“The wealthiest boosters and donors to a PWI rarely ever played sports, but they did go build companies and a lot of wealth. Boosters spend hundreds of millions a year to compete with their friends and business competition from rival schools. The money spent is a bigger game than what happens on the field.” – William A. Foster, IV

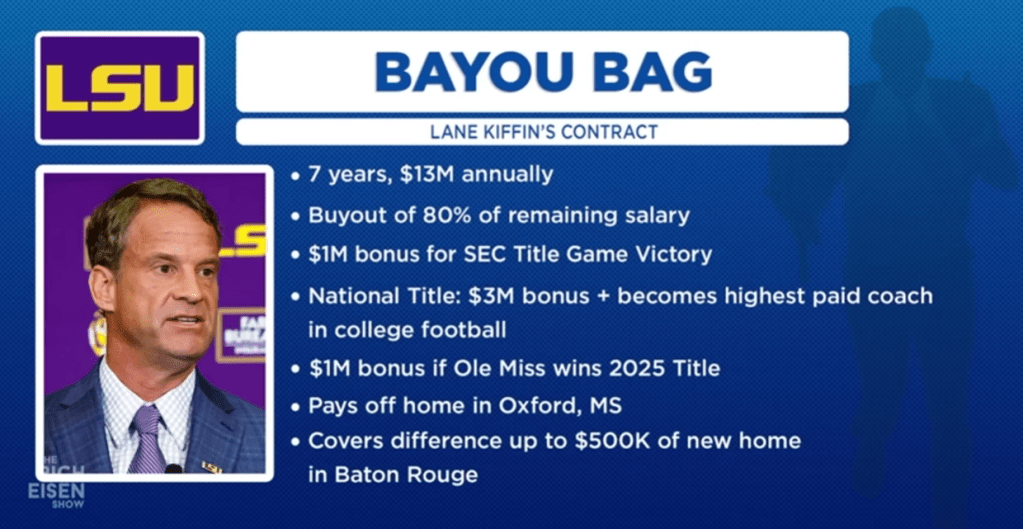

The image circulating across sports media this week says everything without trying to explain anything at all. LSU’s new contract offer to Lane Kiffin — seven years at $13 million annually, stacked with multimillion-dollar bonuses, home buyouts, and housing subsidies looks less like a coaching contract and more like a sovereign wealth transaction. It is the kind of deal only an institution backed by generational wealth, mega-boosters, and a national alumni base at the upper end of the economic ladder could produce. Yet every few months a familiar chorus resurfaces insisting that if “only the top African American athletes chose HBCUs,” the financial gap in college athletics would close. The narrative is compelling, emotional, and rooted in cultural longing, but it remains economically false.

The fantasy is seductive: if only more premier African American athletes chose HBCUs, our athletic programs could compete with Predominantly White Institutions (PWIs). If only we could land that five-star recruit, sign that top quarterback, or attract that elite basketball prospect, everything would change. The dream persists in alumni conversations, on social media, and in aspirational fundraising campaigns. But the dream is built on a fundamental misunderstanding of what actually drives college athletic success and it’s costing HBCUs resources they can’t afford to waste. The numbers tell a story that talent alone cannot rewrite.

Lane Kiffin’s new contract with LSU pays him approximately $13 million annually, making him one of the highest-paid coaches in college football. To put this in perspective, Southern University’s entire athletic department operates on total revenues of $18.2 million for fiscal year 2025-2026. One coach at a PWI earns over 70 percent of what an entire HBCU athletic department generates in revenue. This isn’t an aberration it’s the system working exactly as designed.

The disparity becomes even starker when you examine what funds these massive operations. According to an audit report, Southern University Athletics had total revenue of $17.3 million and expenses of $18.9 million in fiscal year 2023, creating a deficit of $1.5 million. Meanwhile, PWI athletic departments operate with budgets in the hundreds of millions. The athletes on the field, no matter how talented, cannot bridge this chasm.

