The future will not belong to those who can jump the highest, but to those who can think the deepest.” — Anonymous (Modern African Proverb Reimagined)

For every hour a Black boy or girl spends practicing, playing, or watching sports, it becomes an hour not spent mastering math, science, literature, or history. Over time, those missed hours compound not just in skill gaps, but in confidence gaps. And confidence, in education as in life, is everything. The long-term consequence of this imbalance may be far greater than lost academic opportunities. It may be the loss of African America’s ability to compete in the 21st-century economy and the slow erosion of its intellectual sovereignty.

Sports are a cherished part of African American culture, woven through family traditions, community pride, and generational memory. From Jackie Robinson to Serena Williams, from Doug Williams to Simone Biles, athletic greatness has symbolized resilience and excellence in a world that too often sought to deny both. But beneath the surface of that cultural triumph lies an uncomfortable reality: the love of the game may have become too consuming, crowding out the time, attention, and aspiration needed for mastery in science, technology, engineering, and mathematics — the disciplines defining wealth and power in the modern world.

A study by GradePower Learning found that American students spend about 1,000 hours in school each year — and roughly the same amount watching screens. For African American youth, however, there’s an additional pull: sports participation, practices, and games can consume 10 to 20 hours a week, not counting the time spent watching sports media, highlights, or discussing the latest player stats. By the time a child reaches high school graduation, those hours can exceed 8,000 — the equivalent of four full years of math or science instruction. What might have been time spent learning quadratic equations or Newton’s laws becomes time devoted to perfecting a crossover dribble or memorizing playbooks.

In theory, sports are said to teach discipline, teamwork, and perseverance — invaluable traits for life and leadership. But decades of African American participation in sports have shown that, in practice, these virtues rarely translate into collective advancement or institutional power for the community. Sports teach many to endure, but not necessarily to build. They inspire personal excellence but often without structural returns. Meanwhile, other ethnic groups are compounding their time in STEM preparation. In Asian households, it is not uncommon for students to attend supplemental weekend academies for math and science. The same can be said of many immigrant families who prioritize educational mastery as a direct pathway to generational wealth.

This divergence begins early. By middle school, African American students already lag behind in math and science proficiency, and by high school, many have internalized the belief that they “aren’t math people.” Yet, that belief is not innate; it’s cultivated by the habits of time and attention society rewards.

The youth sports economy in the United States is now valued at over $30 billion, according to USA Today. Parents are spending thousands each year on club fees, travel tournaments, gear, and coaching — often with dreams of athletic scholarships or professional contracts that statistically almost never come. A 2025 USA Today report noted that many parents invest between $5,000 and $10,000 annually per child in competitive sports, hoping to secure a college scholarship. Yet, NCAA data show that less than 2% of high school athletes earn athletic scholarships, and an even smaller fraction go on to professional sports.

When those numbers are mapped against household wealth, the economic irony becomes staggering. The median net worth of African American families remains around $44,900, compared to $285,000 for White families. If the average family spends $10,000 per year on youth sports for a decade, they could instead have invested $100,000 into a 529 education savings plan or a family investment fund. Compounded annually at 7%, that investment would yield roughly $196,000 by the time their child turns 18 — enough to pay for college tuition, or serve as seed capital for a business. But the investment goes into jerseys, tournaments, and sneakers. Sports is not just a pastime anymore; it’s an industry — one that thrives on hope, marketing, and the dream of ascension. For African American families, that dream often overshadows a deeper one: intellectual independence.

From the earliest ages, children internalize the models of success they see. If every hero they admire dribbles, runs, or dunks, it subtly shapes what they believe they must become to matter. The African American community has created icons in every field, but sports icons receive disproportionate visibility, media coverage, and cultural veneration. Young boys can name more NFL quarterbacks than Black engineers, scientists, or inventors. This imbalance creates a quiet but powerful feedback loop. The more the community celebrates athletic success as the highest expression of Black excellence, the fewer young people will be inspired to emulate scientific or entrepreneurial greatness. The idolization of the athlete — rather than the innovator — becomes a generational tax on imagination.

