“Never interrupt your enemy when he is making a mistake.” – Napoleon Bonaparte

Throughout history, pivotal moments have reshaped the global balance of power—not only through military conflict but also through strategic missteps in policy, diplomacy, and economics. A recent History Hit article highlights some of the greatest military mistakes in history, such as Crassus’ catastrophic defeat at Carrhae, where overconfidence, misjudgment of the enemy, and environmental ignorance led to one of Rome’s most humiliating losses. These cautionary tales echo eerily in today’s geopolitical landscape, especially in the realm of economic warfare.

As the United States doubles down on protectionist policies and tariffs—particularly under the current administration—there’s a growing concern that this approach may not just harm short-term trade balances but fundamentally alter the global power hierarchy.

The Tariff Trap: Echoes of Strategic Overreach

Crassus believed a swift strike against the Parthians would cement his legacy and expand Roman power. But what followed was a lesson in hubris: his troops, ill-prepared for desert warfare and blindsided by superior Parthian tactics, were decimated. The battle didn’t just cost Rome a legion; it shifted the balance of power in the East and emboldened one of its greatest rivals.

Fast-forward to today’s economic theater, and we see the U.S. taking a similarly aggressive stance—this time not with legions, but with tariffs. Aimed largely at China, but also impacting allies and neutral states, these tariffs are designed to correct trade imbalances and protect domestic industries. Yet, critics argue they may have the opposite effect: damaging global supply chains, triggering retaliatory measures, and accelerating the rise of alternative trade blocs that exclude the U.S.

A Self-Inflicted Isolation?

Just as Crassus underestimated the adaptability and strength of the Parthians, the U.S. may be underestimating how quickly other nations can pivot. Countries like China, India, Brazil, and members of the European Union are increasingly forging their own trade alliances, investing in regional self-sufficiency, and moving away from reliance on U.S.-dominated systems like the dollar-based financial architecture.

The unintended result? The U.S. risks isolating itself in a multipolar world. Much like the Roman Empire found itself checked by Parthian resistance, the U.S. could face a world where its economic leverage is no longer unquestioned. Tariffs might win temporary concessions but lose the longer war of global influence.

When Economic Warfare Backfires

Military historians often point to a failure to adapt as the root cause of strategic disasters. In economic terms, adaptation means recognizing the limits of unilateral action in a globalized world. While the administration’s tariffs may play well to domestic audiences—just as Crassus’ ambition did among the Roman elite—the global repercussions could be severe.

Already, we’re seeing fractures: foreign investment pulling away, key allies distancing themselves, and strategic rivals forming new coalitions. As with the Roman-Parthian conflict, a misstep now may not seem fatal—but it could catalyze a power shift that becomes irreversible.

The Rise of Alternative Power Centers

Historically, economic pressure campaigns have often led to innovation and resistance rather than submission. When the British Empire imposed tariffs and restrictive trade policies on the American colonies, the result was not compliance, but revolution. Likewise, today’s U.S. tariffs may incentivize the very independence and resilience among rival economies that they seek to suppress.

China, for example, has responded to tariffs not just with reciprocal measures but with strategic investments in Africa, Southeast Asia, and Latin America. Its Belt and Road Initiative is quietly redrawing global trade routes, offering infrastructure and financing in exchange for long-term influence. By contrast, the U.S.’s transactional and punitive approach to trade may be reducing its appeal as a partner.

Moreover, countries targeted by U.S. tariffs are increasingly engaging in “de-dollarization,” shifting reserves to euros, yuan, or gold, and conducting trade in non-dollar currencies. This weakens the U.S. dollar’s global hegemony, long a cornerstone of American power. If that pillar falls, the repercussions could be enormous—raising borrowing costs, undermining fiscal flexibility, and eroding confidence in U.S. leadership.