What truly separates PWI athletic programs from HBCU programs isn’t the talent of 18-22 year-olds playing the games. It’s the economic power of the institutions behind them specifically, the size, wealth, and giving capacity of their alumni bases. According to Georgetown University, PWI graduates earn an average of $62,000 annually, compared to HBCU graduates who earn around $51,000. But the income gap is just the beginning of the story. The real disparity lies in generational wealth accumulation and the sheer number of potential donors.

Major PWIs have alumni bases numbering in the hundreds of thousands, often spanning generations of families who have accumulated significant wealth over decades. These institutions benefit from alumni who are CEOs, hedge fund managers, real estate developers, and executives at Fortune 500 companies. Their boosters can write seven-figure checks without blinking. When they want to retain a coach or upgrade facilities, they simply open their checkbooks.

HBCUs represent around 3% of America’s colleges, yet account for less than 1% of total U.S. endowment wealth. The endowment funding gap stands at approximately $100 to $1—for every $100 a PWI receives in endowment money, HBCUs receive $1. This isn’t just about annual giving; it’s about the compound interest of generational investment that HBCUs have never had the opportunity to build.

Corporate sponsors don’t pay for athletic excellence they pay for eyeballs and access to affluent consumer bases. When companies decide where to invest their marketing dollars, they’re calculating the purchasing power and professional networks they can reach through an institution’s alumni base. A company sponsoring a PWI athletic program gains access to hundreds of thousands of alumni with significant disposable income and decision-making power in corporations. The athletes are just the entertainment that delivers this audience. The actual product being sold is access to the alumni network—for recruiting employees, marketing products, and building business relationships.

This is why even if every top African American athlete chose HBCUs, the sponsorship dollars wouldn’t automatically follow. The economic fundamentals would remain unchanged. Companies invest based on return on investment calculations that are tied to alumni wealth and network size, not solely to on-field performance.

The belief that athletic success drives institutional prosperity is perhaps the most dangerous delusion facing HBCU leadership. Even among PWIs, only a tiny fraction of athletic programs actually turn a profit. Most operate at a loss that’s subsidized by the broader university budget, student fees, and institutional transfers. Southern University’s budget shows $2.2 million in “Non-Mandatory Transfer” and $1.4 million in “Athletic Subsidy”—meaning the institution itself must subsidize athletics with nearly $3.6 million in institutional funds. This is money diverted from academic programs, faculty salaries, research, and student services to keep athletic programs afloat.

The PWI athletic model works for PWIs not because athletics are inherently profitable, but because they can afford the losses. They have massive endowments, substantial state funding, and alumni donor bases that can absorb deficits while still funding academic excellence. HBCUs don’t have this luxury. When an HBCU runs a $1.5 million athletic deficit while struggling to pay competitive faculty salaries, upgrade outdated classroom technology, or fund research initiatives, the opportunity cost is devastating. That deficit represents scholarships not awarded, professors not hired, and academic programs not developed.

Some HBCU advocates point to conference television deals and NCAA tournament appearances as potential revenue sources. But here again, the math is unforgiving. Major PWI conferences negotiate billion-dollar television contracts because they deliver large, affluent viewing audiences that advertisers covet. The Big Ten and SEC don’t command massive TV deals because their athletes are more talented they command them because their alumni bases represent valuable consumer demographics. The SWAC and MEAC can’t replicate these deals because they don’t deliver the same audience size and purchasing power, regardless of the talent on the field. Even if HBCUs somehow assembled teams that won national championships, the structural economic advantages would remain with PWIs.

Here’s what proponents of athletic investment don’t want to acknowledge: the marginal difference in talent between a five-star recruit and a three-star recruit is minimal compared to the massive difference in institutional resources. A slightly more talented roster cannot overcome a 10-to-1 or 100-to-1 resource disadvantage.

