Negro banks, as a rule, have failed because the people, taught that their own pioneers in business cannot function in this sphere, withdrew their deposits. – Dr. Carter G. Woodson

What is an ecosystem? How do you develop an ecosystem? Can we develop an African American ecosystem? It seems to be a question that a room full of African American institutional leadership have little understanding of based on the institutional decisions that are continuously made. In their academic paper entitled Economic Ecosystems, Philip E. Auerswald and Lokesh M. Dani, “An ecosystem is defined as a dynamically stable network of interconnected firms and institutions within bounded geographical space. It is proposed that representing regional economic networks as ‘ecosystems’ provides analytical structure and depth to theories of the sources of regional advantage, the role of entrepreneurs in regional development, and the determinants of resilience in regional economic systems.” The most vital part of that definition being interconnected firms and institutions. African American institutions in general at every turn fail to understand this concept and HBCUs are no exception. This is especially true of HBCUs choice of banks and now Alabama State University’s recent decision to forego a plethora of African American Owned Investment and Asset Management firms and hand $125 million to another European American owned investment firm. African American capital once again reinforcing European America’s financial ecosystem – not ours.

It is almost a redundant story at this point. African American institutions all operating on their own island and failing to interconnect and intertwine with each other. African America from individual to institutions all do what is best for themselves individually and not what is best for the collective and certainly not what connects and strengthens the collective. See Hampton University and North Carolina A&T State University decisions to leave an HBCU conference for a PWI one. To that vein is why over 90 percent of African America’s $100 billion in annual tuition revenue goes into PWIs and not HBCUs/PBIs. HBCUs provide very little means of an example for the community to follow. Instead, HBCUs are a glaring headlight of just how poorly African American institutions perform in strategically integrating themselves within the African American ecosystem, especially economically. There are no reports on HBCUs engagement with the African American private sector because HBCUs do not seemingly see that as important. How many of HBCU graduates work for African American owned companies? How much HBCU athletic sponsorship dollars come from African American owned companies/partnerships? How much of the HBCU endowment is invested in African American firms? These are basic questions that any leadership of an HBCU should be able to answer. Unfortunately as Jarrett Carter, Sr., founder of HBCU Digest, once eloquently put it, “Many HBCUs are just trying to be PWI-adjacent.”

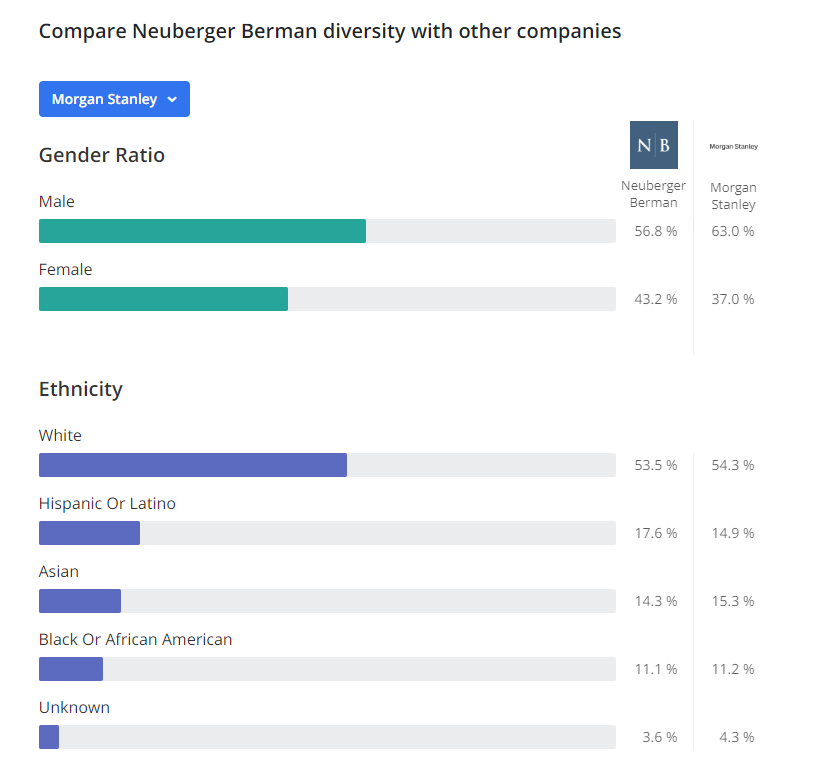

Is $125 million a lot of money? Context matters. To any individual, most would agree $125 million is significant. To institutions, it varies on size, scope, and goals. For African American Financial Institutions, almost down to even the largest of our firms having an $125 million account would see their bottom line acutely move. Providing perspective on the landscape, Pension and Investments reports, “The global asset management industry showed some signs of recovery in 2023, with total assets under management (AUM) rising 12% year-over-year to nearly $120 trillion, according to research by Boston Consulting Group.” For African American Asset Managers, “The largest Black-owned asset managers are responsible for more than $253 billion in assets, according to FIN Searches data. Vista Equity Partners is the largest Black-owned firm in the industry, with the private equity manager handling $103.8 billion in assets.” African American Owned Asset Managers only account for 0.2 percent of the global AUM. By contrast, the Top 10 non-Black asset managers have $22 trillion assets under management which accounts for almost 20 percent of global AUM.

