At the end of 2023, African America had asset values totaling $6.54 trillion and liability values totaling $1.55 trillion. This is an increase of $330 billion and $40 billion, respectively. Below is a breakdown of that wealth by assets and liabilities as reported by the Federal Reserve’s Distribution of Household Wealth data. African American assets amounted to 4% of U.S. Household and African American liabilities amounted to 8.3% of U.S. Household liabilities. This is a 100 basis points decline in assets from 2022 and 50 basis points decline in liabilities from 2022.

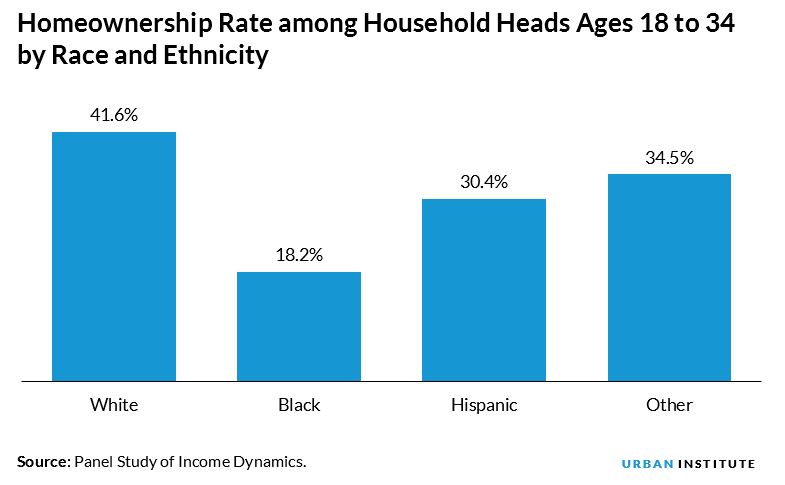

HBCU Money took a look at what exactly the African American asset portfolio entailed. African Americans are highly concentrated in two main areas, real estate and retirement accounts (pensions and 401K), respectively. These two groups comprise over 70 percent of African American assets versus only 43 percent for European Americans. Corporate equities/mutual funds and private business ownership comprise a staggering 35.3 percent of European American assets versus only 9.2 percent for African Americans, these two categories also representing African America’s lowest asset holdings.

Examining where African America puts its money and theorizing why can give us insight into strategies that can help in closing both household and institutional wealth gaps.

ASSETS

Real estate – $2.24 trillion

Definition: Real estate is defined as the land and any permanent structures, like a home, or improvements attached to the land, whether natural or man-made.

% of African America’s Assets – 34.3%

% of U.S. Household Real Estate Assets – 5.0%

4.2% increase from 2022

Consumer durable goods – $570 billion (3.6% increase from 2022)

Definition: Consumer durables, also known as durable goods, are a category of consumer goods that do not wear out quickly and therefore do not have to be purchased frequently. They are part of core retail sales data and are considered durable because they last for at least three years, as the U.S. Department of Commerce defines. Examples include large and small appliances, consumer electronics, furniture, and furnishings.

% of African America’s Assets – 8.7%

% of U.S. Household Assets – 7.2%

3.6% increase from 2022

Corporate equities and mutual fund shares – $270 billion

Definition: A stock, also known as equity, is a security that represents the ownership of a fraction of the issuing corporation. Units of stock are called “shares” which entitles the owner to a proportion of the corporation’s assets and profits equal to how much stock they own. A mutual fund is a pooled collection of assets that invests in stocks, bonds, and other securities.

% of African America’s Assets – 4.3%

% of U.S. Household Assets – 0.7%

17.4% increase from 2022

Defined benefit pension entitlements – $1.66 trillion

Definition: Defined-benefit plans provide eligible employees with guaranteed income for life when they retire. Employers guarantee a specific retirement benefit amount for each participant based on factors such as the employee’s salary and years of service.

% of African America’s Assets – 25.4%

% of U.S. Household Assets – 9.5%

3.1% increase from 2022

Defined contribution pension entitlements – $730 billion

Definition: Defined-contribution plans are funded primarily by the employee. The most common type of defined-contribution plan is a 401(k). Participants can elect to defer a portion of their gross salary via a pre-tax payroll deduction. The company may match the contribution if it chooses, up to a limit it sets.

% of African America’s Assets – 11.2%

% of U.S. Household Assets – 5.6%

21.7% increase from 2022

Private businesses – $330 billion

Definition: A private company is a firm held under private ownership. Private companies may issue stock and have shareholders, but their shares do not trade on public exchanges and are not issued through an initial public offering (IPO). As a result, private firms do not need to meet the Securities and Exchange Commission’s (SEC) strict filing requirements for public companies.1 In general, the shares of these businesses are less liquid, and their valuations are more difficult to determine.

% of African America’s Assets – 5.0%

% of U.S. Household Assets – 2.1%

5.7% decrease from 2022

Other assets – $740 billion

Definition: Alternative investments can include private equity or venture capital, hedge funds, managed futures, art and antiques, commodities, and derivatives contracts.

% of African America’s Assets – 11.3%

% of U.S. Household Assets – 2.7%

2.8% increase from 2022

LIABILITIES

Home Mortgages – $770 billion

Definition: Debt secured by either a mortgage or deed of trust on real property, such as a house and land. Foreclosure and sale of the property is a remedy available to the lender. Mortgage debt is a debt that was voluntarily incurred by the owner of the property, either for purchase of the property or at a later point, such as with a home equity line of credit.

% of African America’s Liabilities – 50.3%

% of U.S. Household Liabilities – 6.0%

1.3% increase from 2022

Consumer Credit – $710 billion

Definition: Consumer credit, or consumer debt, is personal debt taken on to purchase goods and services. Although any type of personal loan could be labeled consumer credit, the term is more often used to describe unsecured debt of smaller amounts. A credit card is one type of consumer credit in finance, but a mortgage is not considered consumer credit because it is backed with the property as collateral.

% of African America’s Liabilities – 47.7%

% of U.S. Household Liabilities – 14.8%

4.2% increase from 2022

Other Liabilities – $30 billion

Definition: For most households, liabilities will include taxes due, bills that must be paid, rent or mortgage payments, loan interest and principal due, and so on. If you are pre-paid for performing work or a service, the work owed may also be construed as a liability.

% of African America’s Liabilities – 1.9%

% of U.S. Household Liabilities – 2.7%

0.0 nonchange from 2022

Source: Federal Reserve