Consider the logistics: While an HBCU football program might struggle to afford charter flights for the team, PWI programs have dedicated planes, state-of-the-art training facilities, nutritionists, sports psychologists, and medical staffs that rival professional franchises. They have recruiting budgets that allow them to identify and court prospects nationally. They have video coordinators, analysts, and support staff that outnumber many HBCU athletic departments entirely. The game is won with infrastructure, coaching depth, medical support, nutrition, facilities, and recovery technology not just with the athletes on scholarship. And these resources require the kind of sustained, massive funding that only comes from large, wealthy alumni bases and major corporate partnerships.

There is an alternative model that makes sense for HBCUs: the Ivy League approach. Ivy League schools have chosen not to compete in the athletic arms race. They don’t offer athletic scholarships for football. They emphasize academic excellence while maintaining competitive but not dominant athletic programs. Their alumni networks and institutional prestige are built on academic achievement, research output, and professional success not athletic championships.

For HBCUs, this model offers a realistic path forward. Focus resources on academic excellence, research capabilities, and entrepreneurship. Build prestige through intellectual output, not athletic performance. Create value through what HBCUs have always done best: developing future leaders, producing groundbreaking research, and serving their communities.

The Ivy League proves that institutional prestige and alumni loyalty can thrive without major athletic success. No one questions Harvard’s or Yale’s institutional value because their football teams don’t win national championships. Every dollar spent trying to compete in the PWI athletic model is a dollar not invested in what could actually transform HBCU economic outcomes: research infrastructure, entrepreneurship programs, endowment building, and academic excellence.

Research shows that more than half of all students at HBCUs experience some measure of upward mobility, and upward mobility is about 50 percent higher at HBCUs than PWIs. This is the actual competitive advantage HBCUs possess their ability to transform the economic trajectories of students from under-resourced communities. This mission deserves full investment, not the scraps left over after athletic departments consume resources. If HBCUs invested the millions currently subsidizing athletic deficits into research grants, business incubators, technology transfer offices, and endowed professorships, they could create sustainable revenue streams while fulfilling their core mission. They could become engines of wealth creation for African American communities rather than junior varsity versions of PWI athletic programs.

Admitting you can’t win an unwinnable game isn’t defeat it’s strategic wisdom. HBCUs should stop trying to beat PWIs at a game rigged by structural economic advantages they will never possess. Instead, they should redefine success on their own terms.

This means:

Rightsizing athletic budgets to reflect institutional resources and priorities, accepting that competing for national championships in revenue sports isn’t financially viable or strategically wise.

Investing in niche sports and athletic experiences that can be competitive without massive resource requirements and that build campus community without drowning budgets.

Redirecting resources toward academic distinction, particularly in high-demand fields like STEM, healthcare, and technology where HBCU graduates can command premium salaries and build generational wealth.

Building research infrastructure that attracts grants, creates intellectual property, and establishes HBCUs as innovation centers rather than athletic also-rans.

Developing entrepreneurship ecosystems that turn students into business owners and job creators, building the kind of economic power that generates sustained institutional support.

Creating HBCU-specific tournaments and competitions where these institutions can showcase their talents to their communities without subsidizing PWI athletic departments through guarantee games.

The African American community’s love for HBCU athletics is real and deep. The pageantry of HBCU homecomings, the tradition of the bands, the pride of seeing young Black excellence on display these matter. But love sometimes means making hard choices about where to invest limited resources for maximum impact. The question isn’t whether HBCUs should have athletic programs. The question is whether they should bankrupt their academic missions chasing a competitive model they can never win, designed by and for institutions with 100 times their resources.

One coach earning $13 million. One entire athletic department operating on $18 million. The math isn’t subtle. The choice shouldn’t be either.

Until HBCUs build alumni bases with the size, wealth, and giving capacity to compete in the modern college athletic arms race, pursuing the PWI model isn’t ambition it’s financial suicide. The path to HBCU prosperity runs through classrooms and laboratories, not football stadiums and basketball arenas. It’s time to stop chasing someone else’s game and start winning our own.

Disclaimer: This article was assisted by ClaudeAI.

