“Financial violence has always been America’s quietest weapon and when African America builds without its own banks, it builds on sand.” – HBCU Money

The announcement that Farm Credit Mid-America, a Kentucky cooperative lender, had placed Uncle Nearest and its affiliated companies under federal receivership has shaken both the whiskey industry and African American business circles. The suit, seeking repayment of more than $108 million in loans, highlights not only the fragility of high-growth consumer brands but also a longstanding structural reality: the absence of large, African American-owned financial institutions that could have acted as lender, partner, and safeguard. At its height, Uncle Nearest was not just a spirits company. It had become a cultural symbol, a multimillion-dollar brand built on the rediscovered story of Nathan “Nearest” Green, the enslaved man who taught Jack Daniel to distill. But symbols are poor substitutes for capital. When the credit cycle turns and lenders impose stricter terms, symbols do not pay creditors, nor do they provide the liquidity needed to weather missteps. Uncle Nearest’s fate is therefore not only a corporate matter but a macro-lesson in institutional gaps that continue to undermine African American economic power. And it is inseparable from a longer history of European Americans wielding financial violence to weaken or erase African American institutions.

Farm Credit Mid-America’s complaint is straightforward in legal framing but heavy in consequence. It alleges default on revolving and term loans, misuse of proceeds—including purchase of a Martha’s Vineyard property outside agreed-upon terms—and inflated valuations of whiskey barrel inventories pledged as collateral. The cooperative insists the company failed to provide accurate financial reporting and violated covenants on net worth and liquidity. For the court, these alleged breaches justified appointing a receiver to oversee Uncle Nearest’s assets. For the wider market, the case raises questions about how one of the fastest-growing American whiskey brands could become so overextended in such a short time. But to view this only through the narrow lens of corporate mismanagement is to miss the structural point. Uncle Nearest turned to Farm Credit Mid-America precisely because African America has no equivalent institution at scale. The problem is not just a troubled borrower but a financial architecture in which African Americans must seek credit from institutions historically aligned against them.

European Americans have long recognized that domination requires more than guns and laws—it requires control of finance. Throughout American history, financial violence has been deployed to cripple African American economic advancement. The Freedman’s Savings Bank collapse in 1874 wiped out the life savings of formerly enslaved depositors, and the federal government refused to fully compensate them, teaching African Americans early that their deposits could be sacrificed without recourse. In the 20th century, European American banks and the federal government codified racial exclusion through redlining maps, systematically denying mortgages in Black neighborhoods. This was not neutral finance; it was engineered financial violence, preventing African Americans from entering the homeownership wealth pipeline. The burning of Greenwood in Tulsa in 1921, often remembered as a physical massacre, was also a financial one. Banks, insurance companies, and credit lines were destroyed alongside homes and businesses. Without access to capital, Greenwood could never fully rebuild. In more recent times, financial violence has taken the form of predatory lending. Subprime mortgage products were disproportionately pushed onto African American homeowners before the 2008 financial crisis, wiping out a generation of household wealth. European American-controlled finance profits from African American participation in the economy while denying equal access to capital formation. Uncle Nearest’s entanglement with Farm Credit Mid-America is not an anomaly but a continuation. When European American-controlled institutions are the gatekeepers of capital, they wield the power not only to finance but also to foreclose, to empower but also to erase.

The Uncle Nearest saga is a case study in how celebrated success stories often obscure fragile foundations. For nearly a decade, business media and cultural outlets heralded the brand as a triumph of African American entrepreneurship. The company claimed exponential growth, distribution in all 50 states, and a flagship distillery that drew tourists. Yet financial statements were rarely disclosed, and profitability was never the focus. The enthusiasm reflected a broader dynamic: African American brands often become cultural darlings before they become financially resilient. Without deep ties to institutional lenders within their own community, they must rely on external credit relationships that can sour quickly. When this happens, the story moves from triumph to turmoil in a matter of months.

