“Let us put our moneys together; let us use our moneys; let us put our moneys out at usury among ourselves, and reap the benefits ourselves.” – Maggie L. Walker, pioneering African American banker and businesswoman:

It is not enough to cheer from the stands.

IIt is not enough to cheer from the stands. If HBCU women entrepreneurs and the institutions that produced them are serious about building generational wealth, influence, and visibility in the global sports economy, then ownership, not participation, must be the goal. The emergence of the Women’s Pro Baseball League (WPBL) offers just such a moment. Four inaugural franchises in Los Angeles, San Francisco, New York, and Boston mark the first professional women’s baseball league in the United States since 1954. And yet, amid this historic announcement, one question should echo across the HBCU landscape: Who will own a piece of it?

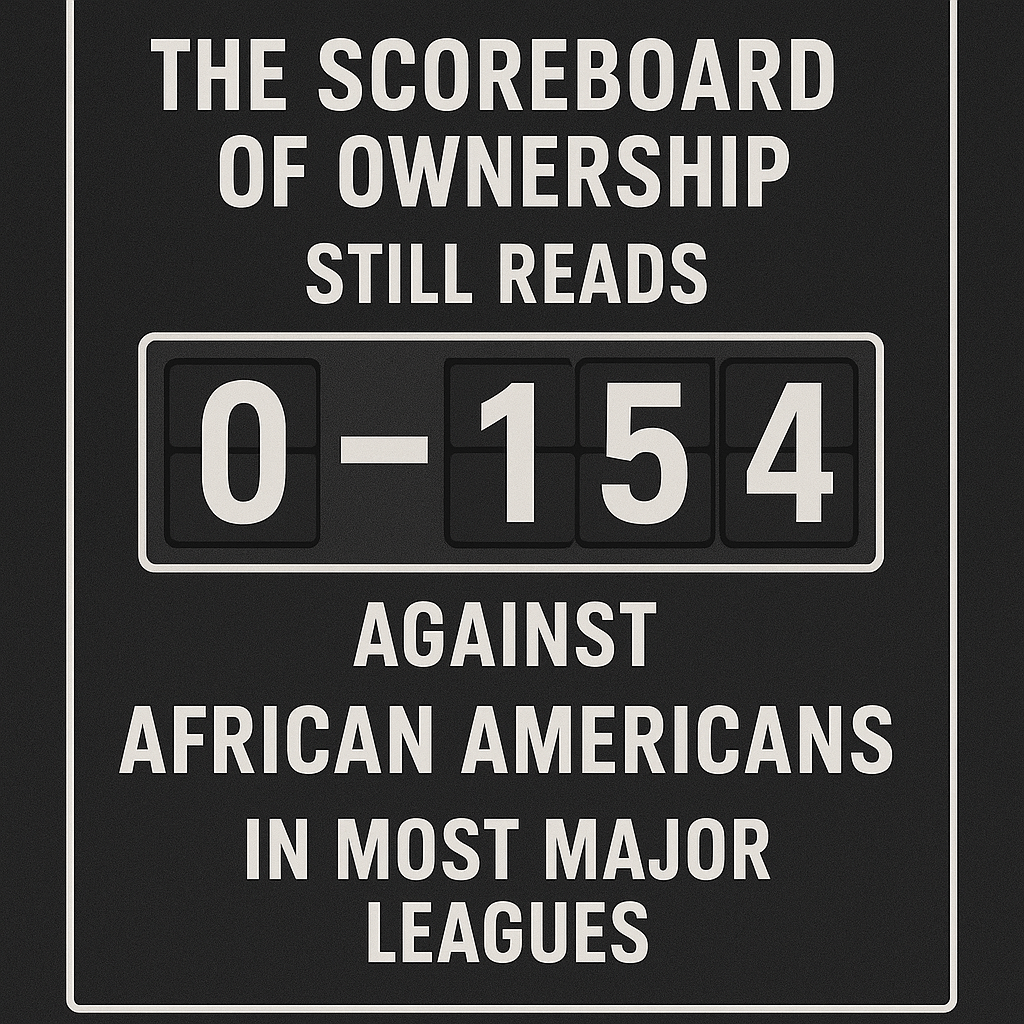

Ownership in sports is about more than trophies it’s about capital, culture, and control. While athletes inspire, it is owners who shape the economic ecosystem: negotiating television contracts, setting standards for pay equity, deciding where teams are located, and determining which communities benefit from their presence. In American sports, Black ownership remains vanishingly rare. Fewer than a handful of African Americans have ever held majority stakes in professional teams across all major leagues. Among women, ownership representation is even smaller. Yet the HBCU ecosystem comprising over a hundred institutions, $4 billion in endowment capital (though still dwarfed by their PWI counterparts), and a growing class of wealthy and capable alumni possesses both the human and institutional capital to change that reality. Buying a WPBL franchise would be a powerful signal: that African American women are no longer content to merely play or support the game, but to own the infrastructure of it.