Charlamagne Tha God & Jemele Hill: The Debate They Both Got Right and Wrong

“If you don’t own anything, you don’t have any power.” — Dr. Claud Anderson

When Charlamagne Tha God proclaimed, “Wake your ass up and get to trade school!” after NVIDIA’s CEO Jensen Huang suggested that the next wave of American millionaires will come from plumbers and electricians, he was not simply shouting into the void. He was echoing a national frustration, one rooted in the rising irrelevance of a degree-driven economy that no longer guarantees stability or wealth. Student debt has grown into a generational shackle, corporate loyalty is dead, and a working class once promised a middle-class life for earning a degree has found itself boxed out of the very prosperity it was told to chase. Charlamagne’s message resonated because trades feel like a lifeboat in an economy where white-collar work has become overcrowded, uncertain, and increasingly automated. But Jemele Hill’s response, “There’s nothing wrong with getting a trade, but the people in the billionaire and millionaire class aren’t sending their kids to trade schools” was the kind of truth that punctures illusions. She was not critiquing the trades; she was critiquing the belief that skill, in isolation from ownership, can produce power.

Her point hits harder within African America because our community has historically been guided into labor paths whether trade or degree that position us as workers within someone else’s institutions. It is not a coincidence. As HBCU Money examined in “Washington Was The Horse And DuBois Was The Cart”, the historical tension between industrial education and classical higher learning was never about choosing one or the other. It was about sequencing. Booker T. Washington understood that African America first needed an economic base, a foundation of labor mastery and enterprise capacity. W.E.B. DuBois emphasized intellectual development and leadership cultivation. But Washington was right about one thing: without an economic foundation, intellectual prowess has no institutional home. And without institutional homes, neither the trade nor the degree can produce freedom. African America today is suffering because we abandoned Washington’s base-building and misinterpreted DuBois’s talent development as permission to serve institutions built by others.

Charlamagne’s trade-school enthusiasm fits neatly into Washington’s horse, the practical skill that generates economic usefulness. But Hill’s critique reflects DuBois’s cart understanding how society actually distributes power. The mistake is that neither Washington nor DuBois ever argued that skill alone, or schooling alone, was enough. Both ultimately pointed toward institutional ownership. Neither wanted African Americans to remain permanently in the labor class. The trades were supposed to evolve into construction companies, electrical firms, cooperatives, and land-based enterprises. The degrees were supposed to evolve into banks, research centers, hospitals, and political institutions. What we actually did was pursue skills and credentials not power. We mistook competence for control.

This is why the trades-versus-degrees debate is meaningless without ownership. Becoming a plumber or an electrician provides income, but not institutional leverage. Becoming a lawyer or an accountant provides upward mobility, but not institutional control. A community with thousands of tradespeople and thousands of degreed professionals but without banks, construction firms, land ownership, hospitals, newspapers, media companies, sovereign endowments, or venture capital funds is still a community of laborers no matter how educated or skilled.

This structural truth becomes even clearer when viewed through the lens of how the wealthiest Americans use education. HBCU Money’s analysis, “Does Graduate School Matter? America’s 100 Wealthiest: 44 Percent Have Graduate Degrees”, observes that while nearly half of America’s wealthiest individuals do hold graduate degrees, the degrees themselves are not the source of wealth. They are tools of amplification. They work because the individuals earning them already have ownership pathways through family offices, endowments, corporations, foundations, and networks that translate education into power. Graduate school matters when you have an institution to run. It matters far less when your degree leads you into institutions owned by others.

African American graduates rarely inherit institutions; they inherit responsibility to institutions that do not belong to them. So the degree becomes a ladder into someone else’s building. And trades, stripped of the communal ownership networks they once fed, become a ladder into someone else’s factory, subcontracting chain, or municipal maintenance operation. We are always climbing into structures that someone else owns.

