Investing Together: How Families Can Benefit from a Sector-Based Dividend ETF Portfolio

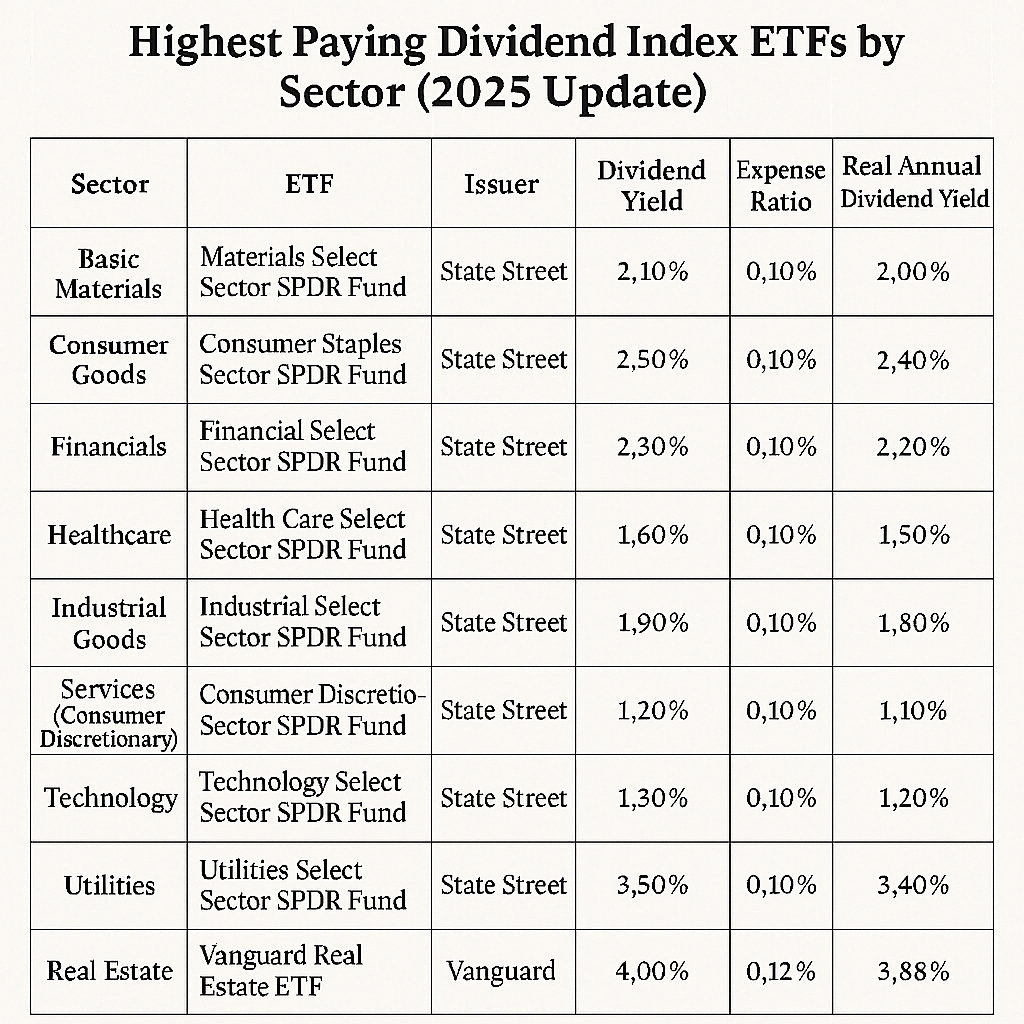

In an age where financial literacy is just as important as traditional education, building a culture of investing within the family unit can be transformative. A sector-based dividend ETF (Exchange-Traded Fund) portfolio, such as the one recently highlighted in the “Highest Paying Dividend Index ETFs by Sector (2025 Update),” provides not only a reliable source of income through dividends but also a foundational tool for families to grow generational wealth, teach financial principles, and maintain economic resilience across economic cycles.

Why Dividend ETFs?

Dividend ETFs are a type of fund that holds a collection of dividend-paying stocks. Instead of owning individual companies and worrying about the performance of one or two stocks, ETFs give you diversified exposure to many companies within a sector. For example, the Vanguard Real Estate ETF (VNQ) gives investors exposure to real estate investment trusts (REITs), which typically pay higher-than-average dividends. Similarly, Utilities Select Sector SPDR Fund (XLU) provides exposure to utility companies, a sector known for steady performance and consistent dividend payments.

What makes these ETFs especially attractive is their passive income potential. By subtracting expense ratios (i.e., the fees to manage the ETF) from the dividend yield, we calculate the real annual dividend yield—the true income an investor earns. As families build portfolios with these tools, they are effectively laying the groundwork for consistent cash flow, which can be reinvested, used for expenses, or saved for long-term goals.

Benefits to Families

1. Creating a Passive Income Stream

Each ETF in the portfolio provides a small “paycheck” in the form of dividends, typically distributed quarterly. A well-diversified ETF portfolio can yield between 1.10% to nearly 4.00% annually, even after accounting for fees. For families, this means having a source of income that doesn’t rely on active work. Over time, reinvesting those dividends can lead to exponential growth—a concept known as compounding.

