We will always have STEM with us. Some things will drop out of the public eye and will go away, but there will always be science, engineering, and technology. And there will always, always be mathematics. – Katherine Johnson

The same institutions that trained Katherine Johnson to calculate trajectories that put Americans on the moon now find themselves locked out of the computational infrastructure powering the next generation of scientific discovery. While Historically Black Colleges and Universities have long punched above their weight in producing Black STEM graduates, they remain systematically excluded from the high-performance computing resources that define cutting-edge research in the new era of AI, quantum computing, and supercomputers. It’s time for HBCUs to stop asking for access and start building their own.

The case for a Pan-HBCU supercomputer and quantum computing initiative is about survival, sovereignty, and strategic positioning in an economy where computational power increasingly determines who owns the future and who rents access to it.

Today’s research landscape is brutally simple: no supercomputer, no competitive research. Climate modeling, drug discovery, materials science, artificial intelligence, genomics, and aerospace engineering all require computational resources that most HBCUs simply cannot access at scale. While predominantly white institutions boast partnerships with national laboratories and billion-dollar computing centers, HBCU researchers often wait in lengthy queues for limited time on shared systems—if they can access them at all.

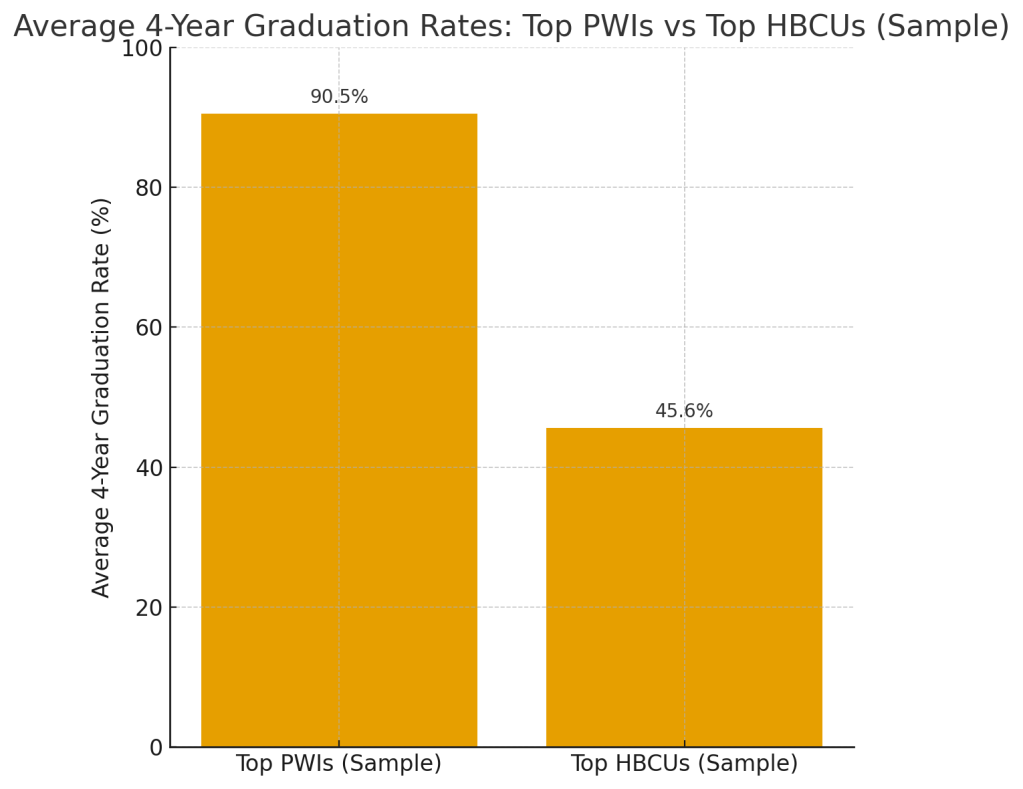

The numbers tell a stark story. According to the National Science Foundation, the top 50 research universities in computing infrastructure investment include zero HBCUs. Meanwhile, institutions like MIT, Stanford, and Carnegie Mellon operate dedicated supercomputing facilities that give their researchers 24/7 access to the tools that generate patents, publications, and licensing revenue.

