordable credit, concentrated wealth in illiquid assets, and prevented the development of financial institutions capable of serving the Black community effectively.

The comparison with other racial and ethnic groups is instructive. White, Hispanic, and other households all maintain mortgage-to-consumer-credit ratios of approximately 3:1 or better. They achieve this not because of superior financial acumen, but because they benefit from higher incomes, greater intergenerational wealth transfers, better access to credit markets, and stronger financial institutions serving their communities.

African American households, by contrast, face headwinds at every turn. Median Black household income remains roughly 60% of median white household income. The racial wealth gap, at approximately 10:1, ensures that Black families receive less financial support from parents and grandparents. Discrimination in credit markets, though illegal, persists in subtle and not-so-subtle forms. And the institutional infrastructure that might counterbalance these disadvantages from Black-owned banks, investment firms, insurance companies remains underdeveloped and undercapitalized.

The result is a community that has achieved a nominal wealth of $5.5 trillion, yet finds that wealth increasingly built on a foundation of expensive debt rather than appreciating assets and productive capital. The $740 billion in consumer credit represents not just a financial liability, but a transfer mechanism that annually extracts tens of billions of dollars from the Black community and redirects it to predominantly white-owned financial institutions.

Breaking this pattern will require more than incremental change. It will require a fundamental restructuring of how capital flows through the African American community, how financial institutions serving that community are capitalized and regulated, and how wealth is built and transferred across generations. The alternative of continuing on the current trajectory is a future in which African American households accumulate assets while simultaneously accumulating debt, running faster while falling further behind, building wealth that proves as ephemeral as the credit that increasingly finances it.

The data from HBCU Money’s 2024 African America Annual Wealth Report provides both a warning and an opportunity. The warning is clear: the current path is unsustainable, with consumer credit growing at more than double the rate of asset appreciation and institutional capacity remaining stagnant. The opportunity is equally clear: with $5.5 trillion in household wealth, the African American community possesses the resources necessary to build the financial institutions and wealth-building structures that could transform debt into equity, consumption into investment, and extraction into accumulation.

The question is whether the community, and the nation, will recognize the urgency of this moment and take the bold action necessary to recirculate capital, rebuild institutions, and restructure household finance before the debt trap closes entirely. The answer to that question will determine not just the financial trajectory of African American households, but the capacity of African America rise in power and to address the racial wealth gap that remains its most persistent economic failure.

Disclaimer: This article was assisted by ClaudeAI.