In the late 1990s, Bangalore wasn’t just a city—it was a story. A warm, chaotic tapestry of engineers coding in rented apartments, of global tech giants betting on untapped talent, and of policymakers quietly scripting India’s biggest soft power play. Two decades later, the city now dubbed the “Silicon Valley of India” commands global tech respect, home to startups valued in the billions and engineers powering the backends of everything from WhatsApp to NASA’s Mars missions. The rise of Bangalore wasn’t just a fluke of economics—it was a proof of concept.

And now, that proof has meaning beyond India. It’s a beacon for another global demographic long denied its shot at innovation supremacy: African America. Specifically, Historically Black Colleges and Universities (HBCUs), and the tech-ready minds they house. What if Atlanta, Raleigh, or Houston could do what Bangalore did? What if the lessons learned across oceans and caste lines could ignite the next Black-led tech renaissance?

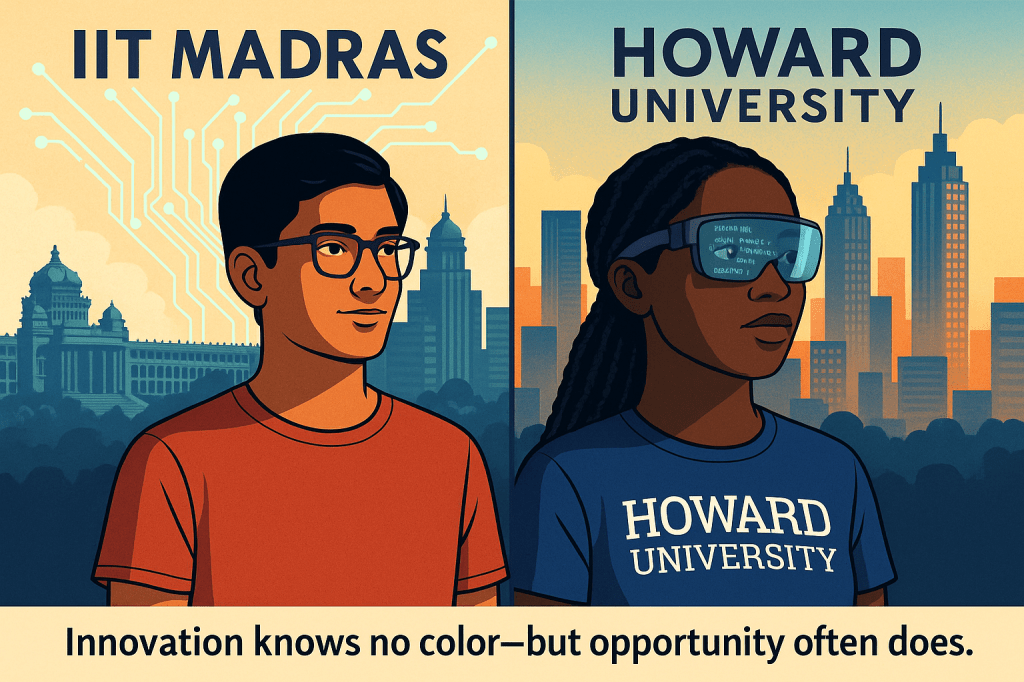

It’s easy to forget, in the blinding glow of app IPOs and TED Talks, that Bangalore’s rise began with a simple premise: educate the best minds in technical skill and keep them connected. Post-independence India was dirt poor, but visionary. It seeded a string of engineering temples—the IITs (Indian Institutes of Technology)—and gave them one directive: create elite minds for a future not yet written. By the 1980s, the global economy began tilting toward software, and India’s bet on technical education paid off. Bangalore, strategically located and flush with graduates, attracted IBM, Texas Instruments, and eventually Microsoft and Google. Infrastructure followed policy. Ecosystem followed talent. And Bangalore turned into a tech vortex.

So why hasn’t something similar happened in Black America? In many ways, the African American and Indian narratives share some DNA. Centuries of marginalization. Outsized cultural contributions. Underutilized brainpower. But where India had the state-backed machinery of nation-building, HBCUs were born out of necessity. Underfunded, segregated, and often geographically sidelined, these institutions have long produced brilliance in spite of their conditions—not because of them. Still, the potential is staggering.

HBCUs produce 25% of all African American STEM graduates. Yet, most lack the kind of venture pipelines, incubator culture, and big-tech partnerships that turn skills into unicorns. India’s tech sector shows what happens when education is backed by policy, investment, and cultural mission. That trifecta is what HBCUs need to replicate—on their own terms.

