“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

A big number means absolutely nothing without context. Saying someone has a lot or a little of something does not tell you much of anything without a control variable to compare it to. This is absolutely one of the most troublesome things in conversation with many in African America where a number is presented like African America’s $1.5 trillion in buying power without asking – is that what is should be? How does it compare on a per person basis with other groups? What percentage of the overall buying power is it? It is in fact only 8 percent of America’s buying power while African America constitutes 12 percent of the U.S. population. Arguably then, African America’s buying power should be closer to $2.1 trillion or 40 percent greater than it is. When it comes to financial numbers we tend to personalize them thinking about if we (an individual) personally had that amount of money as opposed that amount of money spread across 40 million people or the budget necessary to run an entire institution versus a household. Again, context is not only important but imperative to understand what a number means and what it is actually telling you.

In 2020, the total equity market value of the U.S. stock market was $40.7 trillion according to Siblis Research. We asked Nova AI how much of the stock market is actually owned by African Americans, “A 2020 report by The Center for Economic and Policy Research, Black Americans held approximately 1.4% of the total value of U.S. listed public companies.” That amount equals out to the aforementioned $570.3 billion and at first glance it sounds like a tremendous amount, but further analysis says otherwise. First, it is a value that is equal to only 1.4 percent of the total equity market value. Secondly, if African America owned a representative amount of the total equity market value in correlation to our population (12 percent) it would be worth $6.1 trillion or almost 11 times the current ownership value. Lastly, how much would that workout per African American? The $570.3 billion equals out to $12,160 per African American while the $6.1 trillion would work $129,990 per African American. That is every African American man, woman, and child. For a household of four, it is the difference between a family having stock ownership value of less than $50,000 per household versus almost $600,000 per household.

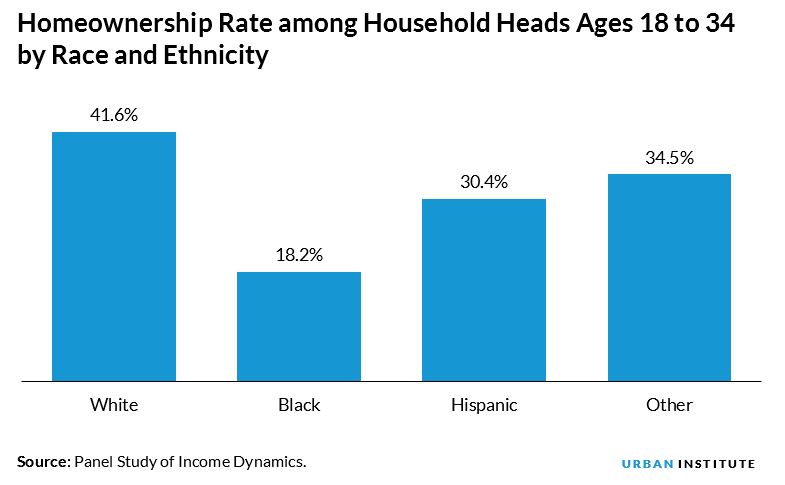

The impact of such a difference is almost hard to truly imagine and/or quantify. Homeownership would skyrocket through 50 percent for the first time in African America’s history without question. African American student loan debt would plummet. HBCU endowments would skyrocket. African American banks, businesses, and nonprofits would flourish in ways not seen since the early 1900s. Access to mental and physical health would be a norm instead of a dogfight. Life expectancy would increase substantially. African American poverty would see significant drops. Marriage for African American would likely see a boom. The list goes on and on. A family with $600,000 in equity market value conservatively would produce $24,000 annually (4 percent yield) in dividend income for the household which is taxed at a lower rate than earned income (your job) and therefore would have African American households keeping more of their money. It would also establish a multigenerational emergency fund for an African American household. Something that seems almost unheard for the vast majority of us.

