For the most current African American Owned Bank Directory visit the 2022 link by clicking here.

All banks are listed by state. In order to be listed in our directory the bank must have at least 51 percent African American ownership. You can click on the bank name to go directly to their website.

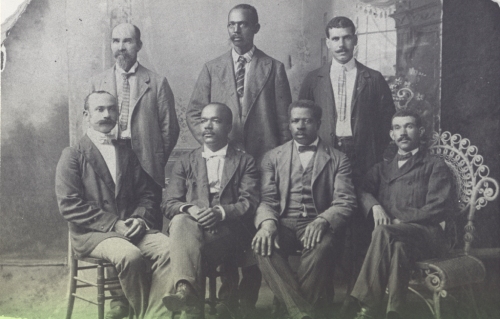

(Founders of Merchants & Farmers Bank in Durham, North Carolina)

OTHER KEY FINDINGS:

- AAOBs are in 17 states and territories. Key states absent are Florida, Mississippi, New York, and Ohio.

- Alabama, Georgia, Illinois, Tennessee, and Wisconsin each have two AAOBs.

- 2016 Median AAOBs Aseets: $107 551 000 ($113 470 000)*

- 2016 Average AAOBs Assets: $210 292 000 ($233 583 000)*

- African American bank assets saw a 1.2 percent decrease or net loss of approximately $57 million in assets in 2015.

- AAOBs control 0.03 percent of America’s $15.7 trillion Bank Owned Assets.

- AAOBs control 2.3 percent of FDIC designated Minority-Owned Bank Assets, which is down from 2.6 percent in 2015.

- There has not been an AAOB started in 16 years.

- Only 8 of 2016’s 22 AAOBs saw increases in assets.

- For comparison, Asian American Owned Banks have approximately $46.1 billion in assets spread over 68 institutions. They control 6.0 percent of Asian America’s buying power.

*Previous year in parentheses

There are 22 African American owned banks (AAOBs) with assets totaling approximately $4.6 billion in assets or approximately 0.43 percent of African America’s $1.1 trillion in buying power.