This cycle was not always our trajectory. The tragedy is that HBCUs once created institutional ecosystems where skill and knowledge were used to build African American economic capacity—not merely transfer it outward. As HBCU Money argued in “HBCU Construction: Revisiting Work-Study Trade Training”, many HBCUs historically operated construction, carpentry, and trade programs that literally built the campuses themselves. Students learned trades while constructing residence halls, dining facilities, barns, academic buildings, and infrastructure that the institution would own for generations. That model kept money circulating internally, built hard assets, created institutional wealth, and established capacity for African American contracting firms. It produced not just skilled laborers it produced apprentices, foremen, entrepreneurs, and business owners. It produced Washington’s economic foundation.

The abandonment of these models created a void. Trades became disconnected from institutional development. Degrees became pathways to external employment. And HBCUs which once trained students to build institutions were transformed into pipelines feeding corporate America and federal agencies that rarely reinvest into African American institutions at scale. This is why the trade-school-versus-college debate is hollow. Both are simply skill paths. Without ownership, both lead to dependence.

Charlamagne’s sense of urgency comes from watching African American millennials and Gen Z face an economy with fewer footholds than their parents had. But urgency alone cannot produce strategy. Hill, consciously or unconsciously, pointed out that the wealthy understand something we have not fully grasped: the ultimate purpose of skill, whether manual or intellectual, is to strengthen one’s own institutional ecosystem not someone else’s. The wealthy do not send their children to college to find jobs; they send them to college to learn to oversee family enterprises, influence policy, govern philanthropic endowments, and maintain social capital networks. A wealthy family’s electrician child does not go into electrical maintenance he goes into managing the electrical firm the family owns.

This is the distinction African America must confront. We keep choosing roles instead of building infrastructure. We choose jobs. We do not choose institutions. We chase wages. We do not chase ownership. This is not because African Americans lack talent or ambition. It is because integration disconnected African America from its economic development logic. In the push to integrate into white institutions, we abandoned the very institutions that anchored our communities—banks, hospitals, insurance companies, manufacturing cooperatives, and HBCU-based work-study and trade ecosystems.

The future requires rebuilding a Washington-first, DuBois-second model. The horse that is the economic base must return. The cart that is the intellectual class must attach to institutions that the community owns. Trades should feed African American contracting firms, electrical cooperatives, and infrastructure companies that service Black communities and employ Black workers. Degrees should feed African American financial institutions, research centers, HBCU endowments, political think tanks, and venture funds. Every skill, trade, or degree must be tied to institutional expansion.

Otherwise, we will continue mistaking income for empowerment, education for sovereignty, and representation for ownership. Trade or degree, individual success means little when the community remains institutionally dependent. Wealth that dies with individuals is not power; it is a temporary advantage. Power is continuity. Power is structure. Power is ownership.

The choice before African America is not between trade and degree. It is between labor and ownership. No skill, not plumbing, not engineering, not medicine, not law creates power without institutions. We are not lacking talented individuals; we are lacking the institutional architecture that turns talent into sovereignty.

Charlamagne spoke to survival. Hill spoke to structure. Washington spoke to foundation. DuBois spoke to leadership. The synthesis of all four is the path forward. Without institutions, African America will always remain the labor in someone else’s empire even when the labor is highly paid, well-trained, and excellently credentialed. Only ownership transforms skill into power, and without rebuilding our institutional ecosystem, we will continue to debate trades and degrees while owning neither the companies nor the universities.

Ownership is the only path. Without it, neither the horse nor the cart will ever move.

Disclaimer: This article was assisted by ChatGPT.

1 Comment

Posted in Uncategorized

Tagged African American cooperative economics, African American economic independence, African American entrepreneurship, African American institutional ownership, Black community ownership, Black construction industry, Black institutional power, black wealth building, Black-Owned Businesses, Booker T. Washington economic philosophy, charlamagne tha god, Charlamagne Tha God commentary, economic empowerment African America, HBCU economic strategy, HBCU Endowment Growth, HBCU trade training, institutional sovereignty Black community, jemele hill, Jemele Hill analysis, trades vs degrees debate, W.E.B. DuBois leadership development, wealth gap analysis