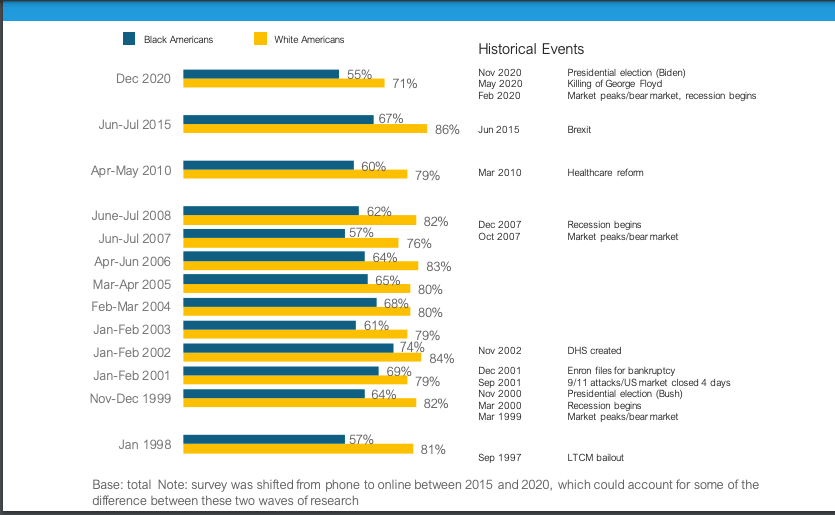

Headwinds for African American families to invest continue to be mountainous. African American median income is lowest among all groups and those African Americans who do find themselves with middle and high incomes tend to find themselves providing for immediate and extended families at a much higher rate than our European American counterparts. In 401(K)’s this shows up as European Americans contribute almost $300 a month while African Americans are just over $200. It may not sound like a huge difference, but when coupled over decades and compounding returns it can have a substantial impact on wealth building. There is also the severe lag in taxable investment accounts for African Americans. The majority of African American investors participate in the stock market strictly through their 401(K) and perhaps a IRA – both of which have annual contribution limits on them. Taxable investment accounts have unlimited contributions, easier to borrow against, more investment options, and easier to access in case of emergency, but according to a FINRA Foundation report, “Among African American respondents, 22 percent reported having a taxable investment account in 2012. The number rose to 26 percent in 2018 (see above).” In comparison, European and Asian American taxable accounts were at 35 and 41 percent, respectively. The latter two groups with higher median incomes, higher investment contributions, and as one sees significantly more taxable investment accounts make it a no wonder why their equity market value is significant head and shoulders above ours.

The answer while not a perfect one lies in group (small scale) and institutional (large scale) investing (ex. Investment Club: Definition, Advantages, How To Start One). Some downsides to group investing is finding likeminded people, consistent participation, employment volatility, less liquidity in case of an emergency. Upsides are more capital to scale investments with and generate greater returns, access to investments quicker allowing for compounding to take place longer, less individual risk, For instance, there is Black-owned real estate investment firm that offers mortgage notes at 20 percent annually, but the minimum is $5,000 to purchase a note. Saving $5,000 in a year is hard for a lot of households and if they can save that much they certainly do not want to lock it up in a note. With group investing perhaps with five people, then each is only responsible for $1,000 or just over $80 a month. Now your $1,000 is earning 20 percent when otherwise it would not be because of the minimum.

Institutional investing is arguably where the answer truly lies. African American institutions like our banks and credit unions, businesses, nonprofits, HBCU alumni associations and chapters, D9 organizations, HBCU endowments, and more do very little institutional investing. Instead, like many African American households most African American institutions hold the majority of their capital in cash and non-interest bearing accounts. The idea of our institutions being institutional investors even if they owned nothing more than vanilla ETFs (exchange-traded funds) like the SPY ETF (S&P 500) which is one of the safest entrees into the stock market investing seems like inventing fire for many African American institutions. Had any African American institution invested just $10,000 in the market in 2008 and held through 2021 that value would have increased over 400% to almost $43,000. Instead, most institutions like our households sat in cash and saw their $10,000 decline in value due to inflation and almost zero interest rates in savings accounts. The Divine 9 for instance has approximately 4 million members, if they could get 15 percent of that membership to give an extra $10 a year that would be $6 million per year able to invest in the stock market allowing the Divine 9 to be a substantive institutional investor and obviously on a scale that probably none of them could wield on their own without stress. That so many African American institutions have limited exposure to the stock market or none at all is arguably by far the greatest constraint on how much of the stock market’s value African America owns.

African America too often is looking to solve institutional problems with individual solutions. Workarounds, imagination, and institutional solutions are what is required if we are going to address much of the systemic mountains before us.