Truth is so hard to tell, it sometimes needs fiction to make it plausible. – Francis Bacon

Heathcliff and Claire. George and Weezy. Carl and Harriette. Florida and James. Philip and Vivian. Martin and Gina. The African American fictional couples over the years who have exuded the importance of the African American family and Black love. From working class to high-income earners one thing has remained consistent. None seemingly were ever investors. The one African American fictional character that was a stockbroker was Living Single’s Kyle Barker and yet even in that show with Khadijah James (Queen Latifah) running what seemed to be a successful magazine and media company, the finances of the characters always seemed to come off as strained – save for Kyle and Maxine. The world of African American fictional characters reflects African America’s attitude towards money in real life. A central belief that the only way you make a lot of money is to have a high paying job. Money working for you through investments then and now is a concept that mightily struggles to take root among African American capital both individually and institutionally in our community.

One thing that was or is rarely discussed in African American fictional shows is money and if it is discussed it is almost always discussed from a consumption and/or struggle vantage point – we all still have trauma from when Florida made James return that money. In real life, African America’s relationship with tax refunds has historically been used as an unrealized forced savings account. Many in African America not realizing that they are not getting money from the government, but are getting their money back from the government. Tax refunds are almost always a sign that an individual or household has paid too much in taxes throughout the year. Again, you are not getting money from the government, you are getting back your money that you overpaid to the government. This is why many refer to it as a forced savings account.

On April 6, 1995 aired Season 3 Episode 22 titled “C.R.E.A.M.” of Martin. It shows Martin and Gina as they are planning for their upcoming wedding. While paying their bills Martin sees a letter from the IRS and like any normal person begins to panic. Because seriously, who gets good news from the IRS? But instead of it being problematic, it turns out that an IRS error has allowed for Martin to receive a $4,000 tax refund. In the excitement, one would think that Martin and Gina just received a check of generational wealth as Martin exclaims, “We PAID! We PAID!” Immediately, Martin’s response is to find ways to spend the money noting that he should go out and buy them a satellite dish, a laser disc player, and himself a new wardrobe. Gina on the other hand actually reigns him in and suggest they actually invest the money. One thing that is glossed over in the exuberance was Gina’s earlier statement that they actually have all their bills paid this month suggesting that Martin and Gina’s finances are perhaps not on the most stable footing. It is likely that they were living check to check if not by some accounts living in the red.

