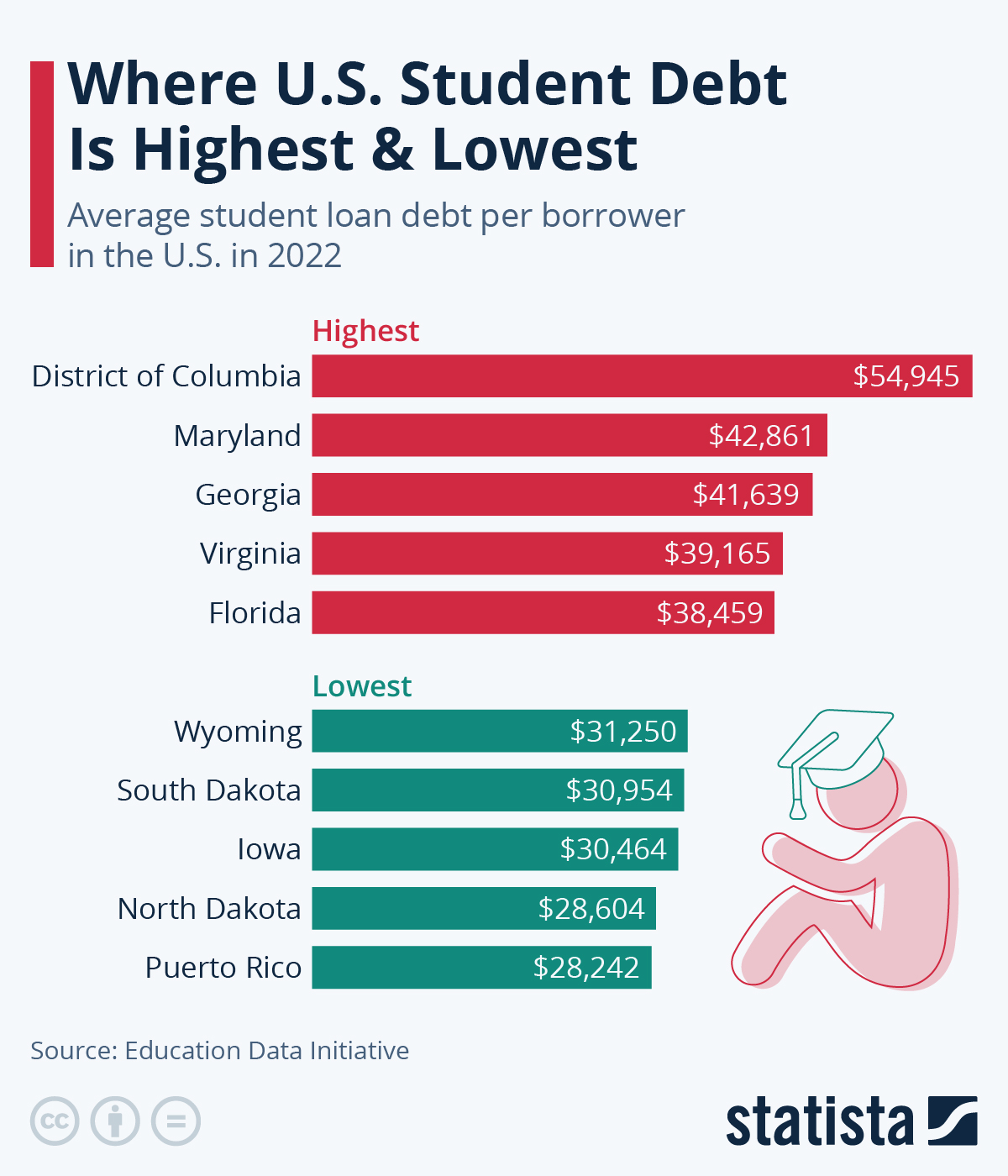

The most recent student loan data is an extremely hard gauge to use given its lag time. This data is the latest data available by ICAS, but also is pre-COVID and pre-George Floyd. The latter in that situation potentially produced a significant increase in student loan debt by students as many sought to help themselves and their families through financial aid refunds. COVID exposed African America’s acute financial fragility through poor health insurance, jobs with high exposure to COVID risk, and more. To the latter, in the post-George Floyd that also occurred where hundreds of millions poured into HBCU coffers led by MacKenzie Scott in levels never seen before and COVID relief funding through the CARES Act to colleges and universities witnessed HBCUs providing an immense amount of financial relief to its students to try and stem the debt tide.

HBCU graduates actually have some good news in that their median debt dropped approximately 8 percent from our last report while their PWI counterparts at major endowed institutions remained virtually unchanged. The bad news is that the percentage of HBCU graduates with debt remains unchanged while their PWI counterparts at major endowed institutions graduating with debt dropped almost 20 percent. This expands the gap of HBCU/PWI students graduating with debt from a previous 46 percentage points difference to now 52 percentage points in this latest report.

