”Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

In an interview with Brandon Hightower, who is better known as B High and a journalist in Atlanta, on his YouTube channel BHighTV, Bernard Freeman, better known as hip-hop legend Bun B, lays down an immense amount of financial wisdom that he has accumulated over the years. Primarily speaking to up and coming hip-hop artists, the conversation could apply to any room in African America. According to an economic study done by McKinsey, African America continues to be the poorest racial group in America with a median net worth of only $24,000 and yet its financial behavior according to Mr. Freeman reflects anything but that.

Mr. Freeman immediately addresses the issue of ownership versus labor that many may have overlooked in the conversation. Asked about how to navigate the issues of artist feeling like they are being robbed by their labels Freeman says, “Don’t sign to a label. I mean that’s just it. Don’t sign to a label and take the slow road.” When pressed by Hightower of people not wanting to take the slow road, Freeman counters with, “Take the fast and get robbed then. Do you want to be famous or do you want to be rich? Because there is a likeliness that you might not be able to be both in this game. At a certain point you have to decide, do you want to be seen and known and look like you got bread and have everybody assume you got bread? Or do you really want to have bread and have people just assume you broke and not really getting it?” The slow road being an independent label that you own and own the masters and all rights to your music or going with a major label who owns the rights to everything you produce in exchange for a small royalty. Do you want to be the owner or do you want to be the labor? This is a question that is consistently overlooked in our community and institutions. HBCUs love to discuss how many of their students have gotten jobs, but when is the last time you saw an HBCU produce an entrepreneurship report detailing how many of their students started companies, hired other HBCU graduates, brought jobs to their community, wealth creation, and overall economic impact in the community? You do not because we do not have a focus there. Our community too often prides itself on finding a “good” job. Despite this push, our unemployment rate always remains twice the national average. Why? Because there is not nearly enough ownership within the community and therefore the ability to dictate employment, wages, and wealth in our community are always at the hands of others.

After a brief exchange on how the African American community seems to not believe that you can be famous and not be rich and be rich and not be famous, Mr. Freeman ask Mr. Hightower if he knows what the Walton Family (pictured above) looks like to which the latter replies no idea. The irony that members of the Walton family could walk into many Wal-Marts around the country and not be recognized, while controlling one of the world’s largest corporations and being one of the wealthiest families on Earth is not to be lost in this age of social media influencer and the like that more and more see as a path to riches. Again, associating being known with being financially successful. And while a few people listed on the Bloomberg Billionaires’ Index maybe well known, such as Bill Gates, Elon Musk, Mark Zuckerberg, 99 percent of that list could walk into many households and be absolutely unknown. However, one thing they all have in common? 100 percent of them are owners.

Mr. Freeman then says in response to Mr. Hightower asking how do we get kids to see beyond the drug dealers, ballplayers, and rap stars, “You have to give them a broader worldview so they can see what real money look like. Because I tell young people all the time everybody that you looking on TV and on the internet that’s rich, with the exception of a hand full of people, maybe ten people, somebody pay them.” He even goes on to discuss Shaquille O’Neal, who he believes either is close to or already a billionaire, but also states that a large portion of O’Neal’s wealth comes from people paying him, but who they themselves were already billionaires and O’Neal had no idea what they looked like before getting paid by them. We often hear of athlete’s salaries, but rarely if ever think about what the owner’s of these teams make. The NFL for instance, which is one of the worst paying professional sports leagues for players based on salaries and career expectancy, is also the most profitable sports league for owners. It is no coincidence that those two things go hand in hand. As of this article, Deshaun Watson, quarterback for the Cleveland Browns, recently signed to become the highest paid player in NFL history at 5 years, $230 million or $46 million per year. Compare that with Jerry Jones, owner of the Dallas Cowboys, who last year took home $280.4 million or six times what Deshaun Watson’s contract is. Even more so, Jerry Jones does not have to take one hit owning the team, can own it longer than any player can play, and then can pass it onto his children (as of this article the Dallas Cowboys are valued at $6.5 billion according to Forbes). Deshaun Watson can claim none of those things. Again, labor versus ownership.

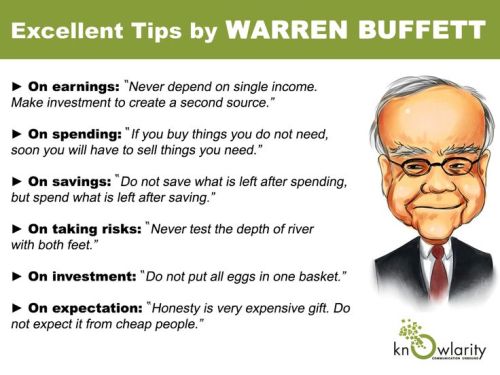

This is not to say that Mr. Freeman is against having fun and enjoying your money as he points out discussing the trend of people who count money on the internet as a form of showing off. But he also follows it with, “Jay-Z is getting richer and richer and he is wearing less and less s**t that looks rich. And you keep going into these rooms with these people trying to look like money. No, you have to sound like money, think like money.” He points out that you will do little to impress Jeff Bezos or Warren Buffett walking into a meeting with them wearing a $4-5 million watch, number 2 and 5 on Bloomberg’s Billionaire Index and worth a combined $400 billion or 36 percent of African America’s buying power. One could argue that you may even turn them off by spending so lavishly. Spending $5 million on a watch versus leveraging that $5 million into $25 million worth of real estate and $2.5 million in annual income from that real estate looks like someone who is not really interested in building generational wealth. Especially for African America when every single dollar is going to count for families, communities, and institutions. In 2019, African Americans accounted for 13.2 percent of the population, but a heartbreaking 23.8 percent of poverty according to the U.S. Census.

“Wealthy does not have to prove to anybody that they are wealthy”, says Mr. Freeman in closing out the show’s segment. And to that point, the lack of wealth in our community and institutions continues to induce behavior that screams of lack. Unfortunately, wealth is not going to be generated by a job or even by starting a business per se. Wealth and power is generated by the building of an institutional ecosystem that is connected and circulates intellectual, social, economic, and political capital within it. African American banks having enough deposits to lend to an HBCU who wants to build a new research facility. An African American venture capital fund setting up and office at an HBCU to fund the next great idea in renewable energy. An HBCU alumni association putting money into an African American community to help ensure the K-12 system is providing the best education with the latest technology. Then all of those moments working together in unison. That is when we will see wealth and then power become not a scarcity in our community but a norm.

To watch the full interview segment, click below or go to http://www.bhightv.com.