By William A. Foster, IV

“Dear Young Black Males… Always remember to hold your head up high, and NEVER doubt who you are. Believe in yourself SO much that other people’s negative words, opinions, and energy won’t discourage or hinder you.” – Stephanie Lahart

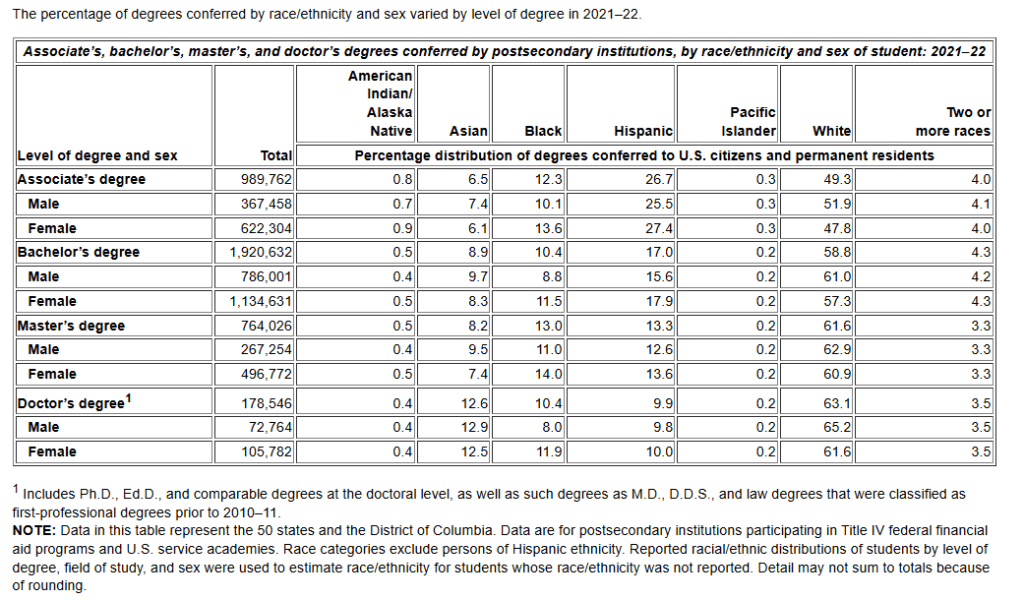

African Americans continue to be the only group where the women outnumber the men in terms of employment. The systemic reasons for this abound and not particularly the focus in this piece, but one of those areas is certainly educational obtainment. Whereas African American girls are in large part taught to focus on mental and academic achievement as a means of success, African American boys are taught to focus on physical and athletic achievement as a means of success. The two most notable gaps are at the Associate’s degree and Doctor’s degree levels where there is a difference of 350 basis points and 390 basis points, respectively. While it would be nice to see more African American young men getting Bachelor’s degrees, from an economic reality, simply getting more of them with an Associate’s is cheaper and faster in terms of return on investment for the community.

Enter the 10 HBCUs that are community or technical colleges along with UDC who has community college division while still being a 4-year institution. This collection of HBCUs represents a network of community and technical colleges dedicated to providing accessible, affordable education and workforce development opportunities. Focused on serving African American communities, these institutions offer associate degrees, certificates, and vocational training programs. There is also the opportunity to create a pipeline to four-year HBCUs or direct entry into the workforce. They emphasize community enrichment, economic mobility, and leadership development, often incorporating faith-based or mission-driven values. Collectively, they play a vital role in empowering individuals and strengthening the communities they serve.

As of 2021-2022 according to NCES, there is an approximately 50,000 Associate’s degree gap between African American Women and Men (Table Below) with women obtaining almost 85,000 Associate degrees annually and men obtaining just over 37,000 Associate degrees annually. The major obstacle to these 10 HBCUs closing the gap is what ails most systemic issues facing African America – finances. These 10 HBCUs have an average tuition cost of $6,500 and median tuition cost of $5,300. But in order cost of attendance is a far more accurate because it includes the ability to pay for residence be it on-campus or off-campus, meal plans, books, and other necessities of educational obtainment. The average and median for that related to these 10 HBCUs is approximately $20,000 which is inclusive of the tuition and fee cost. This cost of attendance is due to both the low cost of tuition at two-year institutions in general and these HBCUs being located in affordable towns as a whole. However, it maybe a lot to ask if the goal is to truly incentivize enough African American Men to take two years if they were not intending to and by the numbers many clearly are not intending to go to college even for an Associate’s degree without a cherry on top. Simply ensuring they have full tuition and room/board is enticing, but it is likely not enough. If we look at this as a salary, then paying African American Men $20,000 a year to be students is probably not going to cut it. However, pushing that number to say $30,000 a year with a disposable income of $10,000 per year could be enough to bring many into the fray.