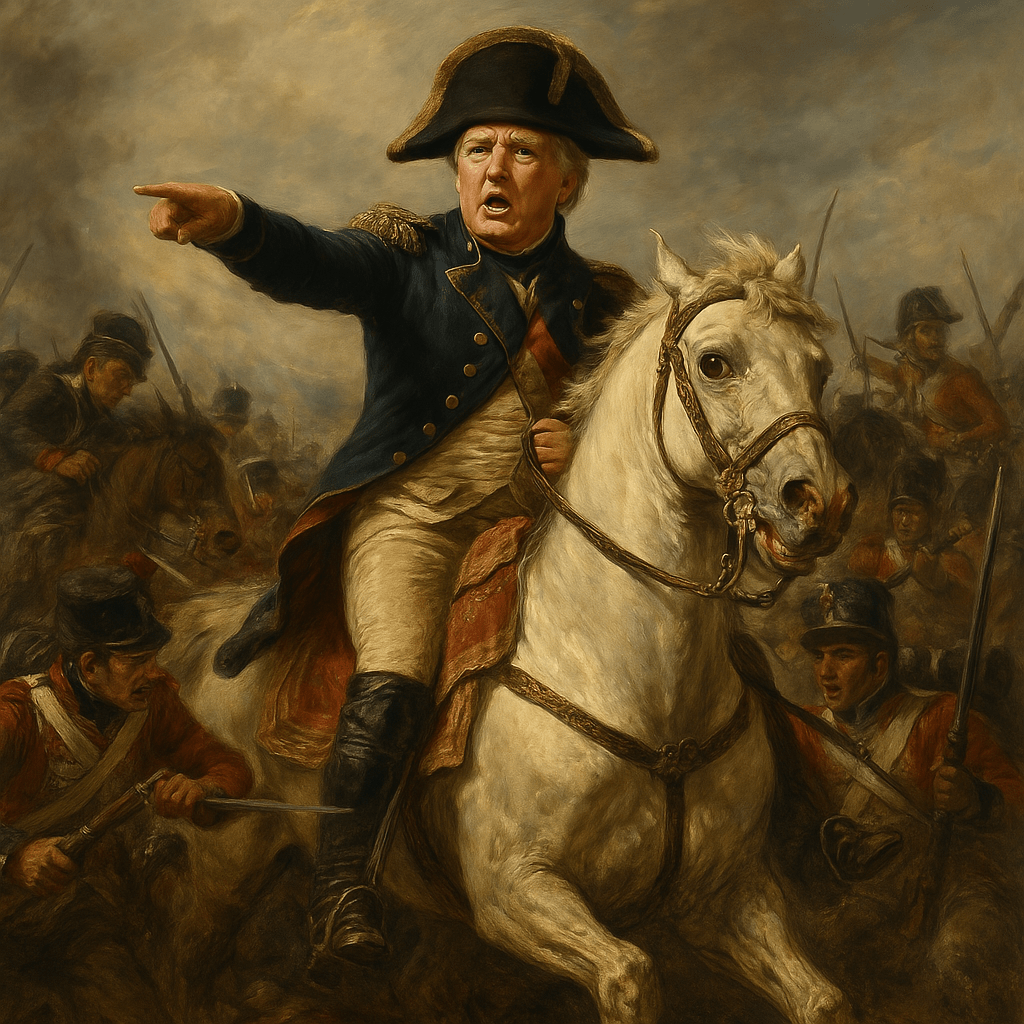

Lessons from Napoleon and the Continental System

The perils of economic overreach are not unique to the U.S. or Rome. Napoleon Bonaparte’s Continental System, aimed at crippling Britain by banning European trade with it, is another stark example. Rather than bringing Britain to its knees, it backfired spectacularly, harming France and its allies while boosting British trade with other global partners. It also provoked resistance from within Napoleon’s empire, contributing to its eventual unraveling.

The U.S. may now be embarking on its own version of a Continental System. Efforts to economically isolate China—through sanctions, tech bans, and tariff walls—risk creating a bifurcated global economy. But in doing so, the U.S. could be sealing itself off from markets, innovations, and influence that are shifting eastward.

Domestic Politics and Short-Term Thinking

One key reason economic strategies go awry is the short-termism driven by domestic politics. Leaders prioritize popular moves that yield immediate gains, even if they incur long-term costs. Crassus sought glory; Napoleon pursued dominance; today, leaders may be seeking electoral wins or media headlines.