This isn’t an accident. It’s the architecture of exclusion, and it’s costing African America billions in lost patents, forfeited breakthroughs, and surrendered market position. Every HBCU chemistry professor who can’t run molecular dynamics simulations is a drug that won’t be discovered. Every computer science department that can’t train large language models is an AI company that won’t be founded. Every physics researcher who can’t process particle collision data is a technology that someone else will own. This is about power—economic power, technological power, the power to shape industries rather than simply participate in them.

If the supercomputing gap is concerning, the emerging quantum divide is existential. Quantum computing represents a fundamental shift in computational paradigms with implications for cryptography, drug design, optimization problems, and artificial intelligence. Nations and corporations are investing billions to establish quantum supremacy, and the institutions that control this technology will own the intellectual property, set the standards, and capture the economic value of the next century of innovation.

HBCUs cannot afford to be spectators in this revolution. The breakthroughs that quantum-accelerated research could deliver everything from targeted therapies for diseases that disproportionately affect Black Americans to predictive models for climate impacts on Southern and coastal Black communities represent billions in economic value. More importantly, they represent the difference between being technology consumers and technology owners. Between licensing other people’s patents and collecting royalties on your own. But only if HBCUs control their own infrastructure. Or better yet, build it collectively.

Imagine a single, HBCU-owned computational facility, a crown jewel of Black academic infrastructure rivaling Los Alamos or Oak Ridge. Not distributed nodes competing for resources, but a unified campus where HBCUs collectively own land, buildings, and the machines that will mint the next generation of Black technological wealth. This is the computational arm of the HBCU Exploration Institute: a physical place where supercomputers hum, quantum processors compute, and HBCU researchers control access rather than beg for it.

The location matters. This facility needs to be somewhere politically friendly to ambitious Black institution-building, with favorable tax treatment, low energy costs, and infrastructure support. Four locations stand out:

New Mexico: Adjacent to Los Alamos and Sandia National Laboratories, with existing fiber infrastructure, favorable renewable energy costs, and a state government actively recruiting research facilities. New Mexico offers technical talent spillover, dry climate ideal for precision equipment, and proximity to Native American sovereign nations experienced in building independent institutions.

Puerto Rico: Tax incentives under Acts 20 and 22 (now Act 60) make it the Caribbean’s premier location for high-tech operations. Abundant renewable energy potential, especially solar, combined with federal research dollars without federal income tax on certain operations. Added benefit: positions HBCUs as bridge between U.S. and Caribbean research ecosystems.

Maine: Northern climate perfect for cooling systems, cheap hydroelectric power, and a state government hungry for high-tech economic development. Access to Canadian research partnerships, Atlantic subsea cable landing stations for data connectivity, and political environment favorable to institutional autonomy.

U.S. Virgin Islands: Caribbean location with full U.S. federal research funding access, generous tax incentives, and positioning as gateway to African and Caribbean collaborations. Year-round operation of field stations and research vessels, with computational infrastructure supporting the marine and atmospheric research missions.

The model is straightforward but transformative. HBCUs contribute capital to the HBCU Exploration Institute to purchase 200-500 acres outright. The land becomes HBCU property that is collectively owned, governed by an HBCU board, generating wealth for HBCU institutions in perpetuity. This isn’t leasing. This is ownership. A single state-of-the-art facility would house exascale supercomputers, quantum processors, AI training clusters, and massive data storage. Economies of scale mean more computing power per dollar than distributed nodes. Concentrated talent means better recruitment and retention. One campus means one set of operating costs, one power bill, one maintenance team.

HBCUs buy in based on their research needs and financial capacity. Larger contributors get more computational allocation and board representation, but every participating HBCU gets guaranteed access. Small institutions pool resources to punch above their weight. Research allocation follows ownership stakes, but the baseline ensures even small HBCUs can run competitive projects. Beyond serving HBCU research, the facility operates as a commercial venture. Lease computational time to corporations, government agencies, and international research collaborations. Host corporate AI training runs. Provide data center services. Every dollar generated flows back to participating HBCUs as dividends proportional to ownership stakes.

Adjacent to the computing facility, housing for rotating cohorts of HBCU researchers, graduate students, and undergraduate fellows creates a research village. Three-month to one-year residencies allow HBCU talent to work on computationally intensive projects while building networks across institutions. This becomes the intellectual hub of HBCU computational science, a place where collaborations form, startups launch, and the next generation of Black tech founders cut their teeth.

