“The future is not a place we are going. It is one we are inventing.” — John Schaar

While many HBCUs still seek validation in a PWI-centered research ecosystem, the University of Texas Medical Branch (UTMB) is doing something more audacious: redefining the rules of engagement. With its inaugural VentureX Summit, UTMB isn’t merely seeking grant money—it’s building an innovation economy. And HBCUs, if bold enough, could do the same.

In a summer dominated by political unrest and macroeconomic uncertainty, the University of Texas Medical Branch (UTMB) in Galveston, Texas, quietly launched what may prove to be one of the most strategically significant higher education events of the decade. The VentureX Summit, hosted on July 17, 2025, marked UTMB’s formal entrance into the growing arena of translational innovation—a sector where science, venture capital, and state-backed institutional development converge to shape the 21st-century economy.

For HBCUs, often relegated to the margins of federal and philanthropic investment in research, the implications of UTMB’s maneuver are profound. Not because UTMB is a peer—it isn’t. But because it offers a roadmap.

UTMB President Dr. Jochen Reiser didn’t mince words in his summit address. Education, research, and patient care were no longer enough. A “fourth pillar”—innovation—was now essential to institutional longevity, impact, and sovereignty. By formally integrating innovation into UTMB’s strategic framework, the institution is doing something few public universities in the South have dared: turning research into economic infrastructure.

This isn’t a rebranding exercise. It’s a full-throated shift in power orientation. UTMB’s Office of Technology Transfer has been reborn as the Office of Innovation & Commercialization, while the Life Science Incubator, adjacent to its research facilities, is being marketed as a landing zone for biotech startups, investors, and licensing agents alike.

Compare this with the strategic inertia found at most HBCUs. While many tout research agendas, few have even minimal infrastructure for commercialization. Fewer still think in terms of venture scalability or intellectual property portfolios. UTMB’s pivot exposes this gap—not as a deficiency of talent, but of institutional courage and vision.

The VentureX Summit focused heavily on kidney therapeutics—a seemingly narrow domain until you recognize that kidney disease costs the U.S. healthcare system nearly $130 billion annually, and disproportionately affects African Americans.

UTMB highlighted three major innovations during the summit: suPAR science, a biomarker-driven immune research platform that reframes the way inflammation and chronic disease are treated; anti-miR-17 for ADPKD, a therapy targeting polycystic kidney disease, recently acquired by Novartis; and Atacicept, a biologic aimed at IgA nephropathy, another major kidney condition with limited treatment options.

Each of these originated at UTMB and moved through stages of clinical validation, patent protection, startup spin-out, and either acquisition or venture partnership. The fact that these stories are not one-off flukes but institutionalized outputs is a direct result of UTMB’s realignment around innovation.

For HBCUs with schools of pharmacy, biology, or public health—particularly those serving communities with high chronic disease rates—this is a flashing neon signal. Owning the intellectual property that treats your community’s disease burden is not just good science. It’s power. It’s capital. It’s destiny.

A painful truth: HBCUs receive less than 1% of NIH research funding. The reasons range from grant-writing disparities and institutional size, to deeper systemic racism in peer review and proposal evaluation.

But what the VentureX Summit revealed is that institutions no longer need to center their R&D portfolios on NIH alone. The venture capital ecosystem—especially in biotech—is beginning to bypass the traditional federal-funding pipeline. Startups and scientists are courting angel investors, family offices, and strategic pharma partnerships earlier than ever.

This trend is significant for HBCUs because it decentralizes capital—opening doors beyond federal gatekeeping; rewards translational impact over pedigree; and allows for mission-aligned ventures—especially in diseases like diabetes, hypertension, and sickle cell that disproportionately affect African Americans.

Imagine a Howard University or Xavier University of Louisiana spinout that secures $5 million in seed capital to develop a culturally tailored mental health AI app. Or a consortium of HBCU researchers patenting an algorithm for early-stage dementia detection among Black elders. With the right infrastructure—IP management, deal-flow coaching, investor networks—this is no longer fantasy. It’s overdue.

That UTMB chose to host VentureX in Galveston, a city more often associated with hurricanes than high finance, is symbolic. It was not at the Texas Medical Center, nor at the flashier campuses of Austin or Dallas. Instead, UTMB used the summit to stake Galveston as a regional biotech innovation node, a move that builds on Houston’s recent success as a Brain Capital hub with Rice University and the Texas Medical Center Innovation Institute.

For HBCUs, particularly in the South, this strategy is critical. The clustering of biomedical and tech innovation around coastal cities like Boston, San Francisco, and Seattle has created access and visibility challenges. But regional clustering, especially when supported by state policy and university systems (as in Texas), creates a new terrain—one that Southern HBCUs like Meharry, Tuskegee, Florida A&M, or Prairie View A&M could dominate.

The key is not just research. It’s the integration of policy, capital, and narrative—what UTMB has shown is possible.