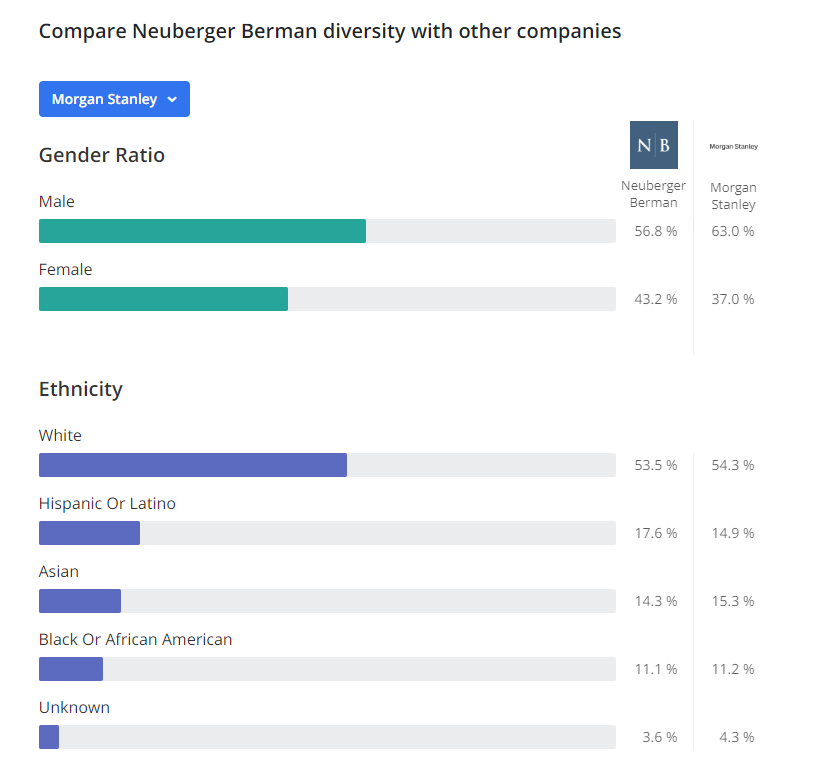

At the core of this episode lies a more sobering truth. African American households control nearly $1.7 trillion in annual spending power, but African American-owned financial institutions hold less than 0.5% of U.S. banking assets. The top African American-owned bank has under $1 billion in assets; Farm Credit Mid-America, the plaintiff in the Uncle Nearest case, controls more than $25 billion. This mismatch leaves African American entrepreneurs, even those with national brands, dependent on institutions whose strategic priorities do not necessarily align with sustaining African American economic power. When defaults arise, the lender’s duty is to recover capital—not to protect the cultural or institutional significance of the borrower. European American-controlled finance, then, becomes not merely a neutral system but an instrument of selective gatekeeping. It funds African American brands when profitable, then withdraws and seizes control when convenient, replicating patterns of dispossession stretching back centuries.

Receivership is not always terminal. In many instances, companies emerge leaner and restructured. A skilled receiver may stabilize operations, preserve brand value, and even attract new capital. But for Uncle Nearest, the optics are punishing. A brand that marketed authenticity, resilience, and cultural restoration is now under external control. From an institutional perspective, the more important lesson is this: receivership often transfers control of assets from founders to outsiders. In this case, the intellectual property, inventory, and brand narrative of Uncle Nearest may ultimately end up in the hands of a major spirits conglomerate. The cultural capital painstakingly built could be monetized by global firms with no obligation to the communities that celebrated the brand’s rise.

This is hardly a new pattern. African American economic history is dotted with enterprises that gained cultural significance but lacked the institutional scaffolding to survive financial storms. From insurance firms in the early 20th century to radio stations in the late 20th century, the cycle repeats: individual success, rapid expansion, external borrowing, crisis, foreclosure, and eventual transfer of ownership. The absence of African American-controlled capital at scale explains why these cycles recur. Wealth is preserved and multiplied not through consumption but through financial intermediation like banks, insurers, investment funds, and cooperatives. Without these, individual businesses operate in a structurally hostile financial environment, an environment designed and maintained by European American interests.