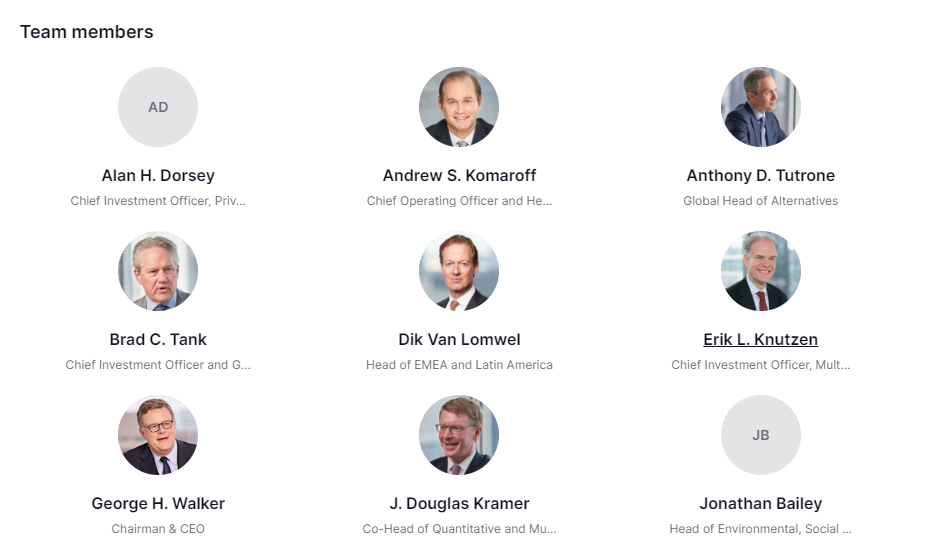

The asset management firm that Alabama State University chose according to World Benchmarking Alliance, “Neuberger Berman is a private employee-owned investment management firm (leadership pictured above) headquartered in New York, USA. It was founded in 1939 and has offices in 39 cities across 26 countries. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals. It managed USD 460 billion of assets (under management) in 2021 and employed 2,647 staff in 2022.” This means that Alabama State University’s $125 million is equal to 0.02 percent of assets under management for Neuberger Berman. A drop in the bucket. The entirety of assets at African American Owned Asset Management firms is only 55 percent of Neuberger Berman assets under management. Alabama State University’s $125 million would have lifted the ENTIRE African American Owned Asset Management’s AUM by 0.05 percent. A move that would have strengthened the African American economic and financial ecosystem.

African America as a community talks about the circulation of the dollar or our lack thereof constantly, but what is virtually never talked about is the circulation of the African American institutional dollar being the largest part of that conversation. It is a fairly accepted statistic that the African American dollar does not stay in the African American community for a day, while other communities see their dollar stay in their communities for weeks and in the case of the Asian American community for almost a month. We often think of the circulation of our dollar like everything else, on an island or as an individual. An individual going and buying food from even an expensive African American owned restaurant is $100-200, but an HBCU building a new building means the opportunity for a new loan worth tens of millions for an African American owned bank, it means tens of millions for an African American owned construction company, so on and so forth. Instead, Bethune-Cookman University borrows from a notorious predatory lender to the African American community in Wells Fargo and almost finds itself losing those buildings due to foreclosure.

HBCU alumni know little about the state of finances or the movement of the money at their alma maters. HBCU administrators either willfully withholding the information or inept themselves of the importance of the information and providing it. Both are problematic. The notion that HBCUs cannot find African American investment firms is a painful thought knowing that a Google search would bring up the HBCU Money African American Owned Bank Directory at the very least. The likelihood is more in line with what Mr. Carter said in that a good deal of HBCU leadership simply wants to be like their PWI counterparts is far more likely. This would explain the debacle “donation” accepted by Florida A&M University’s president recently where a simple Google search would have avoided such embarrassment. Instead, Alabama State University’s Neuberger Berman relationship and a plethora of others instances (a decade ago when we reported “Spelman College & Regions Bank – A Failure To Disclose”) is that likely they are simply mimicking PWI actions and unwittingly reinforcing the PWI/European American ecosystem to say the least. Unfortunately, that mimicking reinforces another community’s economic and financial ecosystems not ours and why you may never see OneUnited Field at any HBCU’s athletic facility. Because we are holding out for J.P. Morgan, Bank of America, or Wells Fargo to show us the same love they show PWIs. Not acknowledging those are not our community’s banks.

If HBCUs are simply going to behave as PWI-adjacent institutions, then it is hard to argue with why over 90 percent of African Americans who go to college are not choosing HBCUs. For many it becomes a question of why get a knockoff when they can get the real thing. After all their ice is colder. HBCUs, HBCU alumni associations, and HBCU support organizations as a whole are not making decisions related to African American institutions ecosystem’s interests and interconnectivity and that is most glaring in the poor institutional decisions we are making in regards to our institutional finances and endowments.