The sticker shock of supercomputing infrastructure is real but so is the cost of exclusion. A competitive supercomputing facility costs between $100-200 million to build and $10-30 million annually to operate, depending on scale and capability. Quantum computing infrastructure is still evolving, but meaningful access could require $50-75 million in initial investment. These aren’t small numbers, but they’re achievable through a combination of federal investment, private philanthropy, and strategic partnerships.

The first call should be to African American and Diaspora wealth both domestic and international. High-net-worth Black individuals, African tech billionaires, Caribbean family offices, and Diaspora investment networks represent untapped capital that understands the long-term value of Black institutional ownership. These are investors and philanthropists who won’t demand the same strings or ideological alignment tests that mainstream foundations impose. Traditional foundations like Mellon and Gates may follow once momentum builds, but Diaspora capital should lead. This ensures the vision remains accountable to Black communities rather than foundation program officers.

The priority for corporate partnerships should be African American and Diaspora-owned tech companies and investors who understand the strategic value of Black computational sovereignty. Seek partnerships with Black-led private equity firms, African tech entrepreneurs, and Caribbean technology investors before approaching mainstream tech giants. When engaging with companies like Microsoft, Google, IBM, and NVIDIA, structure deals that provide HBCUs with hardware, software, and expertise in exchange for joint research projects and equity participation but ensure HBCUs retain majority control and IP ownership. The goal is capital and resources, not dependence.

Federal funding streams exist like the CHIPS and Science Act, NSF Major Research Instrumentation grants, Department of Energy computing initiatives, and NASA research infrastructure programs though the current political environment makes federal support uncertain at best. HBCUs should build relationships and develop proposals now, but plan for a future administration more committed to research equity. In the meantime, the strategy must center on private capital and revenue generation that doesn’t depend on federal goodwill. Once operational, the facility could generate substantial revenue through commercial computing services, corporate research partnerships, and federal agency contracts. The University of Texas at Austin’s Texas Advanced Computing Center generates tens of millions annually through exactly this model, money that flows back into research capacity and student support. An HBCU-owned facility would channel those revenues directly to participating institutions as dividends proportional to ownership stakes.

The real value of HBCU-owned computational infrastructure goes far beyond the machines themselves. It’s about training the next generation of computational scientists, quantum engineers, and AI researchers who don’t just work for tech companies but found them, own them, and profit from them. Students at HBCUs with robust computing facilities wouldn’t just learn about supercomputers in textbooks they’d gain hands-on experience optimizing code for parallel processing, debugging quantum algorithms, and managing large-scale computational workflows. These aren’t abstract skills; they’re the exact expertise that tech companies and national laboratories desperately need and are willing to pay premium salaries to acquire. More importantly, they’re the skills that enable students to launch their own computational startups rather than simply joining someone else’s.

Faculty recruitment and retention would transform overnight. Try recruiting a top-tier computational chemist or AI researcher to an institution where they’ll spend half their time begging for computing time elsewhere. Now imagine recruiting that same researcher with the promise of dedicated access to world-class computing infrastructure and a path to commercialize their discoveries. The competitive landscape shifts dramatically.

This proposal aligns seamlessly with emerging initiatives like the HBCU Exploration Institute and the Coleman-McNair HBCU Air & Space Program outlined in recent strategic planning documents. These ambitious programs envision HBCUs leading research expeditions, operating research vessels and aircraft, and conducting aerospace missions. None of this is possible without serious computational infrastructure. Climate modeling for polar expeditions, satellite data processing, aerospace engineering simulations, deep-sea mapping analysis—these all require supercomputing resources. Want to analyze genomic data from newly discovered marine species? Process atmospheric measurements from research aircraft? Model propulsion systems for small satellites? You need computational power, and lots of it.

A Pan-HBCU Computing Consortium wouldn’t just support these exploration initiatives it would accelerate them, turning HBCUs into genuine leaders in exploratory science rather than junior partners dependent on others’ computational generosity. And every discovery, every patent, every breakthrough would belong to HBCU institutions and their researchers.

The window for building this capacity is closing. As quantum computing matures and AI systems become more computationally intensive, the institutions with infrastructure will accelerate away from those without. The gap between computational haves and have-nots will become unbridgeable, and HBCUs will be permanently relegated to second-tier research status which means second-tier revenue, second-tier patents, and second-tier wealth creation.

