A single twig breaks, but the bundle of twigs is strong. – Tecumseh

The tradition of giving runs deep in African American communities. From the mutual aid societies formed during enslavement to the church collections that funded the Civil Rights Movement, Black Americans have always understood that our collective survival depends on our willingness to invest in one another. Yet somewhere between necessity and aspiration, we’ve lost the language to teach our children that philanthropy isn’t charity—it’s power.

Teaching African American children ages 5-18 about philanthropy means doing more than dropping coins in a collection plate. It means helping them understand that strategic giving builds the institutions that will protect, educate, and employ them throughout their lives. It means showing them that every dollar they contribute to Black-led organizations is a vote for their own future.

Starting Early: Philanthropy for Elementary Ages (5-10)

Young children understand fairness instinctively. They know when something isn’t right, and they want to help fix it. This natural empathy creates the perfect foundation for introducing philanthropic concepts.

Begin with concrete examples from African American history. Tell them about the Free African Society, founded in 1787 by Richard Allen and Absalom Jones, which provided mutual aid to Black Philadelphians. Explain how enslaved people pooled resources to purchase freedom for family members. These aren’t abstract concepts they’re survival strategies that became institutional frameworks.

Create a family giving jar where children can contribute a portion of their allowance or gift money. Let them research and choose a Black-led organization to support quarterly. This could be a local youth program, a historical preservation society, or an HBCU scholarship fund. The key is giving them agency in the decision-making process. When children see their small contributions combine with others to create meaningful impact, they begin to understand collective power.

Use storytelling to illustrate how institutions are built. Talk about how HBCUs were created because white institutions excluded Black students. Explain how Mary McLeod Bethune started a school with $1.50 and turned it into Bethune-Cookman University. Show them that great institutions often begin with small, consistent contributions from people who understood the long game.

Middle School: Understanding Institutional Building (11-13)

By middle school, children can grasp more sophisticated concepts about how money moves and how power is built. This is when we introduce them to the difference between charity and institutional philanthropy.

Charity addresses immediate needs—feeding the hungry, clothing the poor. Institutional philanthropy builds the structures that create long-term change: schools, hospitals, community development corporations, legal defense funds, policy organizations. Both matter, but only institutional philanthropy shifts power dynamics.

Teach them about the NAACP Legal Defense Fund, established in 1940. Explain how sustained philanthropic support allowed lawyers like Thurgood Marshall to develop the legal strategy that led to Brown v. Board of Education. This wasn’t a one-time donation it was years of investment that transformed American society.

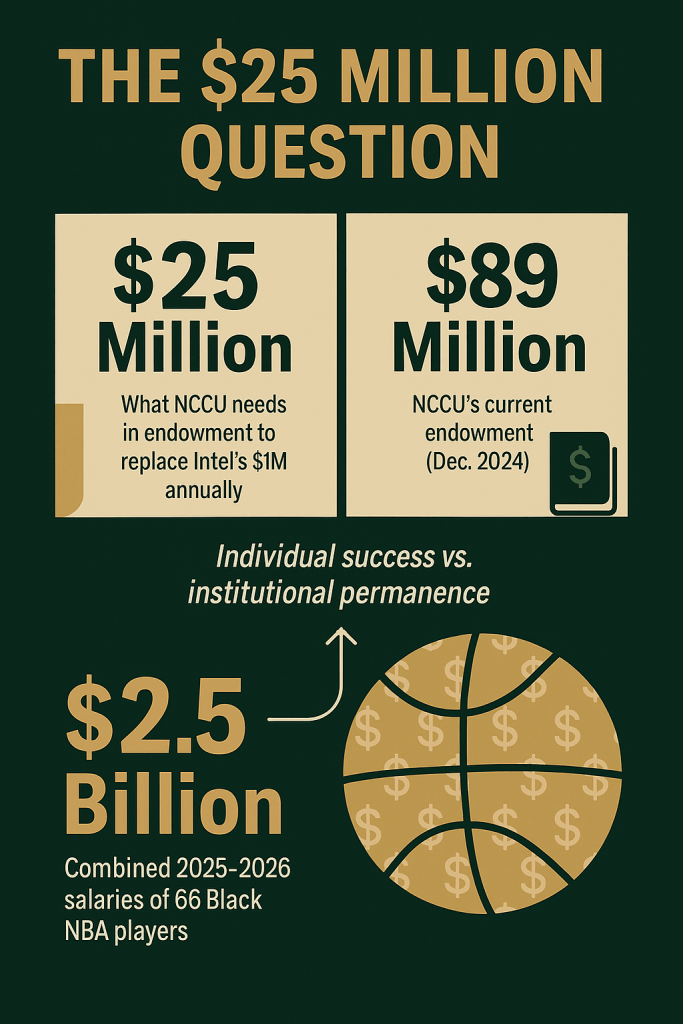

Introduce the concept of endowments and investment income. Too many African American organizations operate in perpetual crisis mode, chasing donations year after year. Show students the difference between an organization with a $100,000 annual budget that must be fundraised every twelve months and an organization with a $2 million endowment generating $80,000 annually in investment income. The second organization can focus on mission instead of survival.