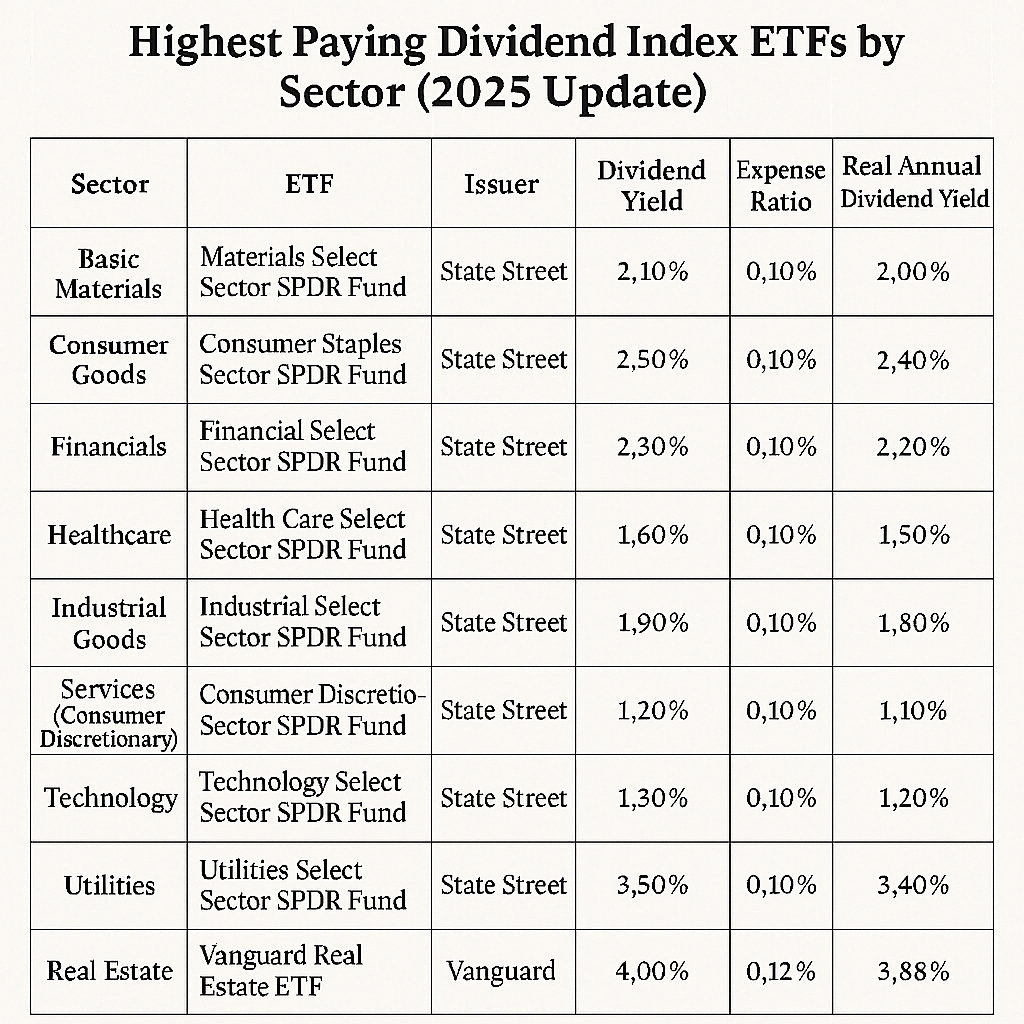

Numbers in parentheses shows the comparative results from the universities of the 30 largest endowments:

Median Total Debt of HBCU Graduates – $31,422 ($24,479)

Proportion of HBCU Graduates with debt – 85% (33%)

Median Private Debt of HBCU Graduates – $17,386 ($44,622)

Proportion of HBCU Graduates with private debt – 7% (5%)

Source: The Institute for College Access & Success

Looking at the numbers even further shows that HBCU Graduates debt is almost 30 percent higher than their PWI major endowed counterparts. This despite HBCUs being significantly cheaper, HBCU Graduates suffer from a student body that acutely comes from families that lack family assets and stability to assist. It is highlighted in the private debt component where PWI counterparts have significantly higher amounts of private debt. Potentially speaking to the borrowing power of those PWI families beyond federal financial aid.

It may be a few years before updated data from within the COVID era is available, but basic extrapolation suggest that even with the donations received after George Floyd and the CARES Act that HBCUs simply still lack the endowments to make up for the acute lack of African American household wealth combined with less than 10 percent of African Americans choosing HBCUs. The latter means that HBCUs operate with smaller alumni pools. These smaller pools means a smaller nominal giving of the alumni who do give and a significantly smaller probability that the HBCU can create a percentage of alumni who go onto become wealthy donors.

In the end, HBCU alumni who care about this must make available scholarship to a wider net of HBCU students while in school. Focusing on creating scholarship that is available to every student who is academically eligible and giving less emphasis to GPA. The large majority of any HBCU graduation class has GPAs between 2.0 and 3.0 and are the ones most likely to be left out of having any ability to decrease their student loan burdens making them almost never to be in a position to become donors.

By expanding eligibility requirements, scholarships can provide financial relief to those who need it most—students who are often balancing academics with work, family responsibilities, and other challenges. Many of these students demonstrate resilience, dedication, and a commitment to completing their education, yet traditional scholarship models disproportionately favor high achievers with GPAs above 3.5. While academic excellence should be celebrated, financial aid should not solely be reserved for the top percentage of students.

A broader approach to scholarships will help create a stronger alumni network in the long run, as more graduates will leave school with reduced debt, making them more likely to support their alma mater financially and contribute to future scholarship funds.

Previous HBCU Graduate Student Loan Reports

The 2016-2017 HBCU Graduate Student Loan Report

Good News/Bad News: Percentage Of HBCU Graduates With Debt Drops But Debt Loads Increase