But it doesn’t have to be this way. The HBCU community has something that other institutions don’t: a shared mission, deep trust networks, and a history of collective action in the face of systemic exclusion. These institutions didn’t wait for permission to educate Black students when others wouldn’t. They didn’t wait for invitations to produce world-class scientists and engineers. They built their own institutions and proved the doubters wrong.

The same spirit that created HBCUs in the first place, the audacious belief that Black excellence could not be contained or denied must now be channeled into building the computational infrastructure these institutions need to compete and win in the 21st century. The question isn’t whether HBCUs can afford to build their own supercomputer and quantum computing infrastructure. The question is whether they can afford not to. In a world where computational power increasingly determines who shapes the future and who profits from it, HBCUs must choose between dependence and ownership.

The choice should be obvious. It’s time to build.

Disclaimer: This article was assisted by ClaudeAI.

Charlamagne Tha God & Jemele Hill: The Debate They Both Got Right and Wrong

“If you don’t own anything, you don’t have any power.” — Dr. Claud Anderson

When Charlamagne Tha God proclaimed, “Wake your ass up and get to trade school!” after NVIDIA’s CEO Jensen Huang suggested that the next wave of American millionaires will come from plumbers and electricians, he was not simply shouting into the void. He was echoing a national frustration, one rooted in the rising irrelevance of a degree-driven economy that no longer guarantees stability or wealth. Student debt has grown into a generational shackle, corporate loyalty is dead, and a working class once promised a middle-class life for earning a degree has found itself boxed out of the very prosperity it was told to chase. Charlamagne’s message resonated because trades feel like a lifeboat in an economy where white-collar work has become overcrowded, uncertain, and increasingly automated. But Jemele Hill’s response, “There’s nothing wrong with getting a trade, but the people in the billionaire and millionaire class aren’t sending their kids to trade schools” was the kind of truth that punctures illusions. She was not critiquing the trades; she was critiquing the belief that skill, in isolation from ownership, can produce power.

Her point hits harder within African America because our community has historically been guided into labor paths whether trade or degree that position us as workers within someone else’s institutions. It is not a coincidence. As HBCU Money examined in “Washington Was The Horse And DuBois Was The Cart”, the historical tension between industrial education and classical higher learning was never about choosing one or the other. It was about sequencing. Booker T. Washington understood that African America first needed an economic base, a foundation of labor mastery and enterprise capacity. W.E.B. DuBois emphasized intellectual development and leadership cultivation. But Washington was right about one thing: without an economic foundation, intellectual prowess has no institutional home. And without institutional homes, neither the trade nor the degree can produce freedom. African America today is suffering because we abandoned Washington’s base-building and misinterpreted DuBois’s talent development as permission to serve institutions built by others.

Charlamagne’s trade-school enthusiasm fits neatly into Washington’s horse, the practical skill that generates economic usefulness. But Hill’s critique reflects DuBois’s cart understanding how society actually distributes power. The mistake is that neither Washington nor DuBois ever argued that skill alone, or schooling alone, was enough. Both ultimately pointed toward institutional ownership. Neither wanted African Americans to remain permanently in the labor class. The trades were supposed to evolve into construction companies, electrical firms, cooperatives, and land-based enterprises. The degrees were supposed to evolve into banks, research centers, hospitals, and political institutions. What we actually did was pursue skills and credentials not power. We mistook competence for control.

This is why the trades-versus-degrees debate is meaningless without ownership. Becoming a plumber or an electrician provides income, but not institutional leverage. Becoming a lawyer or an accountant provides upward mobility, but not institutional control. A community with thousands of tradespeople and thousands of degreed professionals but without banks, construction firms, land ownership, hospitals, newspapers, media companies, sovereign endowments, or venture capital funds is still a community of laborers no matter how educated or skilled.

This structural truth becomes even clearer when viewed through the lens of how the wealthiest Americans use education. HBCU Money’s analysis, “Does Graduate School Matter? America’s 100 Wealthiest: 44 Percent Have Graduate Degrees”, observes that while nearly half of America’s wealthiest individuals do hold graduate degrees, the degrees themselves are not the source of wealth. They are tools of amplification. They work because the individuals earning them already have ownership pathways through family offices, endowments, corporations, foundations, and networks that translate education into power. Graduate school matters when you have an institution to run. It matters far less when your degree leads you into institutions owned by others.

