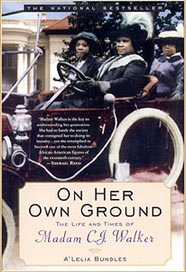

On Her Own Ground is not only the first comprehensive biography of one of recent history’s most amazing entrepreneurs and philanthropists, it is about a woman who is truly an African American icon. Drawn from more than two decades of exhaustive research, the book is enriched by the author’s exclusive access to personal letters, records and never-before-seen photographs from the family collection. Bundles also showcases Walker’s complex relationship with her daughter, A’Lelia Walker, a celebrated hostess of the Harlem Renaissance and renowned friend to both Langston Hughes and Zora Neale Hurston. In chapters such as “Freedom Baby,” “Motherless Child,” “Bold Moves” and “Black Metropolis,” Bundles traces her ancestor’s improbable rise to the top of an international hair care empire that would be run by four generations of Walker women until its sale in 1985. Along the way, On Her Own Ground reveals surprising insights, tells fascinating stories and dispels many misconceptions.

-

Recent Posts

- Russell Wilson and Ciara Wilson: The Quiet Matchmakers Reshaping Black Love and Its Implications for African American Institutions

- Teaching the Next Generation: A Guide to Empowering African American Youth Through Strategic Philanthropy

- The Quiet Collapse of HBCU-Based Credit Unions — and What Michigan State’s $8.26 Billion Juggernaut Reveals About the Cost

- Giving Back to Those Who Give: How HBCU Communities Can Support Their Alumni Teachers

- $50,000 From TI to Morris Brown: The Math of Good Intentions and the Silence of Black Entertainment Wealth

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- October 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- June 2022

- May 2022

- April 2022

- March 2022

- January 2022

- November 2021

- October 2021

- May 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- June 2018

- April 2018

- March 2018

- February 2018

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- December 2011

- November 2011

Categories

Meta