Let’s say a family invests $10,000 evenly across the top-performing ETFs like VNQ (3.88%), XLU (3.40%), and XLP (2.40%). Even at a modest return, that’s hundreds of dollars per year generated simply for holding onto investments—funds that could be used for savings, college funds, vacations, or even to reinvest further.

2. Sector Diversification Reduces Risk

This approach spreads investment risk across multiple parts of the economy: healthcare, real estate, technology, consumer goods, industrials, and more. By investing in ETFs that represent different sectors, families protect themselves from being overly exposed to one industry’s downturn. For example, if the technology sector underperforms, the utilities or real estate sectors—known for stability—can balance the portfolio.

This type of diversification is often compared to the phrase: “Don’t put all your eggs in one basket.” It’s especially vital for families who may not have the resources to weather major financial downturns without support.

3. Education and Involvement

Perhaps one of the most overlooked benefits of a family investment strategy is the educational component. Children who grow up in households where investments are discussed openly tend to have a better understanding of money management, risk, and long-term planning. Sitting together to review ETFs, tracking dividends, and discussing financial goals as a family can become a hands-on, real-world economics lesson.

Imagine a young child asking why a utility company pays more in dividends than a tech company. That conversation could spark curiosity that leads to lifelong financial competence.

4. Building Generational Wealth

Families often think of wealth in terms of property or inheritances. However, stock portfolios—especially those that grow with dividends—can quietly become powerful financial legacies. With dividend reinvestment plans (DRIPs), families can automatically reinvest earnings, buying more shares without lifting a finger.

Over 10–20 years, such compounding can result in significant growth—even for modest contributions. A $5,000 investment today in an ETF yielding 3.5% reinvested annually could be worth well over $10,000 within two decades, assuming modest appreciation. Multiply that across several ETFs and contributions over time, and you’re not just saving—you’re building a legacy.

Getting Started

For families interested in building this type of portfolio, consider the following steps:

- Start Small: You don’t need thousands of dollars. Most brokers now offer fractional shares. You can start investing with as little as $5 or $10.

- Pick Core Sectors: Start with 3-5 sectors that align with long-term stability (e.g., healthcare, utilities, consumer goods).

- Set Up a DRIP: Automatically reinvest dividends to maximize compounding over time.

- Have Monthly Check-ins: Discuss how the investments are performing, what dividends were earned, and what sectors are thriving. Involve your children if appropriate.

- Use Tax-Advantaged Accounts: Consider using Roth IRAs, 529 college savings plans, or custodial accounts to maximize tax efficiency.

Basic Materials

- ETF: Materials Select Sector SPDR Fund (XLB)

- Issuer: State Street

- Dividend Yield: 2.10%

- Expense Ratio: 0.10%

- Real Annual Dividend Yield: 2.00%

Consumer Goods

- ETF: Consumer Staples Select Sector SPDR Fund (XLP)

- Issuer: State Street

- Dividend Yield: 2.50%

- Expense Ratio: 0.10%

- Real Annual Dividend Yield: 2.40%

Financials

- ETF: Financial Select Sector SPDR Fund (XLF)

- Issuer: State Street

- Dividend Yield: 2.30%

- Expense Ratio: 0.10%

- Real Annual Dividend Yield: 2.20%

Healthcare

- ETF: Health Care Select Sector SPDR Fund (XLV)

- Issuer: State Street

- Dividend Yield: 1.60%

- Expense Ratio: 0.10%

- Real Annual Dividend Yield: 1.50%

Industrial Goods

- ETF: Industrial Select Sector SPDR Fund (XLI)

- Issuer: State Street

- Dividend Yield: 1.90%

- Expense Ratio: 0.10%

- Real Annual Dividend Yield: 1.80%

Services (Consumer Discretionary)

- ETF: Consumer Discretionary Select Sector SPDR Fund (XLY)

- Issuer: State Street

- Dividend Yield: 1.20%

- Expense Ratio: 0.10%

- Real Annual Dividend Yield: 1.10%

Technology

- ETF: Technology Select Sector SPDR Fund (XLK)

- Issuer: State Street

- Dividend Yield: 1.30%

- Expense Ratio: 0.10%

- Real Annual Dividend Yield: 1.20%

Utilities

- ETF: Utilities Select Sector SPDR Fund (XLU)

- Issuer: State Street

- Dividend Yield: 3.50%

- Expense Ratio: 0.10%

- Real Annual Dividend Yield: 3.40%

Real Estate

- ETF: Vanguard Real Estate ETF (VNQ)

- Issuer: Vanguard

- Dividend Yield: 4.00%

- Expense Ratio: 0.12%

- Real Annual Dividend Yield: 3.88%

Final Thoughts

Wealth isn’t just about having money—it’s about having the knowledge and structure in place to build and preserve it. A sector-based dividend ETF portfolio provides families a chance to learn together, earn together, and plan together. It turns investing from something abstract into a shared experience with real-life value.

The image of a family gathered around a laptop, reviewing charts and dividend yields, is more than a snapshot—it’s a vision of the future. A future where African American families, and all families, are empowered to take control of their financial destinies one dividend at a time.