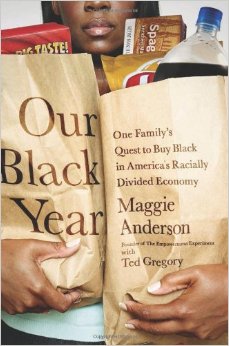

In the Vernon Johns story, this powerful scene shows Reverend Johns trying to explain to his congregation the economic power they can wield in building a strong and vibrant community if they build and own their own institutions. A sentiment that would later be echoed by Martin Luther King, Jr. as he directed African American to move its money into African American owned banks. He also points out the disdain that many communities had (and continue) to have for African Americans, but have no disdain in taking our money. Can we become a self-sufficient people? Just how many things can we not purchase from an African American (Diaspora) company? The scene is powerful and the message still rings as true today as it did then.