Here is the math of getting to $30 billion. Assuming our endowment for this program can generate 5% annually, then it would take $600,000 in principal to generate the $30,000 necessary per student. That is $600,000 times the 50,000 gap we need to close annually or $30 billion. Enough to generate $1.5 billion in interest. At current, there are no African American institutions that are either non-profit or for-profit valued at $30 billion. Howard University has the largest African American non-profit endowment and it is just under $1 billion. World Wide Technology is the most valuable for-profit firm at $20 billion and its African American ownership in the firm at 59 percent makes his stake worth approximately $12 billion.

There is even an argument that should this miraculous endowment appear if it should be spent on African American men ages 18-40 or if it should be focused on African American boys where you could provide supplemental education and academic investment at a far earlier age where you would need to spend a fraction of the $30,000 to get impactful long-term results. While there is a firm argument for this, my answer is resoundingly no. It should and would need to be spent on the 18-40 year old age group. The reason why is simple. African American Women need help now. The gap that has existed for sometime now has caused a crisis in the community with African American women being unable to find African American men that are suitable partners, the overweight responsibility of economic burden they carry, and much more. The closing of the gap is worth $7,700 in increased earnings per African American man who upgrades from a high school diploma to an Associate’s degree or $385 million annually if simply brought in balance with the number of Associate’s that African American Women earn.

The burning question of course is where we get $30 billion in assets from that can produce $1.5 billion annually (a 5 percent return). Unless someone is secretly hiding 300,000 bitcoins, they bought for $0.01 many years ago that are now worth $30 billion there may be no real solid answers. Time is of the essence so the notion that we are going to slow roll our way there as we do with most everything else financially is a nonstarter and just more of the same issues. Government funding is also almost certainly not an option given that regardless of political party very little has been done to rectify systemic issues that face African America. One party would like to give us nothing despite the fact that we pay into the tax system and the other party gives us symbolic and lip service. For context, there are only 5 university endowments that are greater than $30 billion.

In the end, the truth of the matter is this will not be solved by a single endowment or a single organization. However, $30 billion in a collective effort across multiple organizations coordinating with this goal may in fact be possible and pragmatic. With almost $2 trillion in buying power in theory the resources are there – sort of. Buying power can be very misleading because it does not actually speak to disposable income of the African American community. The money that is leftover after the bills are paid. Much of African America’s $2 trillion has very little leftover once you account for needs and necessities of African American households. This actually speaks quite a bit to African America’s buying power only account for almost 11 percent of America’s $18.5 trillion in buying power, but accounting for almost 14.5 percent of the American population. The $2 trillion should be closer to $2.7 trillion. That is $700 billion essentially “missing” from the African American households. Needless to say, it would a lot easier to find that $30 billion there.

A collective and strategic effort is necessary to bridge the Associate’s degree gap between African American men and women. While a $30 billion endowment seems daunting, the solution lies not in a single source of funding but rather in a coordinated approach involving multiple organizations, institutions, and innovative financial strategies. Leveraging partnerships with HBCUs, African American financial institutions, and philanthropic networks can help mobilize the resources needed to generate meaningful change. Furthermore, targeted outreach to influential individuals, businesses, and community leaders can catalyze fundraising efforts.

The focus must remain on providing African American men with the financial support necessary to pursue educational opportunities. By directly investing in their economic advancement, the ripple effect will extend beyond individuals to families and communities. The $385 million annual increase in earnings resulting from closing the Associate’s degree gap underscores the profound economic impact of this initiative. Equally important, this investment addresses the broader social and relational imbalances that have burdened African American women for decades.

Achieving this ambitious goal will require innovative thinking, sustained advocacy, and bold financial commitment. However, with collaboration and purpose, empowering African American men through education can yield lasting benefits for the entire community, fostering stability, opportunity, and generational wealth.