The Uncle Nearest case illustrates several lessons that extend beyond whiskey or even consumer goods. Growth without institutional capital is fragile; rapid expansion must be supported by lenders whose incentives align with the borrower’s long-term survival. Transparency is essential; overstated inventory, inflated collateral, or vague reporting create vulnerabilities. Community lenders could impose discipline while understanding cultural context. Symbols cannot substitute for structures; a brand can inspire, but only institutions preserve value across generations. And perhaps most importantly, financial violence must be anticipated. Entrepreneurs cannot treat European American-controlled capital as neutral. It must be engaged with caution, hedged against, and ultimately replaced by African American-owned capital.

If African American entrepreneurs are to avoid similar fates, the ecosystem must address the capital gap at its root. That means building financial institutions with assets measured not in millions but in tens of billions. Institutional investments by profitable African American owned corporations and high net-worth African Americans of existing African American banks could create scale and efficiency. Other institutional investment vehicles such as real estate investment trusts, private credit funds, and venture platforms controlled by African American institutions could channel capital into businesses without reliance on external lenders. Partnership with HBCUs could pool university endowments, serving as anchor investors for community-controlled funds. These strategies require not just capital but governance discipline. Failed experiments in the past show that poorly managed institutions can collapse under their own weight. The challenge is to combine professional financial management with community accountability.

Internationally, minority communities have built financial ecosystems as buffers against exclusion. In South Korea, family-owned conglomerates leveraged domestic banks to grow global brands like Samsung and Hyundai. In Israel, tight networks of banks, state funding, and venture capital built the foundation for a high-tech economy. African American institutions remain far from achieving comparable coordination. Philanthropic donations, though celebrated, often flow into consumption or temporary relief rather than capital formation. Until African American institutions master the art of financial intermediation, the cycle of celebrated rise and sudden vulnerability will continue.

Uncle Nearest’s predicament carries symbolic weight precisely because the brand itself was constructed around reclaiming lost African American contributions. Nathan “Nearest” Green’s story gave the company authenticity, and Fawn Weaver’s stewardship turned it into a case study of cultural entrepreneurship. But culture without capital is precarious. If the brand is ultimately sold or absorbed into a global portfolio, the irony will be stark: once again, the African American contribution will be remembered, but the financial returns will flow elsewhere. This pattern mirrors the broader reality of African American culture in America—ubiquitous in influence, marginal in ownership.

What would a different outcome look like? Imagine a scenario where an African American-owned financial cooperative, with $20 billion in assets, had been Uncle Nearest’s primary lender. When financial stress emerged, restructuring discussions would occur within the community, balancing creditor protection with brand preservation. A workout plan could have extended maturities, injected bridge capital, and preserved ownership. Instead, the present outcome will likely see the brand either auctioned, restructured under external oversight, or sold into a larger portfolio. The story of Uncle Nearest will remain in museums and marketing campaigns, but the financial rewards will slip away—just as European American institutions have ensured through financial violence for generations.

The Uncle Nearest receivership is not just a cautionary tale about aggressive borrowing or mismanagement. It is a systemic reminder of what happens when cultural triumphs outpace institutional capacity, and when European American-controlled finance holds the decisive power. Financial violence has been the consistent tool used to limit African American progress—from denying mortgages, to burning banks, to predatory subprime lending. Today it manifests in legal filings, receiverships, and foreclosures that strip ownership while preserving value for others. Until African American communities control financial institutions of sufficient scale, stories like this will recur: brilliant brands, celebrated entrepreneurs, cultural resonance—and eventual loss of ownership when credit turns cold. Only when African America builds banks, insurers, funds, and cooperatives at scale will financial violence cease to be an inevitability and become a relic of the past.

The call to action is clear. This moment must not be treated as another sad headline in the long story of African American dispossession. It must be the spark for a generational project to build the financial scaffolding that has been systematically denied. African American investors, entrepreneurs, and institutions cannot wait for European American finance to treat them fairly; fairness has never been the logic of capital. They must pool resources, scaling banks, capitalize funds, and demand that philanthropy move beyond symbolic gifts toward endowments and capital vehicles that last. The future of African American business depends not on individual brilliance or cultural resonance but on the quiet, disciplined construction of financial power. If Uncle Nearest becomes a turning point, it will not be because of whiskey. It will be because African America finally decided that financial violence would no longer be its inheritance, and that institutional capital, built and controlled internally, would be its defense.

Disclaimer: This article was assisted by ChatGPT.