“If you can provide the funding and you get the leadership, you’ll have a competitive team.” – T. Boone Pickens

The Southern United States is awash in energy. From Texas to Louisiana, Mississippi to Alabama, these states are responsible for the bulk of America’s oil and gas production. They are also home to the vast majority of Historically Black Colleges and Universities (HBCUs), institutions that have graduated generations of African American engineers, scientists, and business professionals. Yet, despite the geographic overlap and the energy sector’s enormous influence, there is an unmistakable void when it comes to HBCU alumni-founded firms in oil, gas, or even renewables. It is a paradox of proximity without participation—resources in abundance, yet ownership remains out of reach.

This disconnect is not simply a function of chance. It is the product of historical exclusion, structural barriers, and decades of capital disinvestment. The energy industry, especially oil and gas, has long been one of the most capital-intensive and closed sectors of the U.S. economy. The upstream business of exploration and drilling is not built for first-time entrepreneurs without deep-pocketed backers, multigenerational industry ties, or significant institutional support. Most HBCU alumni have none of the above.

For much of the 20th century, Black Americans were excluded from both land ownership in oil-rich regions and the educational infrastructure required to engage in the energy economy. HBCUs historically focused on liberal arts, education, and public service—disciplines that addressed urgent post-emancipation needs and segregation-era employment restrictions. Petroleum engineering, energy policy, and oil finance were simply not part of the curriculum. And while HBCUs today have engineering programs, few have the dedicated energy labs, industry partnerships, or commercialization infrastructure that their predominantly white counterparts enjoy. At places like the University of Texas or Texas A&M, oil research institutes, private equity-backed incubators, and billion-dollar endowments serve as launchpads for energy ventures. No HBCU currently operates at that scale.

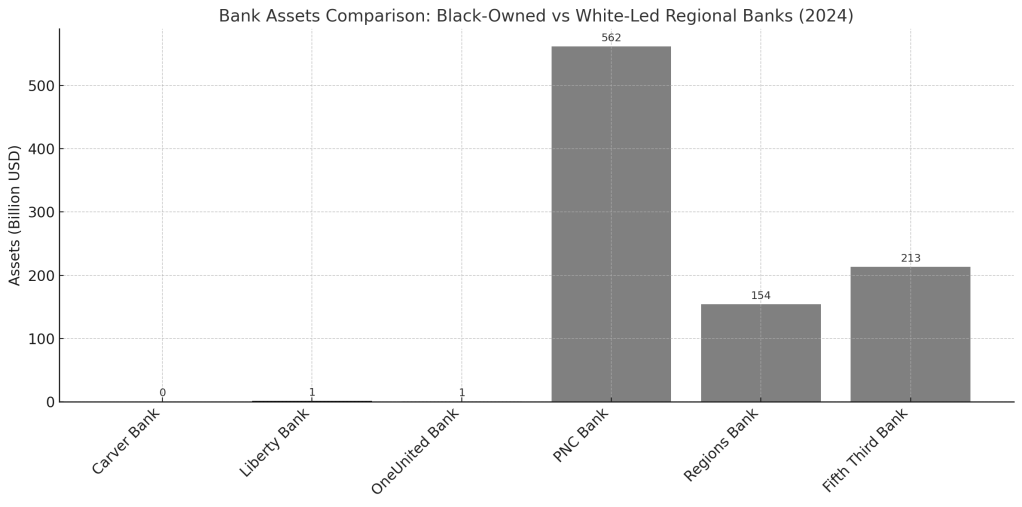

Then there is the question of capital. Even if an HBCU graduate had the technical know-how and vision to build an energy company, the financing would almost certainly be out of reach. According to the Federal Reserve’s most recent small business credit survey, Black entrepreneurs are more likely to be denied loans, receive lower funding offers, and face higher interest rates. In oil and gas, where drilling a single exploratory well can cost millions, these hurdles become insurmountable. And in the renewable energy space, which requires less upfront capital but still demands serious investment and regulatory navigation, Black founders are still underrepresented. Less than 2% of clean energy businesses are Black-owned, a figure confirmed by data from the Department of Energy and Brookings Institution.