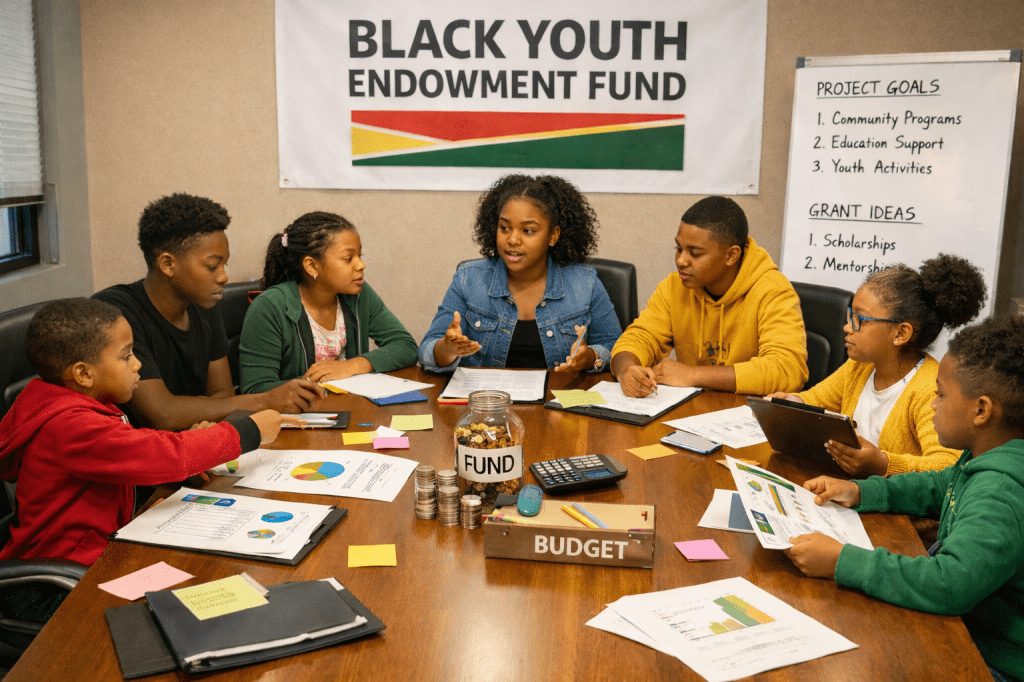

Start a philanthropy club at school or in your community. Let students identify a need in their community and develop a giving circle to address it. They should practice everything: setting fundraising goals, researching organizations, making collective decisions, tracking impact, and understanding how their contributions grow through consistent giving. This hands-on experience transforms abstract concepts into practical skills.

High School: Strategic Power Building (14-18)

High school students are ready to understand philanthropy as a tool for social, economic, and political empowerment. They can analyze power structures and recognize how institutional support or the lack thereof shapes outcomes in Black communities.

Teach them to read institutional budgets and annual reports. Show them how to evaluate whether an organization has sufficient reserves, how much goes to programs versus overhead, and whether they’re building long-term sustainability. This financial literacy is essential for effective philanthropy.

Explore the concept of investment income in depth. Many students don’t realize that major institutions—universities, museums, hospitals—operate primarily on endowment income, not annual fundraising. Harvard’s endowment generated approximately $2.3 billion in investment income in recent years. Imagine if HBCUs collectively had similar resources. Explain that building Black institutional power requires moving beyond the donation mentality to an investment mindset.

Discuss how philanthropy intersects with political power. Show them how think tanks, policy organizations, and advocacy groups are funded. Explain that when Black communities don’t adequately fund our own policy organizations, others define the agenda affecting our lives. The Tea Party movement and its affiliated organizations received hundreds of millions in philanthropic support that reshaped American politics. What might be possible if African American communities invested similarly in organizations advancing our interests?

Examine collective philanthropy models. Traditional philanthropy often centers wealthy donors making large gifts. But collective giving where many people contribute smaller amounts has always been the African American philanthropic model. From church building funds to contemporary giving circles, we’ve understood that our strength lies in numbers. Today’s technology makes collective philanthropy more powerful than ever. A thousand people giving $100 monthly creates $1.2 million annually enough to endow a scholarship, support a community organization, or launch a new initiative.

Encourage students to start giving now, even if it’s $5 monthly to an organization they believe in. The habit matters more than the amount. A teenager who gives $10 monthly from age 16 to 66 contributes $6,000 in direct donations, but if that money is invested and earns average returns, it represents tens of thousands in institutional support.

Teaching African American youth about philanthropy means helping them understand its components and how they work together to build institutional power.

Educational Institutions: HBCUs, independent schools, scholarship funds, and educational support organizations create pathways to opportunity and preserve cultural knowledge. Sustained philanthropic support allows these institutions to build endowments, improve facilities, and attract top faculty and students.

Economic Development: Community development corporations, Black-owned business incubators, affordable housing organizations, and loan funds build wealth and economic stability. These institutions require patient capital and sustained support to create generational impact.

Legal and Policy Organizations: Civil rights organizations, legal defense funds, policy think tanks, and advocacy groups shape the rules that govern society. Inadequate funding in this sector means Black interests remain underrepresented in policy formation.

Cultural Institutions: Museums, historical societies, arts organizations, and media companies preserve our stories and shape narratives. Control over our cultural narrative requires institutional infrastructure that only sustained philanthropy can build.

Health and Social Services: Community health centers, mental health organizations, and social service providers address immediate needs while building the institutional capacity to serve Black communities long-term.

Each component requires different funding strategies. Some need operating support, others need capital for buildings or technology, many need endowment building. Teaching youth to think strategically about where and how they give helps them maximize impact.

The most important lesson we can teach African American children about philanthropy is that it’s not optional it’s essential. Every community that has built institutional power has done so through sustained, strategic philanthropy. Jewish communities support Jewish institutions. Asian American communities support Asian American institutions. African American communities must do the same.

Start conversations early. Make giving a family practice. Teach children to evaluate organizations critically. Help them understand that building Black institutional power is a marathon, not a sprint. Show them that their contributions, combined with others, create the schools, organizations, and institutions that will serve generations to come.

This isn’t about guilt or obligation. It’s about power, self-determination, and legacy. When we teach our children that philanthropy is institution-building, we give them tools to shape their own future rather than waiting for others to determine it for them.

The question isn’t whether African American communities can afford to invest in our institutions. The question is whether we can afford not to.