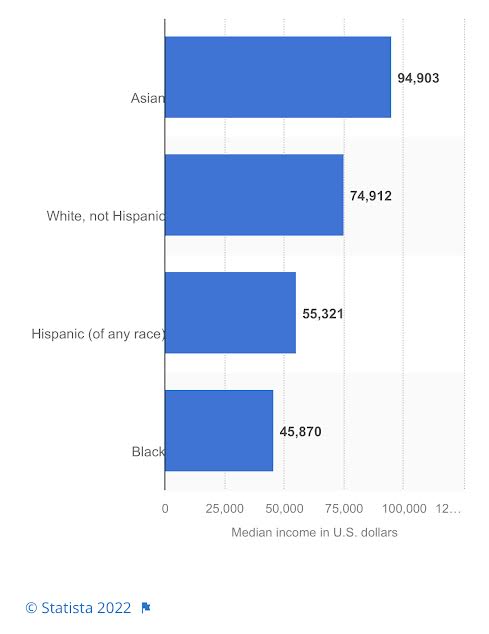

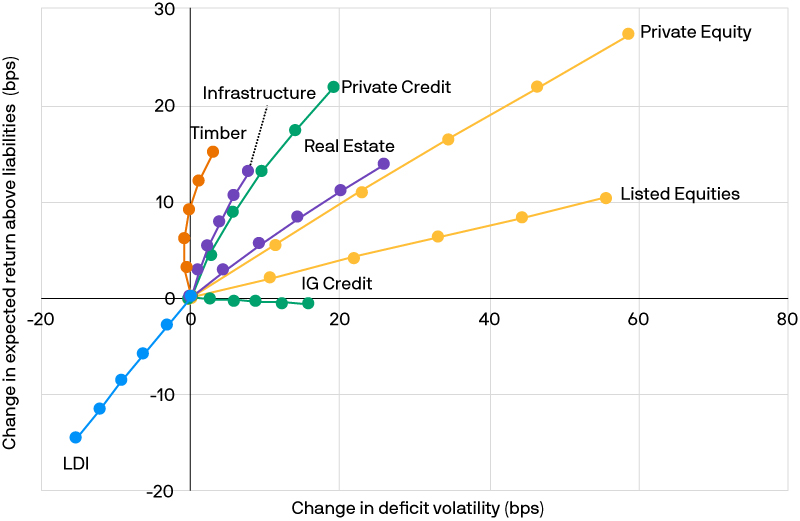

To be clear, their refund was absolutely no small amount given that according to the U.S. Census, African American median household income in 1995 was $22,393. It would be equivalent to receiving almost $10,000 in 2023 terms where African American median household income is currently $46,400. African American homeownership rate during 1995 was the second lowest of any year over the past 30 years at 42.2 percent (see above). Whether or not Martin and Gina should have bought a home in 1995 is questionable given that they lived in Detroit, Michigan and the city 18 years later in 2013 would declare bankruptcy and by all accounts is still mightily struggling to recover for a myriad of reasons. 2013’s bankruptcy would also be in the shadows of the toxic dust from 2008’s Great Recession. According to NOVA AI, the median home price in Detroit in 1995 was $53,300, but by the end of 2022 median home values had only increased to $75,000 according to Realtor.com versus the rest of the country’s median home price in 1995 was $133,900 and at the end of 2022 home values were $479,500. A paltry 41 percent return over almost 30 years in Detroit versus 258 percent return for U.S. housing as a whole over the same period. This is only in nominal returns, but in real returns inflation has increased 92 percent over that same period according to OfficialData.org meaning real housing values in Detroit have actually been negative from 1995 to 2022. Martin and Gina would have needed to move into other asset classes that would be higher on the risk/return ladder (see below). In other words, they would need to either invest in stocks or start a business.

Just west of them headquartered in Seattle, Washington was the not quite a decade old tech company named Microsoft Company that went public in 1986. Had Martin and Gina invested their $4,000 in Microsoft that investment today would be worth approximately $306,000 or a return of 7,548.9 percent. Yes, you absolutely read that correctly. Instead, Martin and Gina invested in the most riskiest of endeavors and a cliche investment among African Americans – a restaurant. “The National Restaurant Association estimates a 20% success rate for all restaurants. About 60% of restaurants fail in their first year of operation, and 80% fail within 5 years of opening.” The comedic tragedy played out as expected according to Fandom.com, “Martin and Gina bite off more than they can chew when they invest all their money in a restaurant, (named Marty Mart’s Meatloaf & Waffles), that becomes more popular than they anticipated. The problem is that neither one of them knows how to run a restaurant or manage the finances, AND they take on Stan as a partner, which leads to lots of hilarious situations along the way.” Alternatively are stocks, owning a piece of a business without having to run a business and is definitely not as risky as starting your own business and especially if that business is a restaurant. Unfortunately, even as recently as 2020 only 34 percent of African American households owned stock versus over 60 percent of European American households. It is likely that it was even less in 1995 during Martin and Gina’s courtship. But it also begs the question, what are the expectations of African America’s fictional worlds? Should they do more to convey wealth building and investing that would help uplift our community?

Many would argue that A Different World (and The Cosby Show) had an immense impact on many African American children and families of the 80s and early 90s on attending HBCUs due to the fictional HBCU, Hillman College. There is a much higher hurdle to overcome as it relates to African Americans and money. Education is an accepted value deeply engrained in our community while investing not so much. However, many would also argue popular culture’s ability to influence behavior is a powerful tool and one worthy of strategic thought in community and institutional development. Fiction has a way of making us believe the impossible is possible. That we can travel the stars one day, be an African American doctor and lawyer couple, and so much more. It may also be the very thing necessary to ingratiate a different set of financial values into our community. Fiction allows us to change the paradigm of possibilities after all. Maybe, just maybe Tommy did not have a job – but he did have a portfolio of assets that provided him an income and the folks down at his “job” were fellow investors in an investment club.

“How To Start An Investment Club” by Better Investing click here.