STEM confidence, like athletic skill, is built through repetition and exposure. A child who spends thousands of hours practicing sports builds confidence in their athletic identity. A child who spends thousands of hours exploring robotics or chemistry develops confidence in their intellectual identity. The problem is not talent — it’s time allocation.

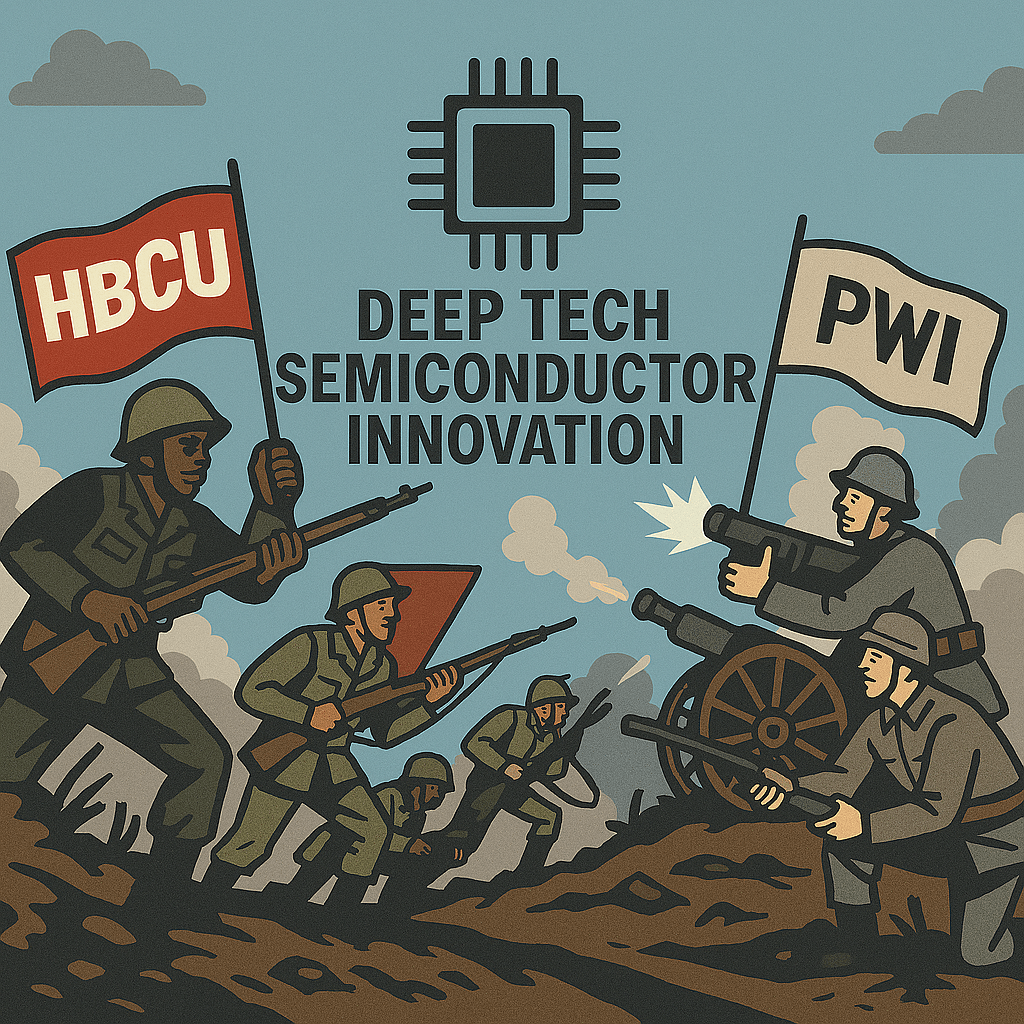

If African America’s endowments are to grow, its intellectual capital must first be rebalanced. STEM fields are not just high-paying; they are high-leverage. Engineers design cities, coders build economies, and scientists control the frontiers of technology and medicine. When African American students are absent from these sectors, it isn’t just a diversity gap — it’s a sovereignty gap. Every innovation African America fails to own is an innovation it must rent from others. Every algorithm not written, every patent not filed, every lab not funded contributes to institutional dependency. Historically Black Colleges and Universities sit at a unique crossroads. While they have been strong in liberal arts, education, and social sciences, they must now pivot aggressively toward STEM dominance. Yet even they face a cultural headwind — many incoming students have been nurtured to see physical performance as validation of worth, while intellectual rigor is often seen as a burden rather than a badge.

An HBCU graduate in engineering or computer science may go on to invent, design, and build. An HBCU athlete may entertain millions. But the wealth gap between those two trajectories is not just individual — it’s institutional. Consider the compound effect of lost hours: one hour per day diverted from academic enrichment equals 365 hours per year. Over 13 years of schooling (Pre-K through 12th grade), that’s nearly 4,750 hours — more than two full school years of instruction. That’s just for one hour. Many student-athletes spend much more time — often 10 or more hours weekly — on practice, travel, and games. By high school, this could exceed 10,000 hours — the exact amount Malcolm Gladwell famously cited as the threshold for mastery in any field.

African American students are becoming masters — just not in the fields where mastery translates into institutional control or generational wealth. Imagine if even half of those hours were redirected into robotics clubs, science fairs, financial literacy programs, or coding bootcamps. The shift in intellectual and economic trajectory would be profound. Culture cannot change overnight, but it can evolve intentionally. African American parents, educators, and institutions must begin redefining what excellence looks like — and where the applause should go. Families should celebrate as loudly when a child aces a chemistry exam or builds a mobile app as when they score a touchdown. Public affirmation must follow academic achievement with the same enthusiasm it gives athletic performance.