Tariffs appeal to a certain political base, often associated with nationalist or populist movements. They create the image of a strong, assertive leader defending national interests against foreign exploitation. But while they may boost approval ratings temporarily, they often mask deeper economic vulnerabilities. Industries protected by tariffs may become less competitive, consumers face higher prices, and the innovation that comes from global competition may stall.

The Ripple Effects: Allies, Rivals, and the Global Commons

Perhaps the most underappreciated aspect of the current tariff strategy is how it affects U.S. allies. The assumption that friendly nations will remain loyal regardless of economic strain may be dangerously optimistic. Tariffs have been levied not just against rivals but also against longstanding partners like Canada, the EU, and South Korea. These actions chip away at diplomatic goodwill and create space for competitors like China to step in with more cooperative offers.

Furthermore, the weaponization of trade sets a precedent. If the U.S. can impose tariffs and sanctions for strategic reasons, so can others. This leads to a world where economic interdependence—once a force for peace and prosperity—becomes a source of suspicion and volatility. The global commons of trade, finance, and communication, painstakingly built over decades, could fracture into warring economic blocs.

The implications extend beyond commerce. Shared challenges like climate change, pandemics, and cybersecurity require collective action. An increasingly divided economic world undermines the possibility of unified responses. If each country retreats into its own economic fortress, the global community may find itself ill-equipped to face the transnational threats of the 21st century.

Strategic Patience vs. Tactical Aggression

The choice facing the United States is not between tariffs or surrender. It is between tactical aggression and strategic patience. Tactical aggression offers immediate gratification: the image of toughness, the appearance of winning. Strategic patience demands investment in long-term capability, trust-building with allies, and tolerance for short-term discomfort in exchange for future security.

Countries that have succeeded in shaping global systems have historically chosen the latter path. The post-World War II U.S. helped build institutions like the IMF, World Bank, and WTO not just out of altruism but to ensure a stable environment for its own prosperity. That model worked—arguably too well, as it enabled the rise of competitors. But tearing down the system that sustained U.S. leadership may be more self-defeating than adjusting it to new realities.

Strategic patience also means crafting trade policies that align with national values—protecting labor rights, environmental standards, and technological sovereignty—without resorting to blunt instruments. Tariffs can be part of that toolkit, but they must be wielded with precision, transparency, and foresight.

Innovation, Not Isolation

In a knowledge-based global economy, innovation is the ultimate currency of power. Tariffs may protect legacy industries, but they do little to foster the next generation of breakthroughs. In fact, they often hinder innovation by increasing input costs, disrupting supply chains, and discouraging collaboration.

To maintain global leadership, the U.S. must invest in education, research, and infrastructure. It must attract talent from around the world and create ecosystems where ideas can flourish. Isolationist policies undercut these goals. The more the U.S. turns inward, the less attractive it becomes as a destination for investment, talent, and creativity.

Tech ecosystems are already becoming more fragmented. China is building its own chips, cloud services, and social platforms. The EU is developing digital sovereignty strategies. The risk is not just economic decoupling, but intellectual and technological divergence that reduces shared standards and mutual benefit.

From Carrhae to Currency Wars

The parallels between Crassus’ doomed campaign and today’s trade tensions are not perfect, but they are instructive. Both reflect moments where ambition overtook prudence, and where the assumption of superiority led to vulnerability. Just as Carrhae signaled a shift in Roman fortunes, today’s tariff wars could mark the beginning of a new global order—one in which American dominance is no longer assured.

But unlike Crassus, today’s leaders have the benefit of hindsight. They can study history, learn from its missteps, and course-correct before irreversible damage is done. The question is not whether the U.S. has the power to lead, but whether it has the wisdom to wield that power wisely.

The world is watching. The path chosen now may determine not just the next trade cycle, but the very contours of global power in the decades to come. If history has shown anything, it is that the price of overreach is often paid not in battles lost, but in influence squandered. The challenge before the United States is not merely to defend its markets, but to secure its legacy.