ALABAMA

Location: Birmingham, Alabama

Founded: January 28, 2000

FDIC Region: Atlanta

Assets: $35 476 000

Asset Change (2015): Down 13.4%

Location: Mobile, Alabama

Founded: February 19, 1976

FDIC Region: Atlanta

Assets: $56 501 000

Asset Change (2015): Down 3.8%

CALIFORNIA

Location: Los Angeles, California

Founded: February 26, 1947

FDIC Region: San Francisco

Assets: $402 902 000

Asset Change (2015): Up 16.6%

DISTRICT OF COLUMBIA

Location: Washington, DC

Founded: August 18, 1934

FDIC Region: New York

Assets: $388 951 000

Asset Change (2015): Up 6.5%

GEORGIA

Location: Savannah, Georgia

Founded: January 1, 1927

FDIC Region: Atlanta

Assets: $42 174 000

Asset Change (2015): Down 2.5%

Location: Atlanta, Georgia

Founded: June 18, 1921

FDIC Region: Atlanta

Assets: $387 897 000

Asset Change (2015): Down 3.2%

ILLINOIS

ILLINOIS SERVICE FEDERAL SAVINGS & LOAN

Location: Chicago, Illinois

Founded: January 01, 1934

FDIC Region: Chicago

Assets: $101 291 000

Asset Change (2015): Down 10.7%

Location: Chicago, Illinois

Founded: January 02, 1965

FDIC Region: Chicago

Assets: $369 544 000

Asset Change (2015): Down 29.3%

LOUISIANA

Location: New Orleans, Louisiana

Founded: November 16, 1972

FDIC Region: Dallas

Assets: $604 163 000

Asset Change (2015): Up 9.4%

MARYLAND

Location: Baltimore, Maryland

Founded: September 13, 1982

FDIC Region: New York

Assets: $285 246 000

Asset Change (2015): Up 22.1%

MASSACHUSETTS

Location: Boston, Massachusetts

Founded: August 02, 1982

FDIC Region: New York

Assets: $648 615 000

Asset Change (2015): Up 4.6%

MICHIGAN

Location: Detroit, Michigan

Founded: May 14, 1970

FDIC Region: Chicago

Assets: $216 821 000

Asset Change (2015): Down 12.3%

NEW JERSEY

Location: Newark, New Jersey

Founded: June 11, 1973

FDIC Region: New York

Assets: $250 095 000

Asset Change (2015): Down 12.9%

NORTH CAROLINA

Location: Durham, North Carolina

Founded: March 01, 1908

FDIC Region: Atlanta

Assets: $298 014 000

Asset Change (2015): Up 3.0%

PENNSYLVANIA

Location: Philadelphia, Pennsylvania

Founded: March 23, 1992

FDIC Region: New York

Assets: $59 001 000

Asset Change (2015): Down 2.5%

SOUTH CAROLINA

Location: Columbia, South Carolina

Founded: March 26, 1999

FDIC Region: Atlanta

Assets: $52 995 000

Asset Change (2015): Down 14.2%

TENNESSEE

Location: Nashville, Tennessee

Founded: January 4, 1904

FDIC Region: Dallas

Assets: $104 060 000

Asset Change (2015): Up 5.1%

Location: Memphis, Tennessee

Founded: December 16, 1946

FDIC Region: Dallas

Assets: $111 042 000

Asset Change (2015): Down 12.3%

TEXAS

Location: Houston, Texas

Founded: August 01, 1985

FDIC Region: Dallas

Assets: $83 327 000

Asset Change (2015): Up 10.3%

VIRGINIA

Location: Danville, Virginia

Founded: September 08, 1919

FDIC Region: Atlanta

Assets: $37 612 000

Asset Change (2015): Down 4.1%

WISCONSIN

COLUMBIA SAVINGS & LOAN ASSOCIATION

Location: Milwaukee, Wisconsin

Founded: January 1, 1924

FDIC Region: Chicago

Assets: $23 684 000

Asset Change (2015): Down 2.7%

Location: Milwaukee, Wisconsin

Founded: February 12, 1971

FDIC Region: Chicago

Assets: $67 115 000

Asset Change (2015): Down 13.0%

Just a quick question about City National Bank, in Newark. City National Bank’s parent co., City National Corp., based in Los Angeles, was bought out by Royal Bank of Canada. It was announced last November. Is the bank in Newark under the same umbrella as the one in Los Angeles? Wouldn’t that take them off the list of Black-owned banks?

According to their website, North Milwaukee State Bank has been closed (https://nmsbank.com/).

How many customers are serviced approximately by our black banks? Secondly Do any of our black banks have free of fees programs for veteran customers.

Clyde B Jones Sr, MBA

Tuskegee Airmen West Region Rep, Natl Bd Dir

TAIWestRegion@gmail.com

707.386.9592

Former Viet Nam era Naval Officer Vet, Travis AFB Chapter member

Why isn’t Carver Bank. NYC on the list?

Pat,

Carver Bank is no longer 51% African American owned. It received a $55 million bailout from Goldman Sachs, Morgan Stanley, & Citigroup.

Oh sweat! No wonder I couldn’t afford their opening rates anymore. $100.00!!!!!!!!!! WOW!!!!! ISN’T THAT TOO MUCH FOR POOR PEOPLE????

I notice that Carver Federal Savinging in NYC is not on this list? Is that due to owner of Carver Frderal Savings not being 51% black ownership? And what is the current % black/ African American owned?

I was recently informed that while Harbour Bank in Baltimore was a Black owned bank it current is no longer owned by Blacks. I’m currently doing some research to confirm this info.

Can you post it I live in md too and need a good credit union

Pingback: HBCU Money’s 2013 African American Owned Bank Directory |

Pingback: HBCU Money’s 2014 African American Owned Bank Directory |

Pingback: HBCU Money’s 2015 African American Owned Bank Directory |

Are there any in new York

Pingback: Solange Becomes A Member Of Black-Owned Bank

Is there no black owned bank in New York City?

Pingback: HBCU Money’s 2016 African American Owned Bank Directory-Reblog – Black Mind Media

I noticed One United is missing from the California list. Are they no longer a Black bank?

Yes, OneUnited is still a black bank. It is headquartered in MA. It has branches in California and Florida, making it the only African American bank with a multi-state footprint.

Liberty Bank, New Orleans, La, has a branch in Jackson, Ms., and several other states.?

An interesting list, some concern with how many black owned banks re no longer black owned. Are there any private or government organizations that supports and helps the creation of black owned banks?

I read somewhere that St. Louis Community Credit Union located in St. Louis, Missouri was Black-owned? If so, why isn’t it listed here? Or are you just not listing credit unions?

Please see our 2016 African American Credit Union Directory.

Pingback: Black-Owned Banks You Didn't Know Existed Until #BlackLivesMatter | STACKS Magazine

The best investment is FUBU!

Pingback: Economic Activism: The Most Viable Long Term Strategy

Pingback: Thousands Moving Money to Black-Owned Banks - IMDiversity

Pingback: Thousands Moving Money to Black-Owned Banks

I do not see any NY Banks on this list but have seen entities such as Urban Upbound Credit Union and One United on other websites. Are there websites I can do the research and find out for myself?