The money spent on club sports, travel, and equipment could be partially reallocated to STEM programs, tutoring, or even early college credit courses. Financial discipline must mirror the rigor of athletic discipline. Imagine a Saturday morning robotics league with the same energy as youth basketball — complete with team jerseys, community support, and trophies. Institutions like HBCUs could sponsor regional competitions to make intellectual pursuit a spectator event. HBCUs can create mentorship pipelines connecting student-athletes with STEM majors to promote balance. Athletic departments should collaborate with STEM departments on interdisciplinary projects that merge sports analytics, biomechanics, and data engineering. Families can begin small: a weekly science documentary, math challenges at the dinner table, or trips to museums and tech expos. What matters most is that curiosity and analysis become part of the household rhythm.

America’s future wealth and power will flow through those who master technology, not those who merely consume it. The engineers designing renewable energy grids, the programmers writing AI code, and the scientists developing space propulsion systems are the ones shaping the next civilization. African America cannot afford to be absent from that frontier — nor can it afford to lose another generation to the illusion of athletic access as a substitute for academic and economic power. The cultural love of sports, once a symbol of survival and community, must now evolve into a love of systems, science, and strategy. The same passion that drives the athlete can drive the engineer. The same discipline that fuels a 5 a.m. workout can fuel a 5 a.m. study session. But only if the institutions — families, schools, and HBCUs — are intentional in redirecting that energy.

The African American community once used sports as a pathway to dignity in a segregated world. Now, the challenge is to use STEM as a pathway to dominance in a digitized one. The scoreboard has changed, and so must the game. For every hour spent on a basketball court, a track, or a field, there should be an equal hour at a computer, in a lab, or under a microscope. Not because sports don’t matter, but because the future does. To win this century, African America must love the pursuit of knowledge more than the pursuit of applause. Its children must learn to compete not just on the field — but in the lab, the boardroom, and the data center. Otherwise, the highlight reels will continue to roll, but the ownership of the next generation’s wealth and innovation will belong to someone else.

Disclaimer: This article was assisted by ChatGPT.