There are, however, rare examples that offer a blueprint for what could be. Volt Energy, a solar development firm founded by HBCU alumnus Gilbert Campbell, has successfully executed projects for corporate and government clients. Its success is owed not just to entrepreneurial grit, but to strategic positioning in the rapidly growing clean energy sector and the willingness of federal partners to prioritize minority-owned firms. Another example is PEER Consultants, founded by Dr. Lilia Abron, an environmental engineering firm that has spent decades advancing sustainability and energy access in underserved communities. These stories are powerful but isolated.

Public and private efforts to address the imbalance are underway, albeit slowly. The Biden Administration’s Justice40 initiative mandates that 40% of certain federal climate investments benefit disadvantaged communities, opening the door for more HBCU-linked projects. The Department of Energy’s HBCU Clean Energy Education Prize, launched in 2023, is another signal of intent. It provides multi-million-dollar funding to HBCUs for curriculum development, student research, and partnerships in clean energy. But such programs are only as impactful as the ecosystems that surround them. Without access to long-term venture funding, procurement opportunities, and business mentorship, their reach will be limited.

Much of the challenge lies within institutional economics. The endowment gap between HBCUs and wealthier PWIs (predominantly white institutions) is massive. The entire HBCU sector holds less than $6 billion in endowment funds. By contrast, the University of Texas system—heavily funded by state oil revenues—controls more than $30 billion through its UTIMCO investment vehicle. These endowments don’t just fund scholarships; they finance research labs, spinouts, and equity investments in faculty or alumni-founded ventures. HBCUs, without comparable financial arms, cannot deploy the same kind of catalytic capital.

In this environment, oil-rich states like Texas, Louisiana, and Mississippi may continue to generate immense wealth from energy while HBCU alumni remain employees at best and consumers at worst. Ownership, the core driver of generational wealth and political leverage, continues to elude them.

But the renewable transition could offer an inflection point. The barriers to entry are lower, the policies more inclusive, and the urgency to diversify the energy economy is real. Solar and battery storage firms don’t require billion-dollar capex or land acquisition. Distributed energy resources, community solar projects, energy efficiency startups, and green construction ventures are all areas where HBCU alumni could lead—if properly funded and supported.

That shift requires vision, not just from government, but also from philanthropists, Black-owned banks, and corporate ESG programs. Capital alone, however, will not solve the problem. HBCUs must also expand their academic footprint into energy entrepreneurship, clean tech commercialization, and regulatory policy. More importantly, HBCU alumni must begin to see energy not just as an employer, but as a domain in which to build power, both economic and political.

The stakes are higher than ever. Energy is not simply about electricity or gasoline—it is about who owns the infrastructure of the future. Whether it’s solar farms, transmission networks, EV charging corridors, or hydrogen production, the assets being built today will define tomorrow’s winners. If HBCU graduates are not in the room now, they risk being locked out of that ownership for another generation.

The irony of standing on land that produces billions of dollars in oil revenues while holding none of the titles is no longer tolerable. The future energy economy must be diverse not only in technology but in ownership. For HBCUs, the time to act is now—not for symbolic inclusion, but for structural participation.

From fossil fuels to photovoltaics, the opportunity exists to move from resource curse to resource empowerment. Whether that opportunity is seized will depend on whether HBCUs, their alumni, and their partners choose to build ownership into the core of their energy future, or remain content with being near power, but never in control of it.

Supporting Data & Charts

1. Oil Production by HBCU States (2023, million barrels):

| State | Production | Number of HBCUs |

|---|---|---|

| Texas | 20,000 | 8 |

| Louisiana | 446 | 4 |

| Mississippi | 113 | 6 |

| Alabama | 27 | 14 |

| Oklahoma | 1,830 | 1 |

2. Black-Owned Firms in Energy (2022):

| Sector | % Black Ownership |

|---|---|

| Oil & Gas Extraction | <1% |

| Solar Installation | 1.3% |

| Energy Consulting | 2.1% |

| Utility-Scale Renewables | 0.5% |

3. Endowment Comparison (2024):

| Institution/System | Endowment ($B) |

|---|---|

| Harvard University | 53.2 |

| Stanford University | 37.6 |

| All HBCUs Combined | 5.2 |

| UTIMCO (Texas System) | 65.3 |

Disclaimer: This article was assisted by ChatGPT.