The WPBL represents a once-in-a-century opportunity. The last women’s professional baseball league folded in 1954 when postwar America reverted to its gendered labor norms and refused to institutionalize women’s success on the field. Today, that same sport returns in a vastly different economy one defined by media fragmentation, digital storytelling, and institutional investing that rewards niche audiences and strong narratives. Women’s sports are on the rise. The WNBA just received a $75 million investment round from Nike, Condoleezza Rice, Laurene Powell Jobs, and others. Women’s college basketball ratings have exploded, drawing more viewers than some men’s sports. The National Women’s Soccer League has seen team valuations grow fivefold in the past five years. Investors are realizing what the data already shows: undervalued leagues often yield outsized returns once visibility and infrastructure catch up.

The WPBL sits at this exact inflection point. Early investors will not just shape the league they will define its culture, inclusivity, and profitability. This is why HBCU women entrepreneurs, backed by HBCU endowments and alumni capital, should move swiftly. Ownership here is not a vanity project it is a long-term equity position in the fastest-growing frontier of professional sports.

Start-up sports franchises are not the billion-dollar investments of the NFL or NBA. The WPBL’s initial teams are expected to sell for figures in the mid-seven to low-eight figures: expensive, yes, but feasible through a syndicate model combining entrepreneurial capital and institutional backing. A $15 million franchise, for instance, could be financed with $5 million in equity from HBCU women entrepreneurs, $3 million in matching commitments from HBCU endowments through a joint-venture investment arm, $5 million in debt financing via an African American–owned bank or credit union consortium, and $2 million in naming rights, sponsorship pre-sales, and city incentives.

Such a structure distributes risk while maximizing institutional leverage. It also allows for a reinvestment loop: returns from franchise appreciation, media deals, or merchandising could feed back into the endowments that helped fund the acquisition, growing HBCU wealth through private equity in sports. At a modest ten percent annualized return over fifteen years, a $3 million endowment investment could grow to more than $12.5 million, even before accounting for franchise appreciation. The social return of visibility, leadership, and influence would be immeasurable.

HBCU women entrepreneurs already lead some of the most innovative ventures in the country from fintech to fashion to wellness. They have built companies with leaner budgets, higher risk tolerance, and community-driven missions. That same acumen could translate seamlessly into sports ownership. A women-led ownership group rooted in HBCU culture would bring authenticity to a league whose audience is already primed for inclusive storytelling. They would not merely own a team they would shape its identity around empowerment, intellect, and cultural sophistication. Imagine a team whose executive suite reflects Spelman’s academic rigor, Howard’s creative dynamism, and FAMU’s entrepreneurial grit.

Moreover, the investment aligns with HBCU women’s long history of institution building. From Mary McLeod Bethune’s founding of Bethune-Cookman University to Maggie Lena Walker’s creation of the first Black woman–owned bank, African American women have always been at the forefront of merging mission with market. Buying a professional sports franchise is simply a modern continuation of that legacy.

Most HBCU endowments remain undercapitalized. Collectively, they total roughly $4 billion, compared to Harvard’s $50 billion alone. That gap underscores why traditional endowment investing centered on conservative asset classes may not close the wealth chasm. Sports equity, particularly in emerging women’s leagues, represents a hybrid investment: cultural capital meets growth asset. Endowments could carve out a modest allocation for strategic co-investment vehicles aimed at ownership in minority- or women-led sports ventures. Such a move would not only produce potential returns but reposition HBCU endowments as active agents in wealth creation, mirroring how elite universities use their endowments as venture capital arms. The same institutions that once nurtured the first generations of African American scholars could now nurture the first generation of African American women sports owners.