First, HBCU campuses must become startup colonies. India didn’t wait for venture capital to fall from the sky. It built software parks—zones with tax incentives, broadband access, and office infrastructure. These became hotbeds for early startups and outsourcing deals. HBCUs can do the same. Howard’s Innovation Center is one of the few early experiments: a co-working space and incubator embedded on campus. But it’s not enough. Imagine Prairie View A&M spinning up a “Black Code Foundry” with dorm-hackathon hybrids, investor demo days, and embedded alumni venture scouts. Picture Southern University hosting a summer startup accelerator focused on agri-tech for Black farmers. The infrastructure doesn’t need to be perfect—India’s wasn’t—but it needs to exist.

Second, the alumni diaspora must become an angel army. Here’s the dirty secret behind India’s rise: the real money and mentorship came from abroad. Indian engineers who moved to Silicon Valley in the 1980s and 90s didn’t forget home. They wired money, built companies back in India, and sent their kids to the IITs they graduated from. Bangalore became an offshore brain extension of Palo Alto. HBCUs need the same loyalty loop. Black technologists at Google, Meta, and Apple shouldn’t just donate to alma maters—they should embed, invest, and mentor. A reverse brain trust—Black diaspora talent reinvesting in the pipeline they came from—could supercharge the entire system.

Third, code plus culture equals competitive advantage. India’s strength isn’t just in code. It’s in context. The best Indian tech products, from Flipkart to Paytm, were designed for the specific quirks of their users: cash-only commerce, slow networks, multilingual markets. That’s the play for African American tech, too. What if HBCUs trained developers not just in Python, but in designing fintech apps for unbanked Black users? Or telehealth tools for historically underserved zip codes? Black America has problems Silicon Valley doesn’t understand—and that’s a market advantage. Building for community isn’t charity. It’s a trillion-dollar design edge.

Fourth, policy must follow performance. One reason India succeeded is that its government saw tech as national strategy. It rolled out Special Economic Zones, offered tax holidays for startups, and treated engineering education as sacred. African American political leadership must adopt similar postures. Imagine a federal “Black Innovation Act” that grants funding to HBCU-based incubators, supports Black-owned VC firms, and protects patents developed at minority institutions. More tangibly, cities with large Black populations and HBCUs should offer land, broadband, and zero-interest loans to Black founders. If Chattanooga can build a public gigabit network, so can Tuskegee. Policy isn’t optional. It’s foundational.

Fifth, this requires narrative, not charity. India’s rise wasn’t framed as aid—it was ambition. It wasn’t “helping the poor.” It was “backing the next global power.” HBCUs and Black tech should be framed with the same boldness. The next Amazon might come from Alabama A&M. The next Oracle from Morgan State. What’s needed isn’t pity—but placement. African American founders shouldn’t be exceptions—they should be expectations. Tech journalism, film, and digital storytelling can help here. Highlight the successes. Build the lore. Change the perception.

Sidebar: What HBCUs Can Build Now

| Move | Description | Potential Impact |

|---|---|---|

| Campus Incubators | On-site startup hubs with mentorship and funding access | Trains 1,000+ founders annually |

| Black Tech Diaspora Network | Online and in-person platform linking alumni with current students | Cross-generational capital + experience |

| Community-Centric Product Labs | Build tech for African American problems (e.g., finance, health, education) | Monetizes underserved user segments |

| Policy Consortium | HBCUs jointly lobbying for innovation policy with state + federal officials | Unlocks $1B+ in tech zone funding |

| Cultural Storytelling Units | Cross-discipline media studios to tell Black tech success stories | Shifts perception of HBCUs from “legacy” to “launchpad” |

In a way, India’s tech story was never just about tech. It was about self-respect. About telling the world that brown minds could be global minds. That the future didn’t need to be imported. For African America, the stakes are the same. HBCUs are already proving grounds for cultural genius—music, politics, social theory. Tech should be next. A Black Silicon Valley doesn’t need to mimic the old one. It just needs to learn the playbook, remix the rhythms, and code to its own beat.

The next tech capital might not be in Cupertino or Shenzhen—but in the back streets of Atlanta, lit by the glow of laptop screens in an HBCU dorm room. Because somewhere out there, a kid from Jackson State is already building the future. All they need is the infrastructure—and the imagination—to finish the job. If India’s story is a testament to what happens when a nation believes in its brainpower, then the African American tech future will depend on whether HBCUs and their communities can believe in theirs—loudly, structurally, and unapologetically. Not for permission. But for power.

Disclaimer: This article was assisted by ClaudeAI and ChatGPT