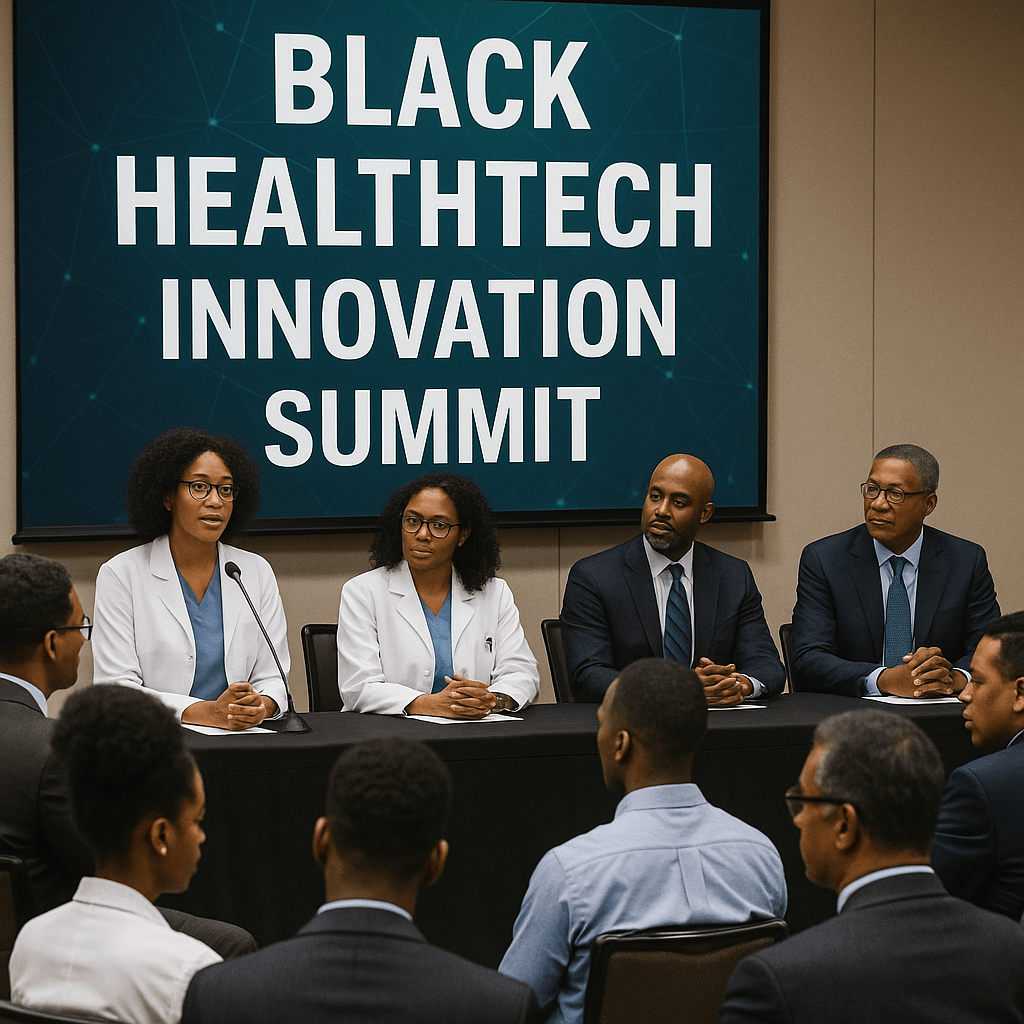

Let’s imagine that a group of HBCUs—say, North Carolina A&T, Howard, Jackson State, and Xavier—joined together to create an annual Black HealthTech Innovation Summit.

Its components could mirror VentureX: showcasing translational research in diabetes, maternal health, cancer, and neurodegeneration; pitch competitions where researchers and student-founders present to Black-owned VCs, foundations, and corporate venture arms; investor speed networking to build relationships beyond the conference walls; and policy roundtables with state legislators to promote technology transfer tax incentives and university IP protections.

This could be rotated annually among campuses, forming the basis of a HBCU Tech Transfer Consortium, modeled after the University of California’s system-wide innovation strategy or Texas’s CPRIT (Cancer Prevention and Research Institute of Texas) fund.

Beyond optics, such a summit would provide a platform to rewrite the power structure of Black health, wealth, and innovation. It would signal to both the federal government and philanthropic sector that HBCUs are not just asking for funding—they are offering investable opportunity.

One of the less discussed but perhaps most important takeaways from UTMB’s summit was the sheer willingness to claim space in the innovation economy. While other universities remain passive, waiting for “innovation” to emerge organically, UTMB made clear that innovation is a designed outcome, not an accidental one.

This is where many HBCUs fall short. The fear of failure, of overreach, of stepping outside the traditional academic role, looms large. But UTMB’s leadership—and the state of Texas—are demonstrating that academic institutions can be architects of economic infrastructure, not just participants.

This is a mindset shift.

For HBCUs to replicate UTMB’s success, they must invest in tech transfer offices staffed with professionals who understand patents, licensing, and venture capital—not just compliance officers; build research parks and incubators that bridge the university with startup ecosystems; champion internal innovation competitions where faculty and students propose scalable solutions to community problems—with funding and follow-up; and cultivate industry partnerships that go beyond recruiting to include co-development and revenue-sharing IP agreements.

The VentureX Summit offered a model of regional self-determination wrapped in a biotech suit. But for African American institutions, it carries heavier implications. Innovation, in this context, is not just about research prestige. It’s about ownership, equity, and the future of Black health and wealth.

Just as land ownership, education, and voting rights were once the battlegrounds of civil rights, ownership of innovation ecosystems must become a new frontline. Because if we are not at the table—writing the patents, launching the startups, leading the trials—then we will once again find ourselves as the subject, not the author, of the future.

HBCUs must now ask: Are we ready to hold a summit of our own? Or will we remain an afterthought in the innovation economy we helped build?