The path to ownership would unfold in phases: coalition building, institutional partnerships, financial structuring, branding, and media engagement. The first step would be forming an HBCU Women Sports Ownership Council an alliance of HBCU alumnae entrepreneurs, investors, attorneys, and sports professionals. Its mission would be to identify a WPBL franchise opportunity, conduct due diligence, and negotiate terms. Next, endowments, foundations, and alumni associations could serve as anchor investors via a pooled HBCU Sports Ownership Fund. African American–owned financial institutions would provide credit facilities, ensuring that capital circulation strengthens Black banking. The team’s branding could reflect HBCU values of intellect, resilience, and excellence. Annual “HBCU Heritage Games,” scholarships for women in sports management, and partnerships with K–12 baseball programs would ensure the franchise deepens institutional impact.

By the time Opening Day 2027 arrives, the vision becomes real. A stadium in Atlanta or Houston cities with deep HBCU roots roars with excitement. The team, perhaps named The Monarchs in tribute to the Negro Leagues, takes the field in uniforms stitched by a Black-owned apparel company. The owner’s suite is filled not with venture capitalists, but HBCU women—founders, engineers, bankers, educators—raising glasses to history. Every ticket sold funds scholarships. Every broadcast includes HBCU branding. Every victory multiplies across the ecosystem, from the university’s endowment statement to the little girl in the stands whispering, “She looks like me.” That is the multiplier effect of ownership.

A defining mark of this ownership group’s legacy should not only be who owns the team but who benefits from it. When an HBCU-led syndicate buys a women’s professional baseball team, it must ensure that every dollar of the fan experience circulates through Black and HBCU-centered businesses. Ownership without ecosystem-building simply recreates dependency; real power multiplies through participation.

An HBCU women’s ownership group has the chance to build an authentically circular sports economy, where concession stands, catering services, and retail vendors reflect the same entrepreneurial DNA as the team itself. The model for this begins with women like Pinky Cole, founder of Slutty Vegan, who transformed plant-based dining into a cultural and economic phenomenon through purpose-driven branding and community investment. Her ability to merge food, culture, and empowerment offers a blueprint for how HBCU women entrepreneurs could anchor the ballpark experience in ownership and identity.

Complementing this vision is the role of HBCU-owned service enterprises like Perkins Management Services Company, founded by Nicholas Perkins, a Fayetteville State University alumnus and owner of Fuddruckers. Perkins Management operates food services across HBCUs and federal institutions, combining operational scale with cultural competence. Partnering with Perkins Management to run stadium concessions or hospitality would ensure that the team’s operations mirror the ownership group’s values efficiency, reinvestment, and excellence.

Such an approach would transform the stadium into an economic hub for HBCU enterprise. Food vendors would come from HBCU alumni-owned companies. Uniform suppliers could source from HBCU textile programs. Merchandise stands could feature HBCU student designs. Hospitality contracts would prioritize HBCU-affiliated culinary programs. The music during games could feature HBCU marching bands or alumni artists. Even the stadium’s artwork could highlight HBCU painters and photographers, ensuring every sensory detail honors the ecosystem that made the ownership possible. A fan buying food or merchandise would not just be a consumer they’d be participating in a shared mission to strengthen African American institutions.

This reimagined sports environment would also offer internships, apprenticeships, and consulting opportunities for HBCU students and faculty. Business students could study operations. Communication majors could intern with the PR team. Engineering departments could advise on stadium energy efficiency. Each partnership would turn the franchise into a living classroom of applied HBCU excellence.

At a time when major leagues outsource globally, a women’s baseball franchise owned by HBCU women could reimagine localization and reinvestment as competitive advantage. Every game day would circulate dollars through a self-sustaining ecosystem that feeds back into HBCU entrepreneurship. Because when the ballpark itself is powered by HBCU women’s enterprise from boardroom to concession stand it ceases to be a venue. It becomes a living institution.

If the Women’s Pro Baseball League truly takes off, early ownership will be the golden ticket. African American investors have often entered markets too late once valuations skyrocket and access narrows. Now, before the WPBL matures, is the time for HBCU institutions and their entrepreneurial alumnae to act collectively. The call is not for charity but for strategy. Pooling even a fraction of the capital that circulates annually among HBCU alumni could change the power dynamic in sports forever. Endowments could stake equity. Alumni could invest through private funds. Students could study the economics of their own institution’s franchise. The result would be a feedback loop of wealth, wisdom, and visibility.

The first women’s professional baseball league in seventy years deserves first-of-its-kind ownership and no community is more qualified to deliver it than HBCU women. Because when HBCU women own the field, the entire game changes.

Disclaimer: This article was assisted by ChatGPT.