African American graduates rarely inherit institutions; they inherit responsibility to institutions that do not belong to them. So the degree becomes a ladder into someone else’s building. And trades, stripped of the communal ownership networks they once fed, become a ladder into someone else’s factory, subcontracting chain, or municipal maintenance operation. We are always climbing into structures that someone else owns.

This cycle was not always our trajectory. The tragedy is that HBCUs once created institutional ecosystems where skill and knowledge were used to build African American economic capacity—not merely transfer it outward. As HBCU Money argued in “HBCU Construction: Revisiting Work-Study Trade Training”, many HBCUs historically operated construction, carpentry, and trade programs that literally built the campuses themselves. Students learned trades while constructing residence halls, dining facilities, barns, academic buildings, and infrastructure that the institution would own for generations. That model kept money circulating internally, built hard assets, created institutional wealth, and established capacity for African American contracting firms. It produced not just skilled laborers it produced apprentices, foremen, entrepreneurs, and business owners. It produced Washington’s economic foundation.

The abandonment of these models created a void. Trades became disconnected from institutional development. Degrees became pathways to external employment. And HBCUs which once trained students to build institutions were transformed into pipelines feeding corporate America and federal agencies that rarely reinvest into African American institutions at scale. This is why the trade-school-versus-college debate is hollow. Both are simply skill paths. Without ownership, both lead to dependence.

Charlamagne’s sense of urgency comes from watching African American millennials and Gen Z face an economy with fewer footholds than their parents had. But urgency alone cannot produce strategy. Hill, consciously or unconsciously, pointed out that the wealthy understand something we have not fully grasped: the ultimate purpose of skill, whether manual or intellectual, is to strengthen one’s own institutional ecosystem not someone else’s. The wealthy do not send their children to college to find jobs; they send them to college to learn to oversee family enterprises, influence policy, govern philanthropic endowments, and maintain social capital networks. A wealthy family’s electrician child does not go into electrical maintenance he goes into managing the electrical firm the family owns.

This is the distinction African America must confront. We keep choosing roles instead of building infrastructure. We choose jobs. We do not choose institutions. We chase wages. We do not chase ownership. This is not because African Americans lack talent or ambition. It is because integration disconnected African America from its economic development logic. In the push to integrate into white institutions, we abandoned the very institutions that anchored our communities—banks, hospitals, insurance companies, manufacturing cooperatives, and HBCU-based work-study and trade ecosystems.

The future requires rebuilding a Washington-first, DuBois-second model. The horse that is the economic base must return. The cart that is the intellectual class must attach to institutions that the community owns. Trades should feed African American contracting firms, electrical cooperatives, and infrastructure companies that service Black communities and employ Black workers. Degrees should feed African American financial institutions, research centers, HBCU endowments, political think tanks, and venture funds. Every skill, trade, or degree must be tied to institutional expansion.

Otherwise, we will continue mistaking income for empowerment, education for sovereignty, and representation for ownership. Trade or degree, individual success means little when the community remains institutionally dependent. Wealth that dies with individuals is not power; it is a temporary advantage. Power is continuity. Power is structure. Power is ownership.

The choice before African America is not between trade and degree. It is between labor and ownership. No skill, not plumbing, not engineering, not medicine, not law creates power without institutions. We are not lacking talented individuals; we are lacking the institutional architecture that turns talent into sovereignty.

Charlamagne spoke to survival. Hill spoke to structure. Washington spoke to foundation. DuBois spoke to leadership. The synthesis of all four is the path forward. Without institutions, African America will always remain the labor in someone else’s empire even when the labor is highly paid, well-trained, and excellently credentialed. Only ownership transforms skill into power, and without rebuilding our institutional ecosystem, we will continue to debate trades and degrees while owning neither the companies nor the universities.

Ownership is the only path. Without it, neither the horse nor the cart will ever move.

Disclaimer: This article was assisted by ChatGPT.

1 Comment

Posted in Uncategorized

Tagged African American cooperative economics, African American economic independence, African American entrepreneurship, African American institutional ownership, Black community ownership, Black construction industry, Black institutional power, black wealth building, Black-Owned Businesses, Booker T. Washington economic philosophy, charlamagne tha god, Charlamagne Tha God commentary, economic empowerment African America, HBCU economic strategy, HBCU Endowment Growth, HBCU trade training, institutional sovereignty Black community, jemele hill, Jemele Hill analysis, trades vs degrees debate, W.E.B. DuBois leadership development, wealth gap analysis